EOS bulls dominate- Here’s how China can help sustain the price rise

- China’s affinity for EOS may play out well for robust volumes if China embraces crypto.

- Signs of short-term sell pressure are evident after a strong uptick.

The EOS cryptocurrency achieved a 25% rally in just three days. A contrast to its previous struggle to overcome a resistance range in which it was stuck since the last week of January.

Is this just a fluke rally or is there something more to it?

Is your portfolio green? Check out the EOS Profit Calculator

Recent data suggests that there might be more to this EOS rally than meets the eye and it might involve China. Earlier this year we saw prospects of China potentially switching gears in favor of a softer approach to cryptocurrencies.

In other words, we might see a strong surge in liquidity from China and EOS might absorb a substantial proportion.

The alt has previously been the favorite cryptocurrency for many Chinese traders. This is according to a ranking done by China’s Center for Information and Industry Development.

The EOS network managed to outshine some of the top blockchain networks including Ethereum as per the ranking.

China’s Center for Information and Industry Development has published its 24th Rankings of Crypto Projects.$EOS $ETH $IOST $TRX $XTZ $QTUM $GXC $NEO $XLM $DASH $LSK $BTS $BTC $ONT $KMD $STEEM $NULS $ETC $ATOM $XRP $STRAT $XMR $NAS $NANO $ARK $LTC $WAVES $XVG $ZIL $BCH $HSR $ADA pic.twitter.com/GrTJQeqnrc

— ?? CryptoDiffer – StandWithUkraine ?? (@CryptoDiffer) August 11, 2021

A less aggressive stance from China means EOS might still continue strong demand from the country as was the case in the past.

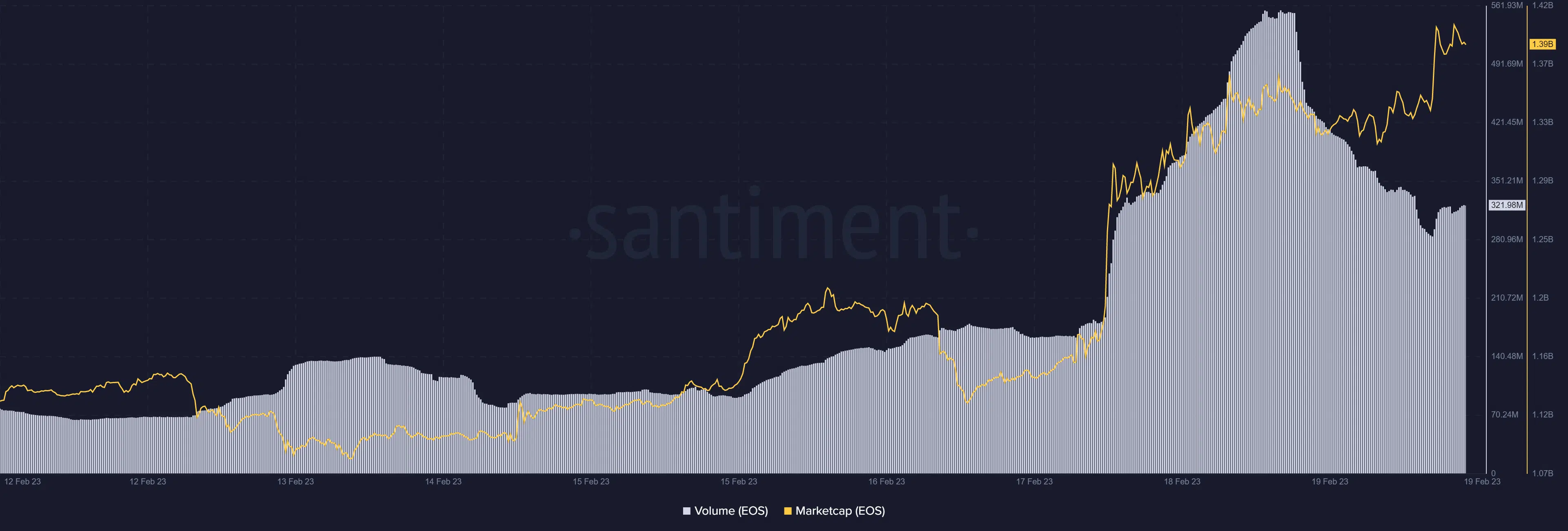

Now that the market is recovering from the crypto winter that was 2022, the bullish volumes are coming back. This is already evident in EOS’s performance.

It has already demonstrated that it can still attract a lot of investors’ attention as was the case since Friday (17 February).

The strong demand was enough to push it above resistance at the $1.12 price level, as well as the 200-day MA.

Although EOS is currently bullish, it is worth noting that the price is now almost in overbought territory.

Hence, there is a higher likelihood of short-term profit-taking. As far as the metrics are concerned, the weighted sentiment metric did see a surge in the last seven days. However, it peaked on 17 February followed by a sharp pivot.

The pivot may indicate that the rally might be about to experience a correction in the next few days.

Prior to the pivot we also saw a slowdown in price volatility and after the weighted sentiment shift, the price volatility metric pivoted and increased.

Realistic or not, here’s EOS market cap in BTC’s terms

A potential reason for the extended rally despite the sentiment shift is that so far there has been low sell pressure. The volume dropped off in the last two days, but the market cap is still holding up well.

Given the above conditions, the expectations of some more sell pressure in the next few days would not be misplaced.