EOS hit a key roadblock – Can shorting yield profit?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- EOS reached a crucial overhead resistance.

- The Funding Rate remained unchanged, but development activity and sentiment increased.

Despite outperforming the crypto market, the uptrend of EOS [EOS] could slow. EOS was an outlier, at the time of writing, after posting a 7.5% hike in the past 24 hours as the crypto sector declined by 3.5%, according to Coinmarketcap. However, the uptrend momentum could slow because EOS reached a crucial overhead resistance level.

Read EOS Price Prediction 2023-24

EOS’s strong recovery in March was partly boosted by the planned launch of an EVM scheduled for April 14, 2023. Yves La Rose, CEO of EOS Network Foundation, announced on Twitter that the EVM would be 3X faster than BNB and Solana combined.

On April 14th, #EOS EVM will launch!

Combining the performance of EOS with the familiarity of Ethereum, Solidity developers are in for a treat.

At 800+ swaps per second, $EOS EVM will be BY FAR the fastest EVM, benchmarked 3x faster than Solana + BNB and 25x faster than Avax. pic.twitter.com/JxYtcbLiTE

— Yves La Rose (@BigBeardSamurai) March 1, 2023

Can bears gain entry at the $1.276 hurdle?

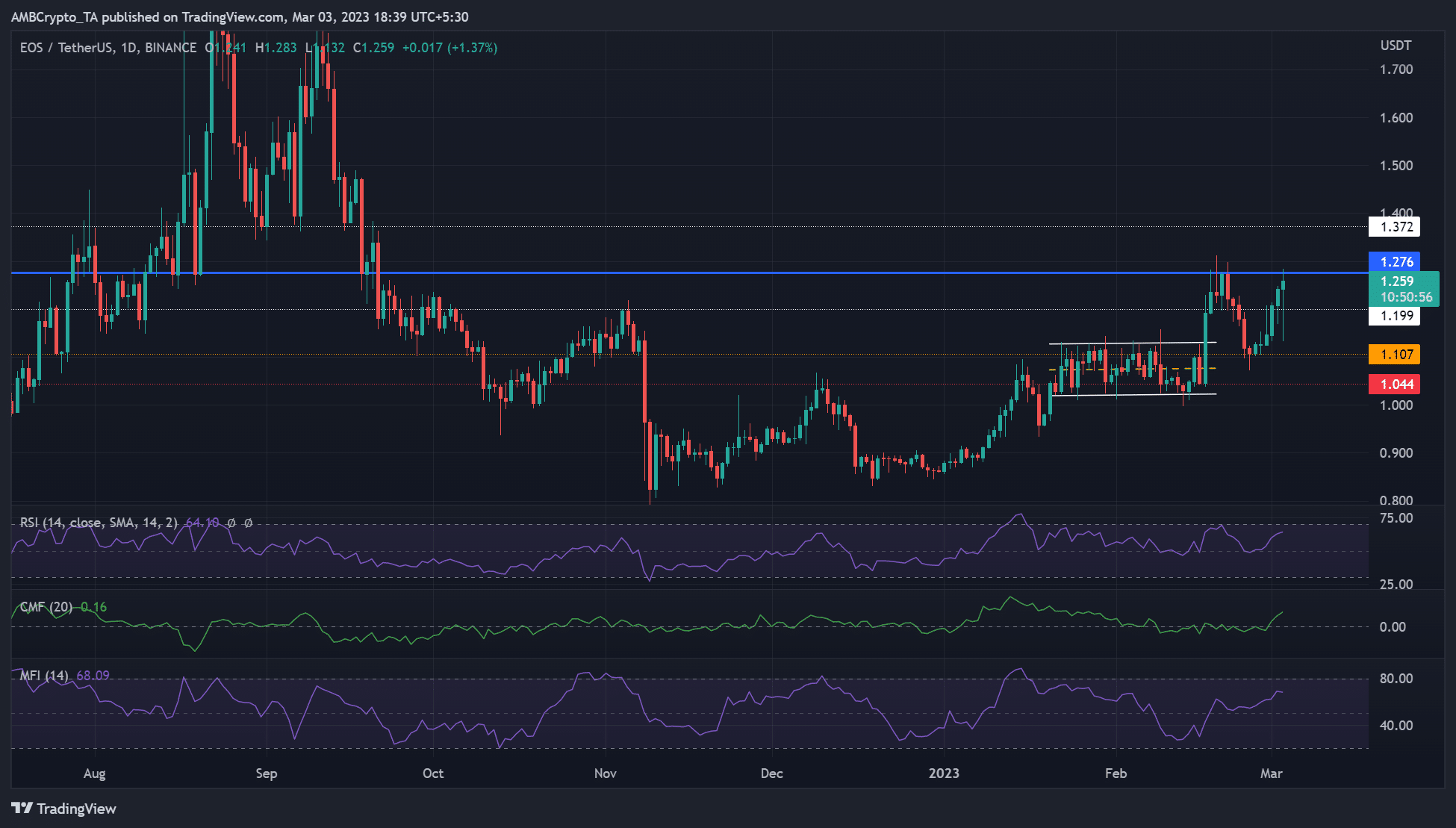

EOS consolidated within the $1.022 – $1.130 range between mid-January and February before an upside breakout in mid-February. But the bulls faced price rejection after hitting the $1.276 resistance level. If the trend repeats, EOS could face a similar rejection and offer bears shorting opportunities.

Bears could look to book profits at $1.119 or the immediate support at $1.107. An extended drop beyond these levels could be kept in check by $1.044 or $1.000. As such, the stop loss could be placed above the $1.276 hurdle.

Alternatively, bulls could bypass the hurdle and seek more gains ahead. The next key resistance lies at $1.372, $1.500, and $1.748. A bullish BTC and surge above $23K could accelerate the upswing needed to bypass the $1.276 roadblock.

The RSI (Relative Strength Index) and MFI (Money Flow Index) showed upticks, indicating buying pressure and accumulation increased. In addition, the Chaikin Money Flow (CMF) moved northwards, indicating the market favored bulls.

Development activity increased, but the Funding Rate stagnated

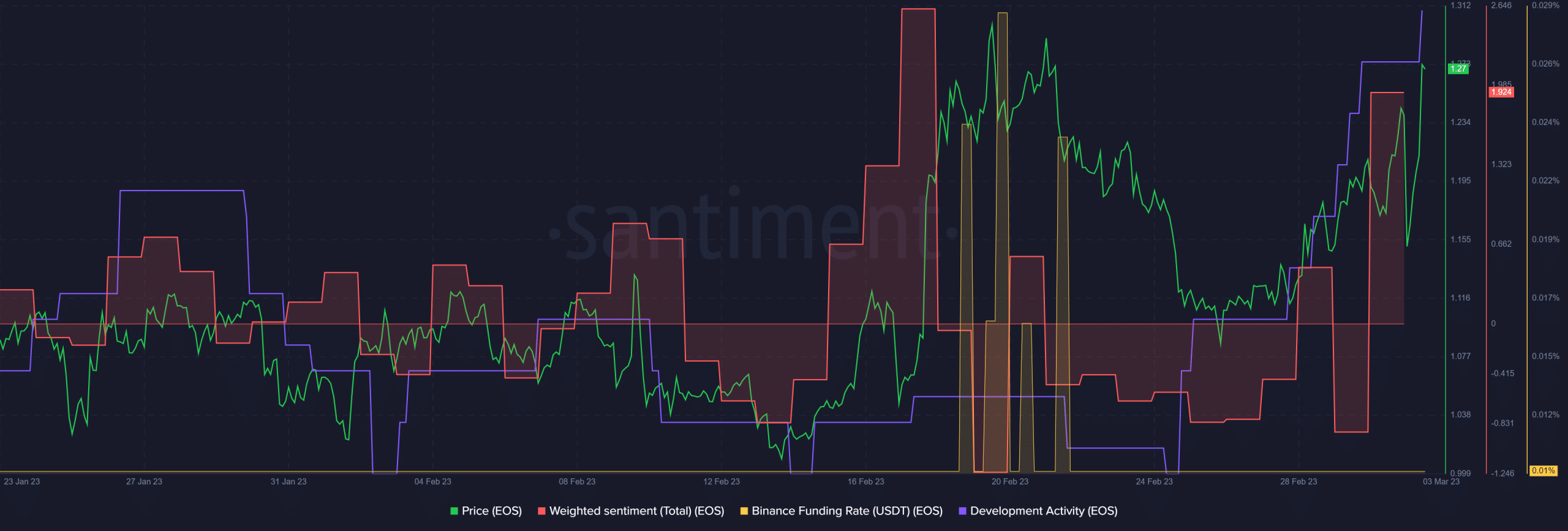

According to Santiment, EOS saw a sharp increase in development activity, showing the network was undergoing massive building, perhaps in preparation for the April EVM launch.

The uptick in the development activity could boost investors’ outlook on the native token. Interestingly, the weighted sentiment improved and exhibited a high positive elevation, showing improved investors’ confidence in the token.

Is your portfolio green? Check out the EOS Profit Calculator

However, the Funding Rate remained eerily stagnant, showing EOS rally hasn’t attracted much demand in the derivatives market. Such a limited demand could undermine the uptrend and potentially tip the scale in favor of the bears.