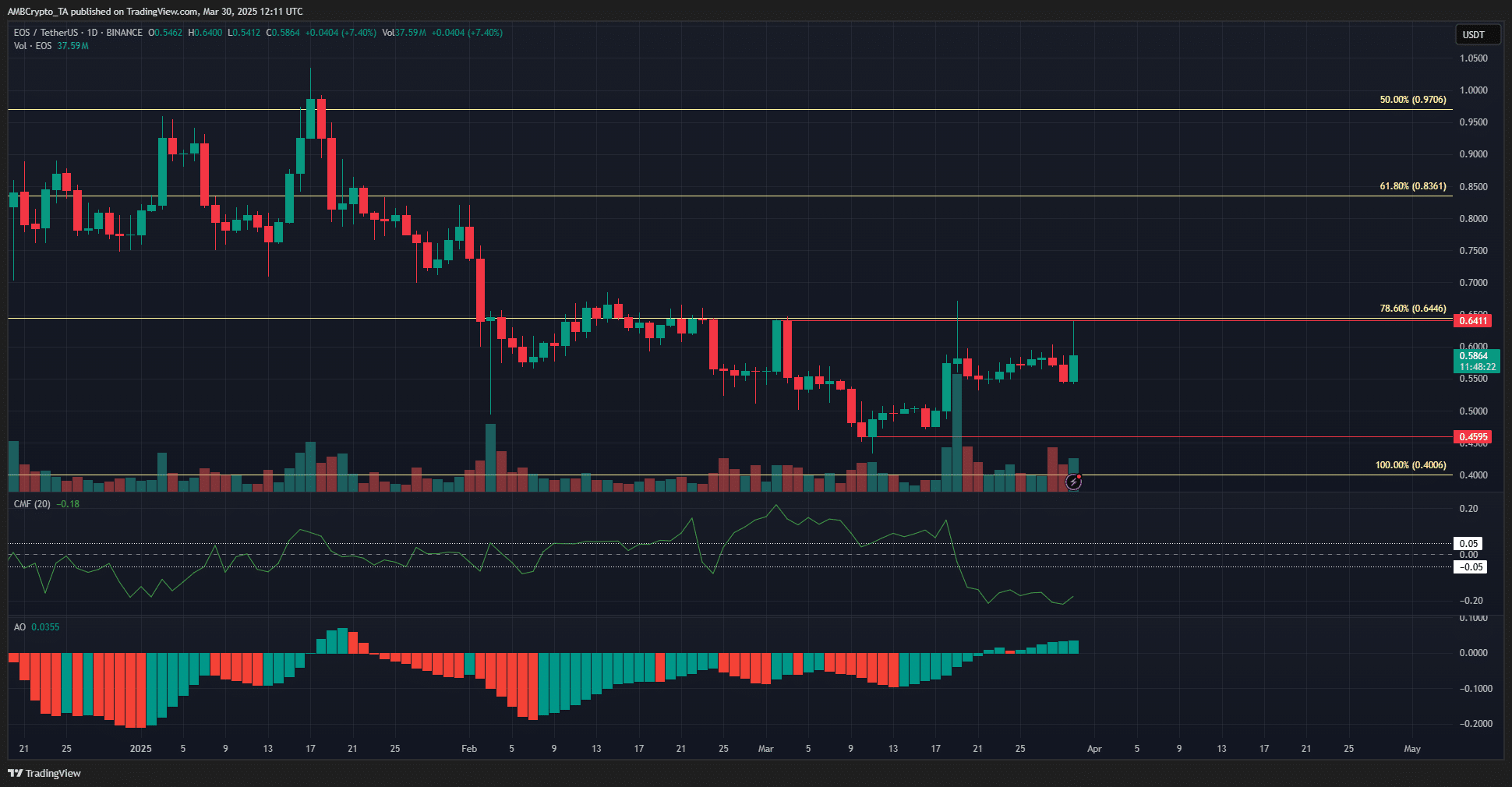

EOS likely to remain below the $0.64 level, here’s why

- EOS volume indicator showed keen selling pressure in March.

- A range formation between $0.46-$0.64 was a possibility.

With gains of 5.4% in 24 hours, EOS [EOS] was one of the better-performing altcoins with a sizable market cap. However, it failed to climb above the $0.64 resistance level once again.

This raised the possibility of a range formation for the token.

EOS traders should be cautious of volatility in the short-term

EOS tested the $0.64 resistance level for the third time in March. The previous two times saw the price quickly drop to $0.55 or $0.45. It was likely that this attempt would fail to yield a breakout.

The Awesome Oscillator climbed above the zero mark to signal a momentum shift in the 1-day timeframe. However, despite the gains made in the past three weeks, the CMF was well below -0.05.

This indicated heavy capital flows out of the EOS market and seller dominance.

A reversal from $0.64 could see a range formation materialize. This could push prices to $0.55 or lower to the $0.45 level, both notable supports in the past month.

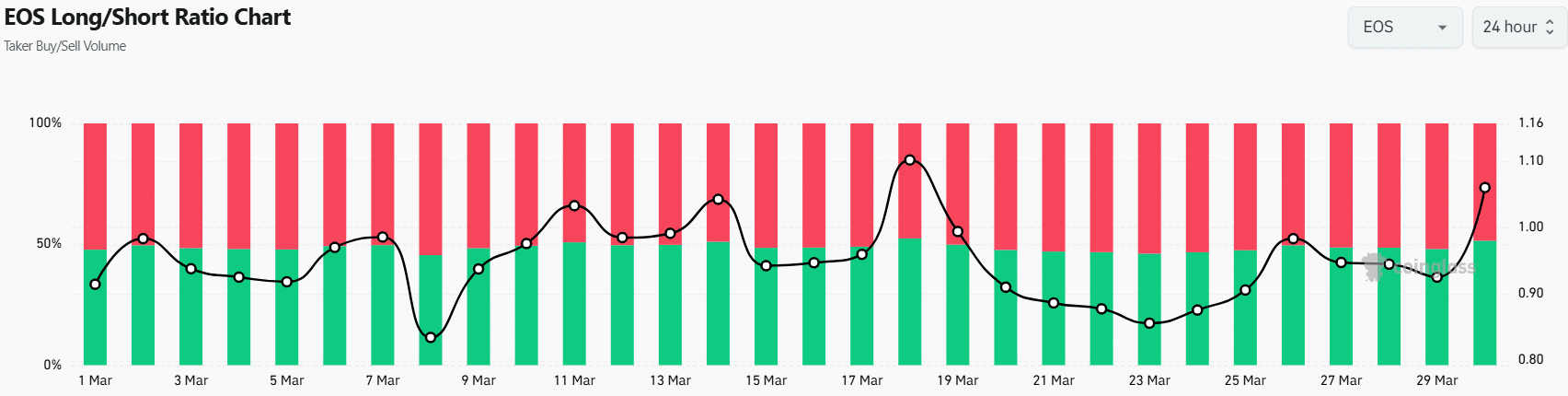

Source: Coinglass

The Long/Short Ratio chart showed that long positions represented 51.4% of the taker volume. The last time it saw such a high ratio was on the 18th of March. On the 19th of March, EOS plunged from $0.67 to $0.56.

Hence, it appeared likely that Monday could see a similar reversal from the overhead resistance level at $0.64.

Source: Coinglass

The 3-month liquidation heatmap showed that the $0.66-$0.69 was a magnetic zone that could attract prices higher.

A bearish reversal appeared likely, due to the lack of buying pressure seen on the 1-day chart, as well as the price action on the same timeframe.

Due to the high long/short ratio, traders should be cautious of going long. A retest of the $0.64-$0.66 area would likely give an opportunity to sell the EOS token.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion