Analysis

EOS: Recent breakout could mean this for long term holders

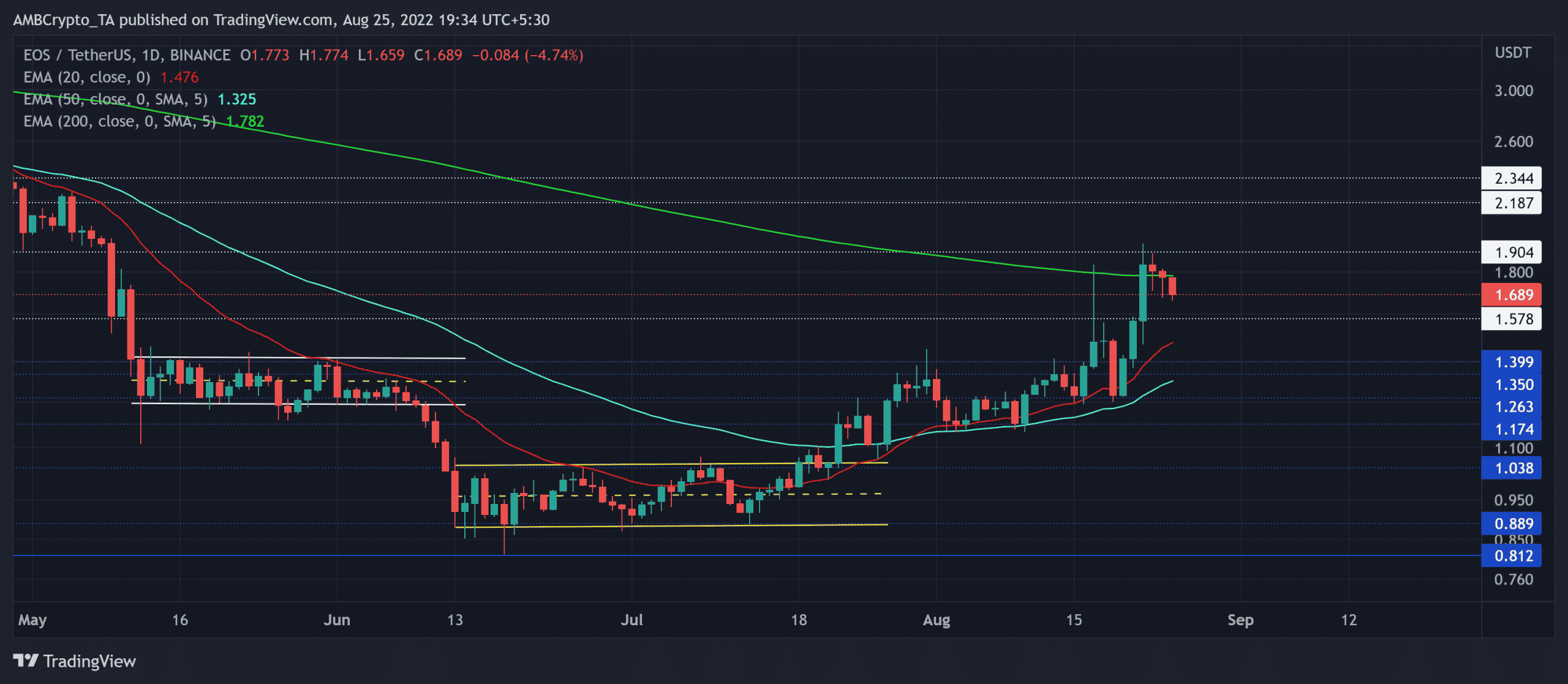

The recent bullish crossover on the 20 EMA (red) and the 50 EMA (cyan) came to fruition after EOS’s side-channel (yellow) breakout. The resultant growth entailed a position above the near-term EMAs. But the 200 EMA (green) evoked the selling pressure and a few red candlesticks.

The recent bearish pull below could help the sellers inflict a near-term decline before a likely bullish resurgence. At press time, EOS traded at $1.689.

EOS Daily Chart

EOS saw a rectangle bottom (white) breakdown that rekindled the bearish inclinations. Meanwhile, the 20 EMA suppressed the buying efforts for nearly three months until mid-July.

After a month-long low volatility phase, the side-channel breakout laid the foundation for the alt’s ongoing bull run. Also, the 20/50 EMA finally looked north. The recent bullish crossover has reinforced the possibility of the EMAs flipping to a support level.

The current reversal from the 200 EMA could find rebounding grounds from the $1.4-$1.5 range. A likely U-turn from this range would position the coin for a continued upside. In this case, the buyers must look for a potential retest of the $1.9-$2.1 range in the coming days.

Rationale

The Relative Strength Index (RSI) marked a solid recovery toward its overbought region. But the current reversal could ease the near-term buying pressure.

On the other hand, the Chaikin Money Flow (CMF) exhibited a slight buying preference by maintaining a position above the zero mark. The traders should look for a potential decline below the equilibrium to gauge the chances of a bullish invalidation. Also, the Moving Average Convergence Divergence (MACD) lines continued to display a bullish advantage in the current structure.

Conclusion

The current reversal from the 200 EMA resistance could find rebounding opportunities from EOS’s near-term EMAs. With the indicators affirming a bullish bias, buyers could aim to expedite their edge.

Traders/investors should keep an eye out for the breach of critical thresholds on the CMF before placing calls. The potential targets would remain the same as discussed. Finally, keeping a watch on the king coin’s movement could help make a profitable bet.