ETH/BTC pair drops below 0.04: Is this Ethereum’s bottom?

- The ETH/BTC dip highlighted ETH’s extended weakness against Bitcoin, as the latter’s dominance soared higher.

- Low address activity underscores caution and declining organic demand, but could things change soon?

Ethereum [ETH] just dropped to its lowest level against Bitcoin [BTC] since April 2021. But could this be one of the signs that ETH and the altcoin market are about to kick a major rally in what could be the start of altcoin season?

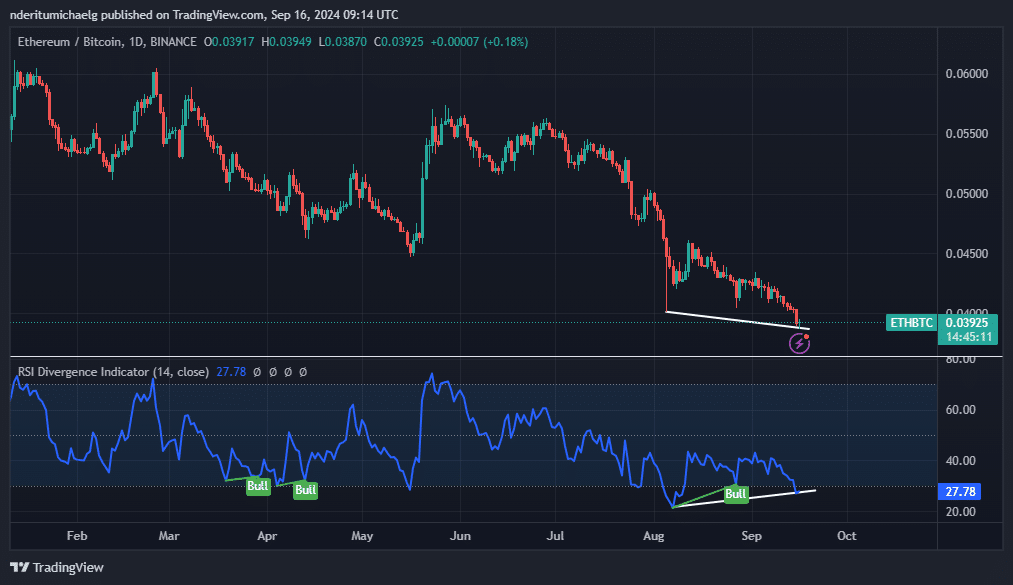

The ETH/BTC pair hit a low of $0.0387 in the last 24 hours. This was the lowest level that the currency pair has achieved since April 2021.

It highlights how ETH has extended its weakness against Bitcoin, as well as further postponement of altcoin season.

At the same time, the recent downside in the ETH/BTC pair has demonstrated an extended divergence. Some analysts see this as a sign that a strong pivot might be about to take place.

Meanwhile, Bitcoin dominance just hit a new YTD high at 58.07% in the last 24 hours.

In addition, Bitcoin dominance has also flashed a potential reversal sign with a divergence pattern.

This suggests that it could face a major pivot which would pave the way for liquidity to flow into altcoins, in which case, ETH would benefit.

ETH’s sell pressure and demand

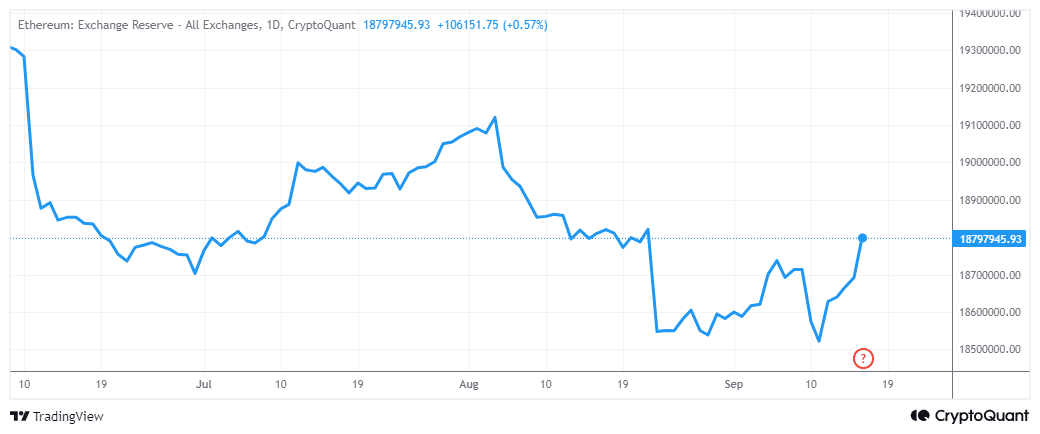

ETH has so far not demonstrated significant outflows. For example, exchange reserves pivoted on the 11th of September after achieving a new YTD low at 18.52 million coins.

There were 18.79 million ETH in exchange reserves at the time of writing. This reflected the resurgence of sell pressure that made a comeback during the weekend.

The cryptocurrency traded at $2,298 at press time. This was close to its opening price on Monday of the previous week, meaning it had given up its weekly gains.

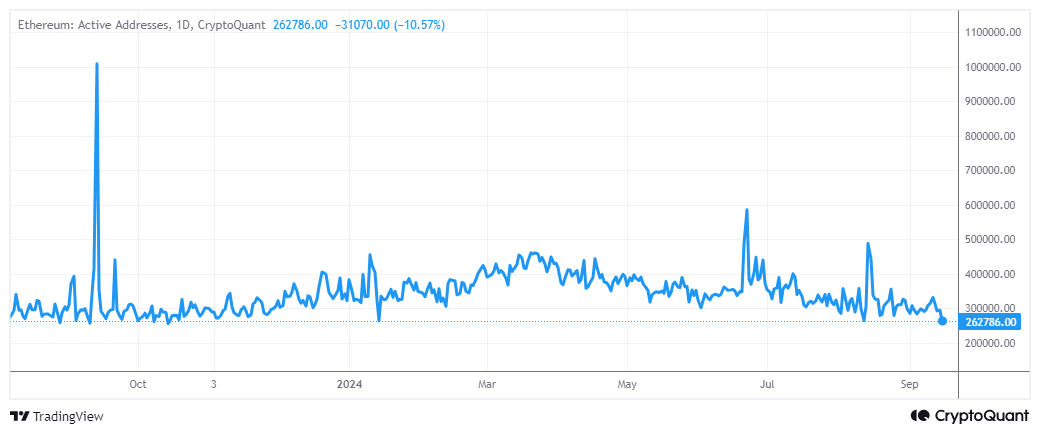

A deeper assessment of ETH’s on-chain activity revealed that address activity was down to 262,786 addresses. This was the lowest number of active addresses that the network recorded since mid-January 2024.

This slowdown reflected the higher level of uncertainty in the market as key market decisions are about to take place. Nevertheless, there were signs of ETH accumulation in as price dipped lower.

Read Ethereum’s [ETH] Price Prediction 2024–2025

For example, historical concentration revealed that whale addresses grew from 58.44 million coins on the 13th of August to 8.47 million coins on the 15th of September.

Retail addresses grew from 64.94 million coins to 64.97 million coins during the same period. These findings signal that investors, both whales and retail traders, are taking advantage of the discounted prices.