ETH derivative traders take neutral stance amid recovery- Here’s why

The cryptocurrency market experienced a small recovery phase as it crossed the $1.03 trillion market cap. Two of the leading cryptos, Bitcoin [BTC] and Ethereum [ETH] witnessed a surge in their respective price action over the last seven days.

But, it looks like the latter showed more focus and determination towards its recovery.

Rising from the ashes

Ethereum‘s major and most-expected upgrade, Merge (also known as Ethereum 2.0) is scheduled for this summer by ETH developers. However, a fixed date hasn’t been set yet. Nonetheless, some of the ETH holders are rejoicing in their profits thanks to their decision of HODLing.

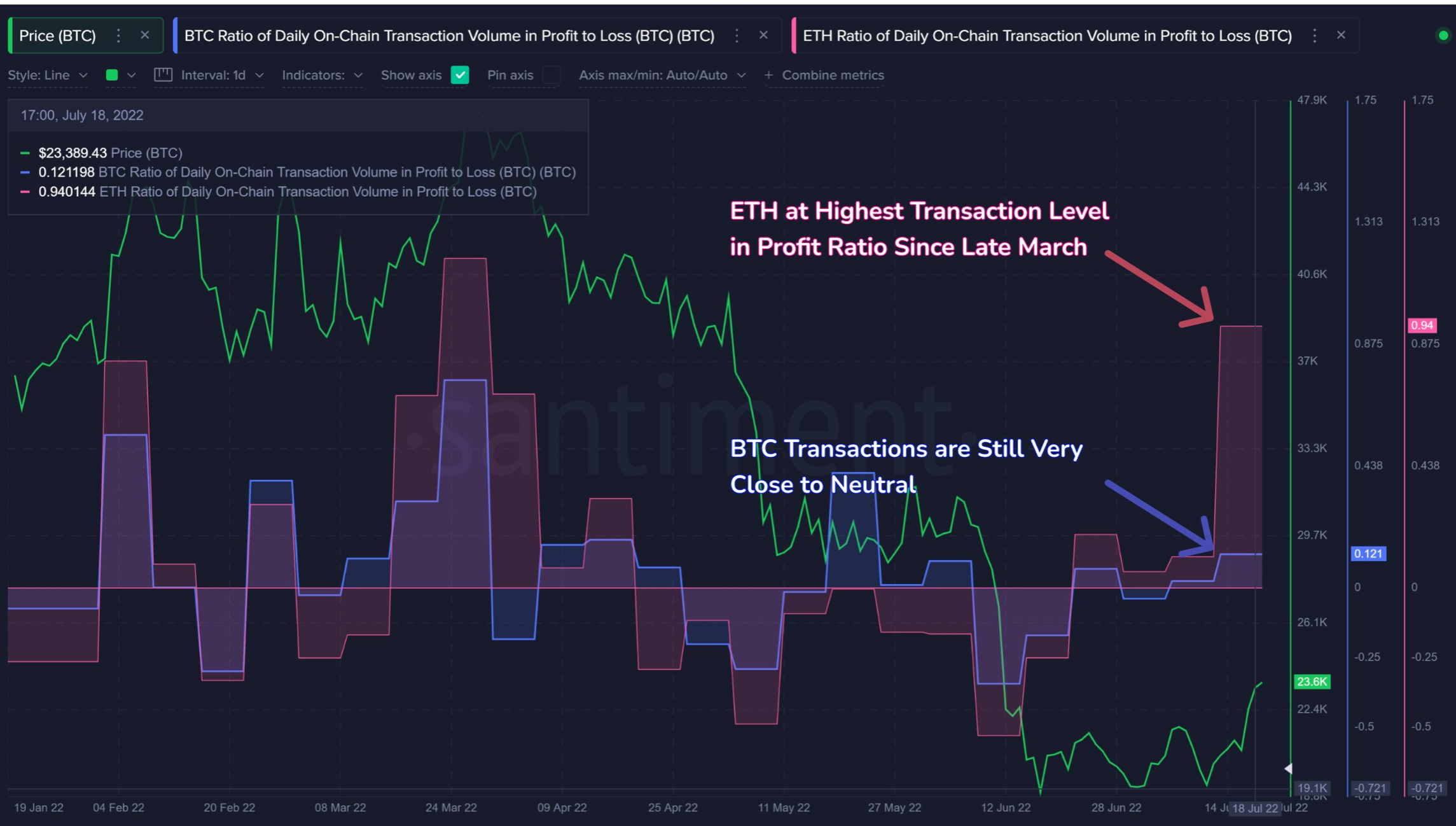

Both BTC and ETH have had a great rebound month in July. But, the largest altcoin saw far more signs of profit taking as compared to BTC’s neutral approach.

The ratio between transactions in profit vs. loss painted two very different pictures for the top market cap assets. Clearly, ETH’s metric rose above its arch-rival.

Indeed, the much-anticipated Merge created an overall optimism within the flagship network. For instance, ETH whales have been accumulating the token with the merge approaching closer.

Furthermore, Ethereum developers have shared a target for a mid-September Merge, fueling ETH’s rise to $1500. In fact, the token traded at around the $1,508 mark, at press time.

In fact, many companies are extending support to the largest altcoin now. For example, Galaxy Digital. The Galaxy Institutional Ethereum Fund bought $75.6 million worth of ETH according to a filing with the Securities and Exchanges Commission.

The purchase was on behalf of 21 investors, each with a minimum of $100,000 invested.

In or out?

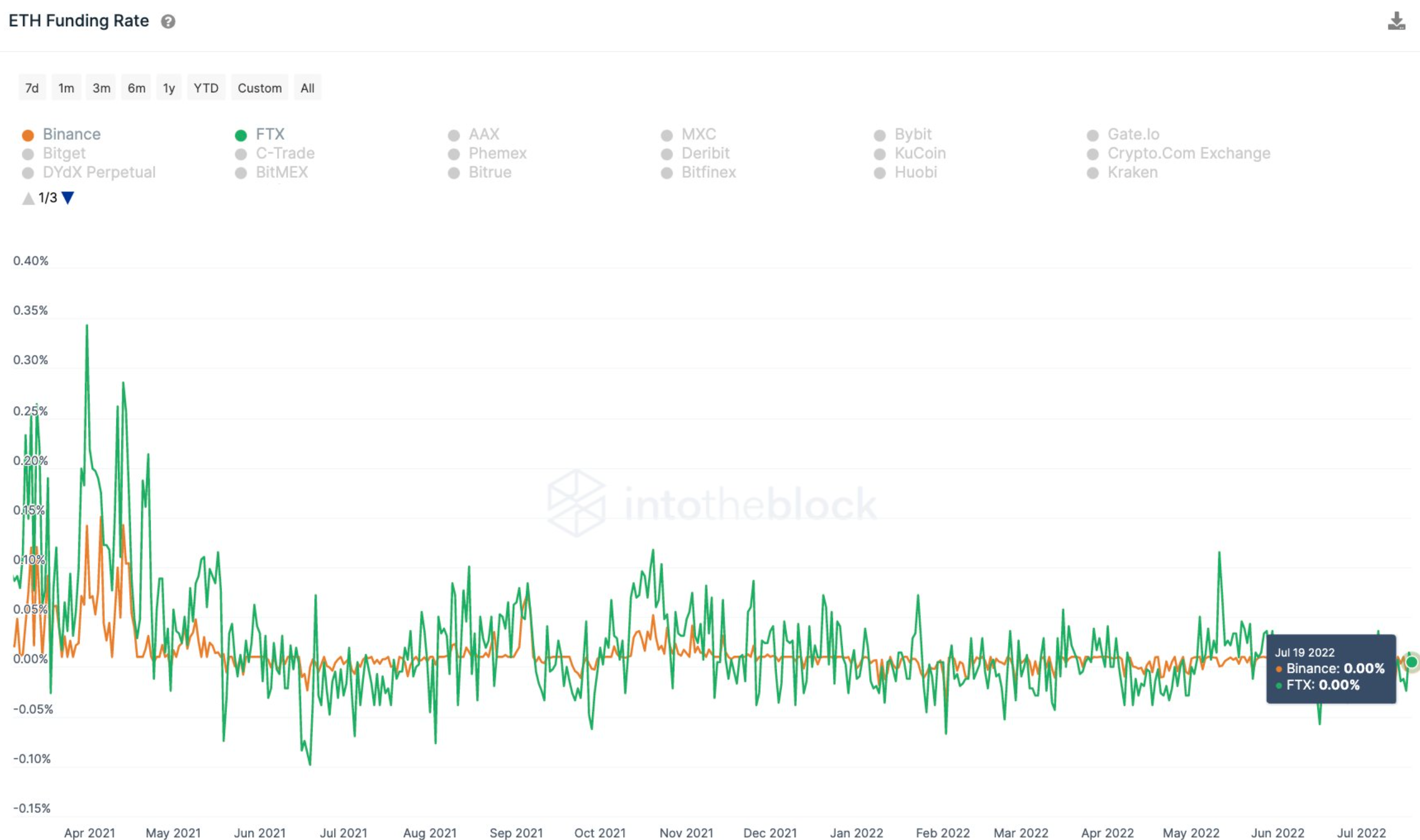

Now, you might ask- Is the market getting overheated? Well, there could be a possibility as derivatives traders showed a rather neutral approach.

ETH funding rates remained at 0%, pointing to neutral positioning from derivatives traders. This is in contrast with periods like April and November 2021, where funding rates stayed strongly positive.

In fact, the funding rate for ETH has been above zero for the most part of 2020 and 2021.

This means that more investors predicted a bullish move for the Ethereum market back then. Now, the tables have turned given the massive sell-offs in 2022.