ETH staking surges, could liquid staking derivatives see an upside

- Interest in staking ETH surged as Shanghai Upgrade approaches.

- Protocols such as Lido, Frax Finance and Rocket Pool reaped the benefits.

As the Shanghai Upgrade inches closer, interest in Ethereum [ETH] staking continued to increase. According to a 2 April tweet by Lido [LDO], 15% of all Ethereum supply was being staked.

+15% of the ETH supply is now staked ? pic.twitter.com/FkXbCzMHQv

— Lido (@LidoFinance) April 2, 2023

Is your portfolio green? Check out the LDO Profit Calculator

LSDs see some upside

This interest in Ethereum staking impacted the Liquid Staking Derivative (LSD) space positively. LSDs are financial instruments that allow investors to retain their staked assets’ earning potential while maintaining liquidity. They enable token holders to participate in various DeFi applications and earn yields while still having the flexibility to trade their staked assets.

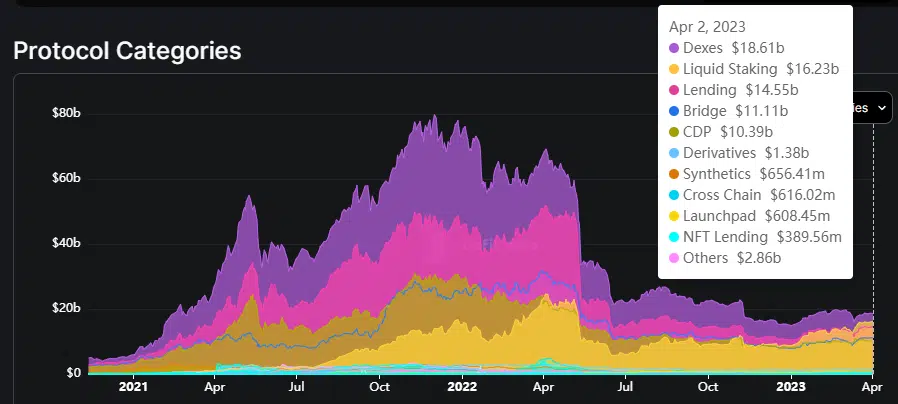

According to analyst Dynamo Patrick, LSD’s have become increasingly popular in the crypto space and have overtaken many sectors in the DeFi space, and have managed to rank second in terms of deposits made in the sector.

Popular LSDs in the crypto space include Lido, Frax Finance, and Rocket Pool.

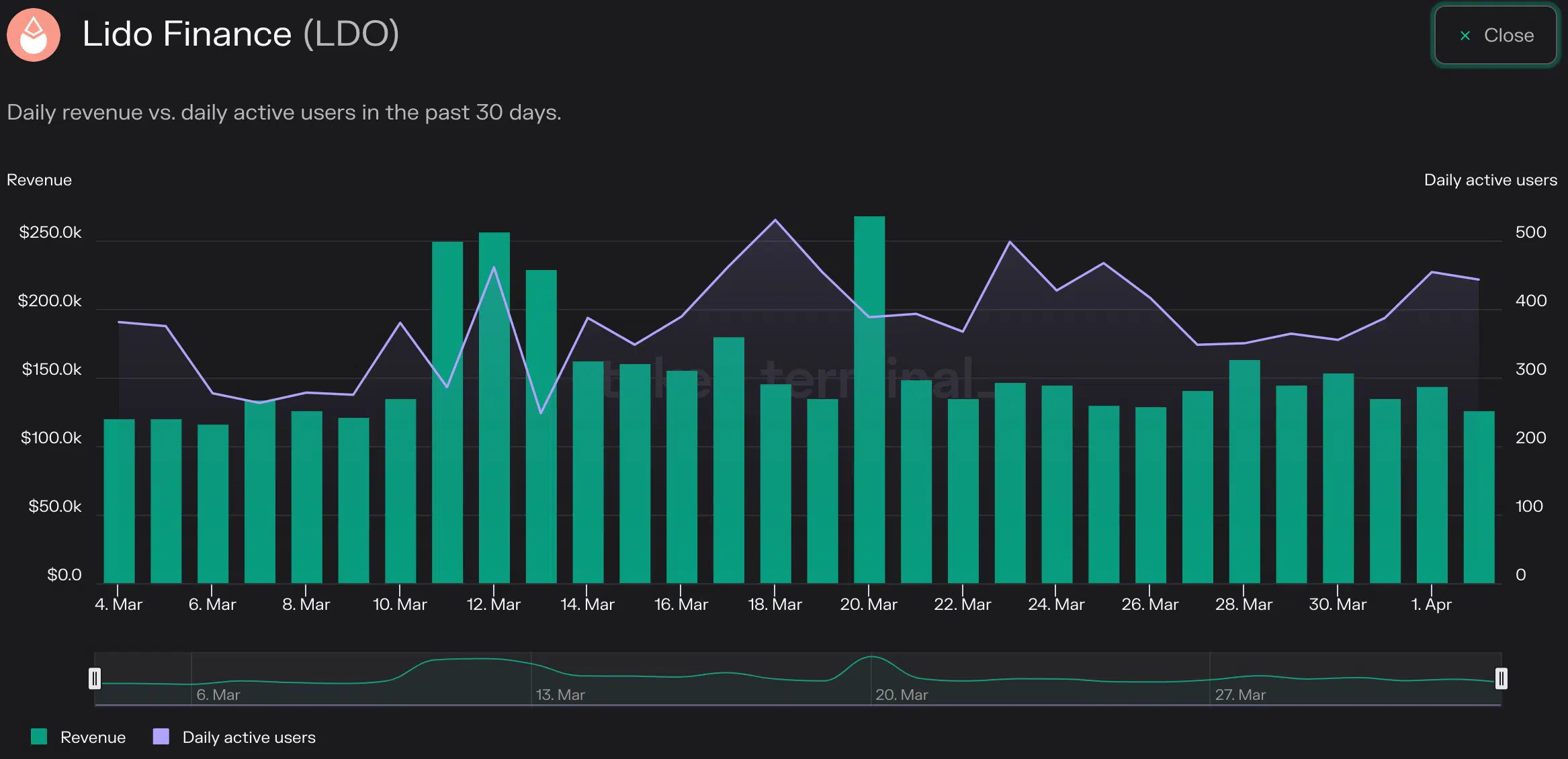

A large majority of the staked ETH has been deposited through Lido. According to Dune Analytics’s data, 31.4% of all staked ETH has been deposited through the protocol. Due to the dominance of Lido, the protocol has seen a massive surge in TVL over the last few months.

Coupled with that, the revenue generated by Lido increased by 22.1% over the last month. The main reason for the spike in revenue on the network would be the increased daily activity on the protocol.

Not just Lido

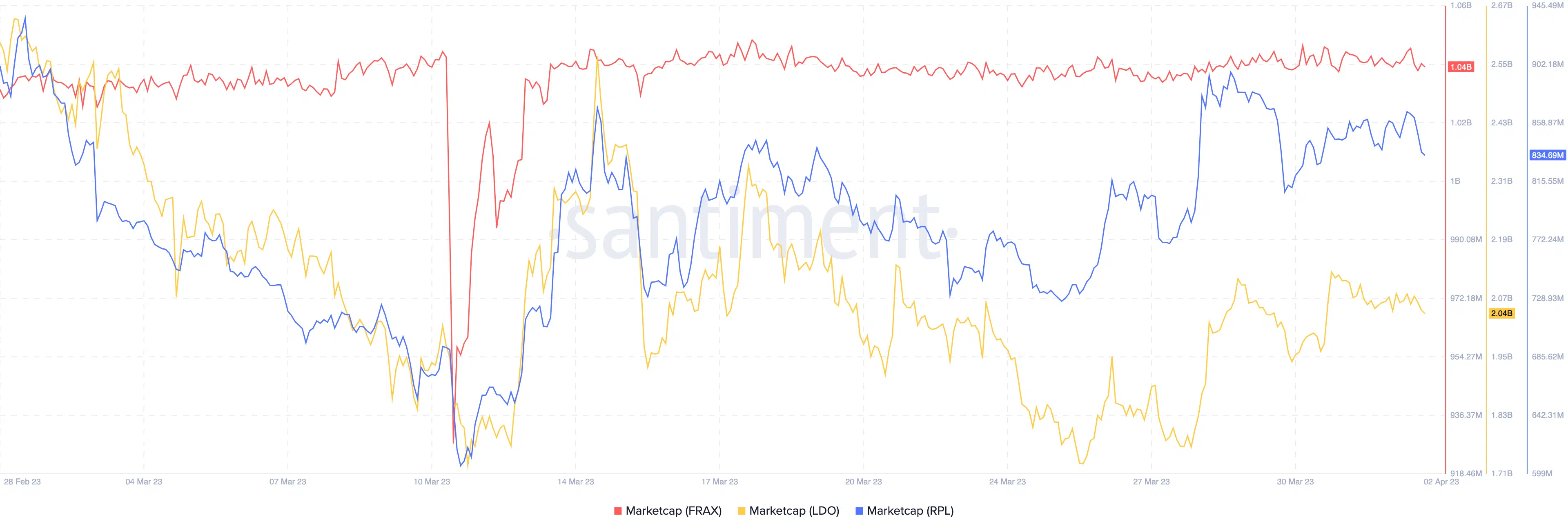

However, it won’t just be Lido that is impacted by the interest in staking, other protocols, such as Frax Finance and Rocket Pool also stood a chance of benefiting from the attention on LSDs.

Realistic or not, here’s XRP’s market cap in LDO’s terms

Each protocol’s token, LDO, RPL and FRAX has started to witness a rise in interest as a result. Investors and traders alike are buying tokens of these protocols to benefit from the interest being generated through staking. This was showcased by the growing market cap of each of these tokens over the last few days.

Only time will tell whether the interest in these tokens will continue long after the Shanghai Hardfork.