ETH traders put up an optimistic front despite falling prices, here’s why…

- Ethereum traders go long on ETH despite high market volatility.

- Activity on the protocol remains stable, whereas NFT interest sees growth.

The price of Ethereum experienced a significant degree of fluctuation subsequent to the highly anticipated Shapella upgrade. While a considerable number of traders displayed a pessimistic outlook towards ETH initially, it now seems that the prevailing sentiment has shifted.

Read Ethereum’s [ETH] Price Prediction 2023-2024

According to GreeksLive’s data, Ethereum observed block call option trades exceeding a value of $20 million, where a substantial proportion of these trades are for short-term calls and have been executed predominantly by prominent whales.

The high volume of block call option trades on ETH, particularly in short-term calls, suggested a bullish sentiment among large investors.

Additionally, based on OkGeeks’ data, the probability of a decline in implied volatility (IV) over the following days was significantly high. Implied volatility (IV) is the market’s expectation of how much an asset’s price is likely to fluctuate in the future and is a significant factor in determining option prices.

This reduction in volatility may indicate a stabilization of the market, providing a more predictable environment for investors.

At press time, ETH was trading at $1,889.23 and had fallen by 1.61% in the last 24 hours. Even though the prices were declining, other factors were in favor of the traders.

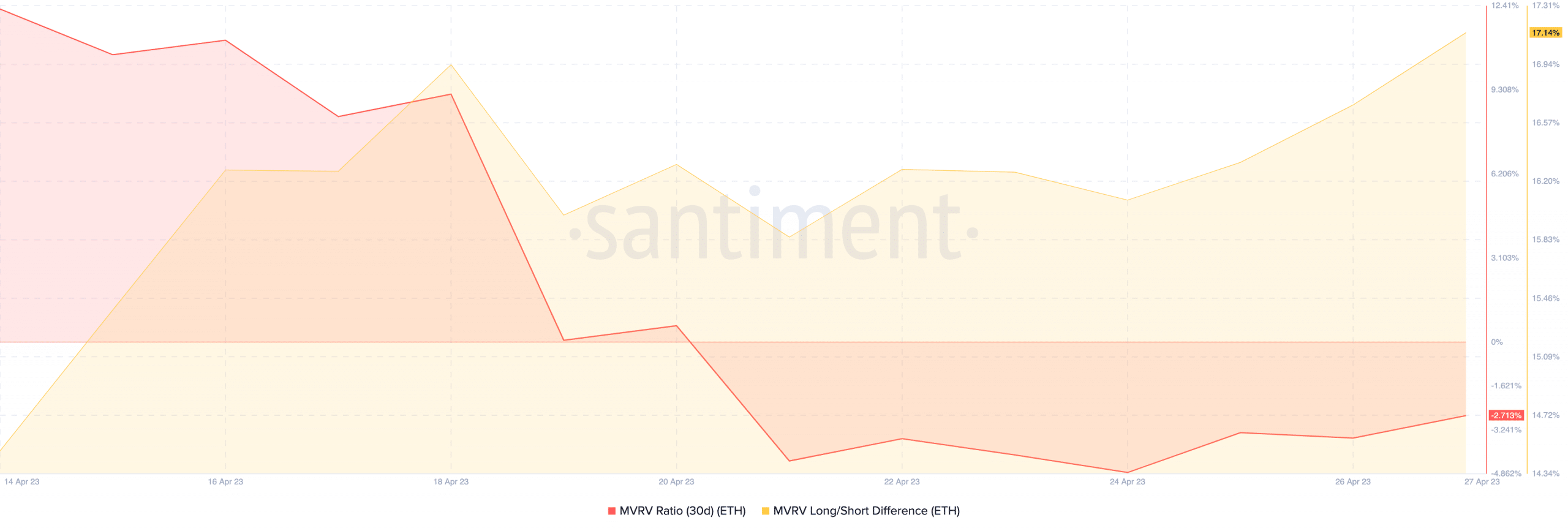

For instance, the negative MVRV ratio indicated that ETH was in an oversold position. The growing Long/Short Difference implied that the majority of ETH addresses were long-term holders, who were unlikely to sell at a loss.

What’s next for ETH?

Coming to the protocol, the Ethereum network recently announced its plans for its future. The changes to the protocol will include, making usage on the network cheaper using Danksharding. Danksharding is a way to increase the capacity of a blockchain network by grouping transactions into smaller subsets called “shards.”

Improvements to the security will also be made to the protocol. To prevent Denial of Service(DoS) attacks on validators, Ethereum would be implementing secret leader election on its network.

Realistic or not, here’s ETH market cap in BTC’s terms

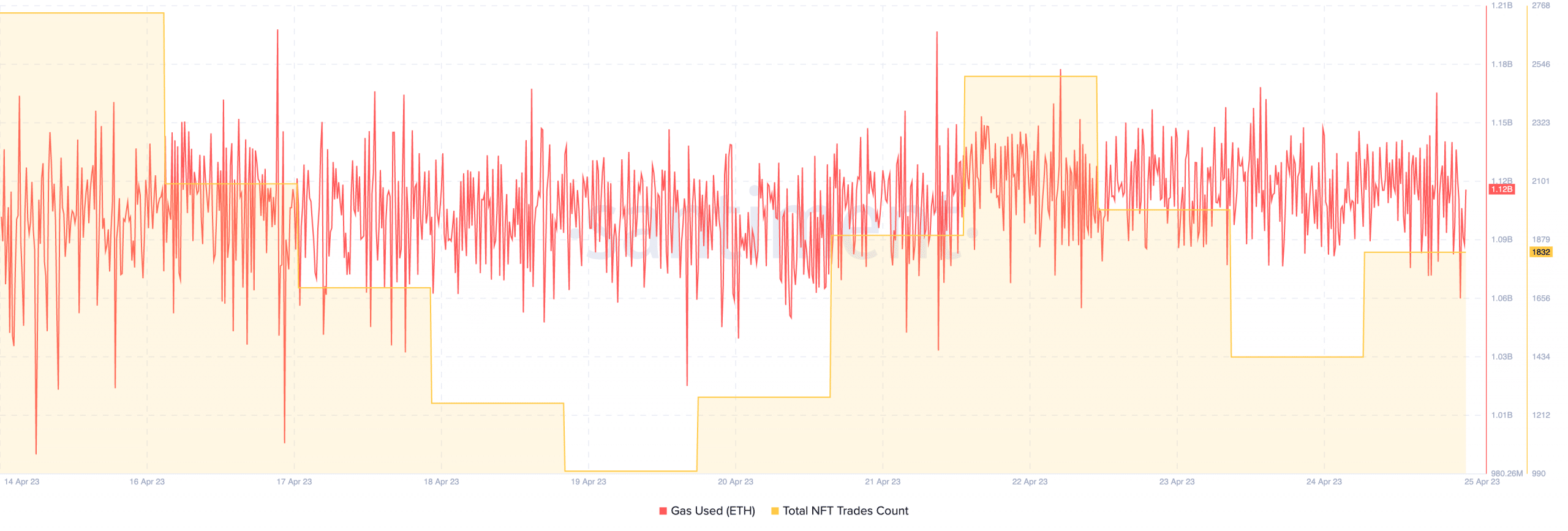

The activity on the network has larger remained consistent as showcased by the gas usage on the Ethereum network. In terms of NFT usage, on April 22nd, there was a slight reduction in the trading volume of Non-Fungible Tokens (NFTs) on the Ethereum network.

However, the market has shown signs of recovery over the recent days.