Ethereum

ETH validators witness MEV reward spike but not without bear trouble

Ethereum validators hit the jackpot with soaring MEV rewards amidst DeFi turmoil. However, the market’s bearish trend raises questions about ETH’s trajectory.

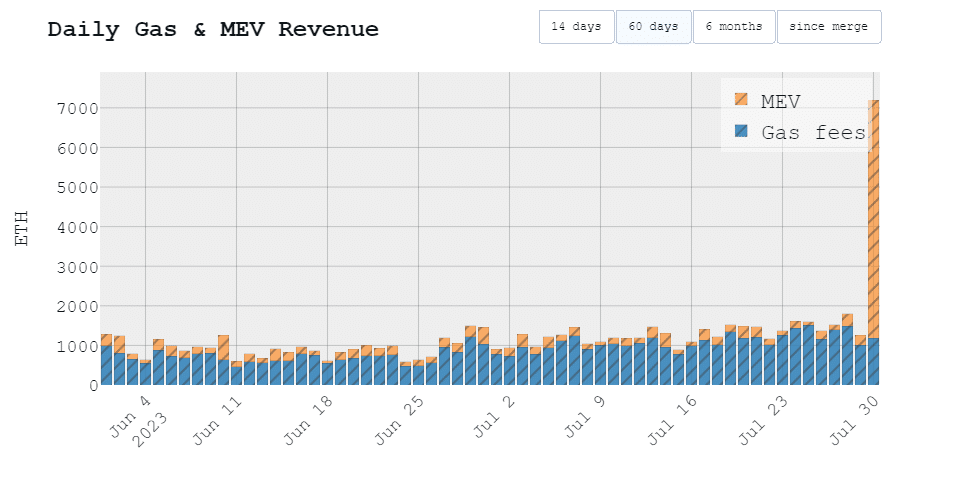

- MEV rewards spiked to over 6,000 during the weekend.

- Ethereum transactions and TVL remain normal as ETH’s bearish trend continues.

Amidst a whirlwind of turbulence in the DeFi space over the weekend, the Ethereum Maximal Extractable Value (MEV) soared to remarkable heights. It hit levels that were not seen in a long time.

This surge in rewards naturally left many curious about the state of transactions on the Ethereum network and ETH.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum validators ramp up rewards

During the weekend’s DeFi exploit, Ethereum network validators witnessed a remarkable surge in profitability, according to a post

. According to data from MevBoost, the tech industry’s turmoil led to a substantial spike in MEV rewards for these validators.On 30 July, the recorded MEV rewards peaked at over 6,000 ETH. This marked the highest level observed since Ethereum’s transition to Proof of Stake (POS). The second-highest recorded reward occurred on 11 March, with approximately 5,100 MEV rewards.

MEV plays a pivotal role in trading on the Ethereum

protocol, representing the additional profits validators earn by manipulating the order of transactions within a block. To access MEV, Ethereum validators predominantly rely on MEV-Boost, a software developed by Flashbots, enabling them to request blocks from a network of builders.By utilizing MEV-Boost relays, validators earn MEV, and an overwhelming 89% of validators employ this method to add blocks to the blockchain.

Impact on Ethereum transactions and TVL

DefiLlama’s data revealed that despite the spike in MEV rewards, there were no corresponding spikes in other on-chain metrics on Ethereum. The transaction activity on the network remained relatively stable, with no unusual surges observed.

As of this writing, the transaction volume was over 976,000, slightly higher than the volume recorded on 30 July, which was around 950,000. Similarly, the Total Value Locked (TVL) exhibited no significant trends. As of the latest data, the TVL stood over $23 billion and showed only a slight downtrend.

ETH gains but remains bearish

As of this writing, Ethereum’s

price experienced a minor uptick on the daily timeframe chart. It was trading at approximately $1,860, reflecting a slight increase of less than 1%. Despite this small gain, the overall trend remained bearish.– How much are 1,10,100 ETHs worth today

This bearish sentiment was evident from its Moving Average Convergence Divergence (MACD) indicator, which continued to trend below the zero line. This could be taken as a sign of bearish momentum in the market.

The Relative Strength Index (RSI) was also trending below the neutral line, further confirming the bearish outlook.