Altcoin

Ethena [ENA] surges 36% – Will the next $0.46 target break?

Ethena’s emergence as a leading weekly gainer reflects optimism, yet some factors may undermine its long-term prospects.

![Ethena [ENA] surges 36% - Will the next $0.46 target break?](https://ambcrypto.com/wp-content/uploads/2024/09/NewsarticlesFIRitika2-1-2-1000x600.webp)

- Ethena has made a notable comeback, climbing 36% in just over a week and positioning itself on the top weekly charts.

- While the current momentum is bullish, AMBCrypto advises exercising caution.

Ethena [ENA] launched six months ago at an ICO price of $0.57, shot to $1.46 in the first week. Since then, it has faced a bearish trend.

However, mid-September saw ENA break past its previous rejection level, reaching $0.413 – a solid 36% gain in just one week.

According to AMBCrypto, ENA’s next milestone is to retest the $0.46 resistance, contingent upon sustaining the upward trend.

Ethena proposes new developments

Ethereal Exchange has proposed integrating its DEX into Ethena’s hedging engine, sparking excitement in the market, evident by the 10% rise in ENA in the last 24 hours.

If approved, ENA holders would receive 15% of any potential Ethereal governance token.

In essence, this would allow the Ethereal DEX to manage on-chain spot and derivative positions backing USDe, Ethena’s native stablecoin, which is also expected to play a role in future developments.

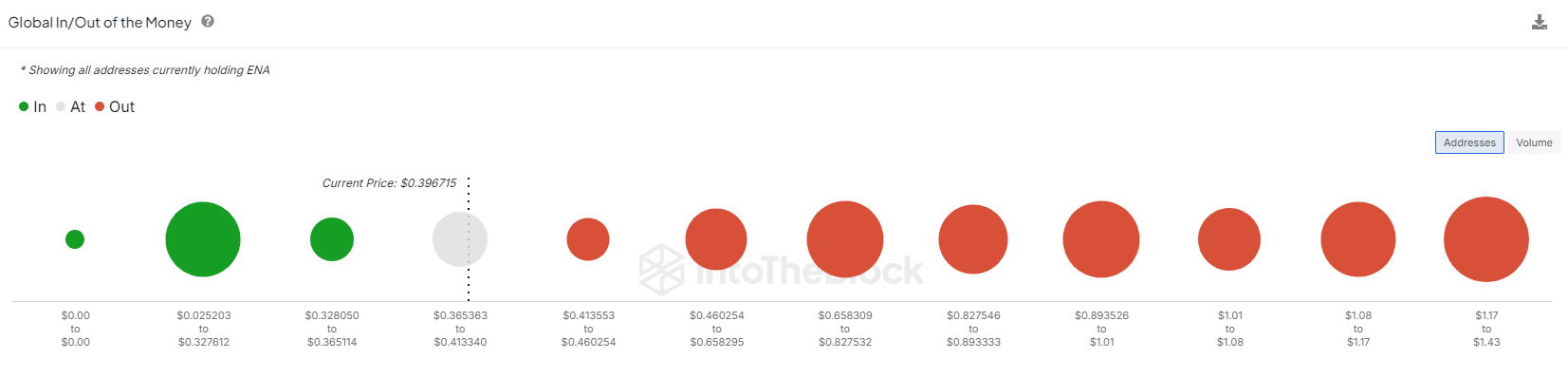

Interestingly, a significant cluster of holders in net loss positions accounts for 85% of the total ENA allocations.

Per AMBCrypto, this concentration suggests that the majority of investors are holding at a loss, potentially awaiting a reversal or key developments to regain value.

Thus, while Ethena’s upcoming roadmap could boost liquidity in the network, it might fall short of sparking a sustained bullish rally. Unless…

Large holders support these propositions

Since Bitcoin’s bearish downturn in late August, Ethena has experienced a similar pullback, largely driven by large holders selling off.

Notably, whales – who make up 85% of this group and hold approximately 13.45 billion ENA – have been consistently selling portions of their holdings.

However, in the past week, net outflows from these holders have been increasing daily, reaching approximately 12 million just two days ago.

Caution is advised

In the past seven days, speculative trading of Ethena has been driven by traders shorting ENA.

Historically, the first week of September also saw market shorts take over, pushing Ethena to seek support at $0.19.

However, despite the surge in shorts, they couldn’t trigger a pullback, as whale activity absorbed much of the pressure – creating an ideal short-squeeze scenario.

Yet, if the market capitulates to a downward swing in BTC and whales lose confidence in future gains, a resurgence in shorts could undermine the rally, rendering the recent announcement less impactful.

Realistic or not, here’s ENA’s market cap in BTC terms

Per AMBCrypto, monitoring their activity is crucial for pushing Ethena closer to its earlier rejection at $0.46.