Ethena: Should you bet on ENA after its 97% surge?

- Demand for ENA increased as collateralized BTC and ETH surpassed $1.40 billion.

- On-chain metrics supported a price increase despite issues with USDe’s APY.

Ethena [ENA], the native token of the dollar-denominated saving protocol, began its introduction into the market, on the offensive path. In the last seven days, the price of ENA has increased by a mind-altering 96.57%.

This happened at a time when many other altcoins corrected until the 8th of April. But there were reasons why ENA, despite being relatively new, was atop the performance table.

First off, let’s look at the fundamentals. Ethena prides itself as a crypto solution for those who want an alternative to the traditional banking infrastructure.

Big promise, more demand?

With this, Ethena created Ethena USDe [USDe], a DeFi-based stablecoin. One thing AMBCrypto observed was that Ethena’s objectives were similar to TerraLuna before the 2022 crash.

However, the project seems to be putting structures in place to avoid such collapse. From its official website, it held collateral positions in Bitcoin [BTC]. This was worth $594 million.

Ethereum [ETH] also had a place there, with collateral worth $809.10 million. These measures were necessary considering that Ethena offers an incredible 37.1% Annual Percentage Yield (APY) on USDe savings.

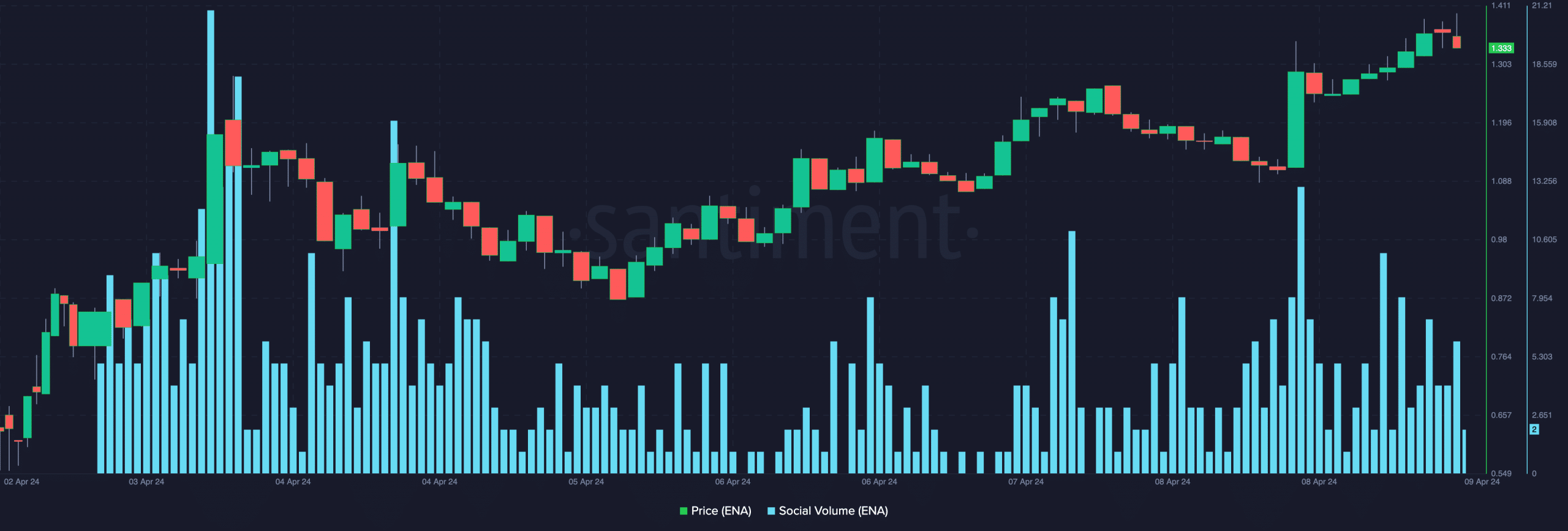

Despite that, market participants have shown confidence in the project. This was evident from the social volume. Since its launch, ENA’s social volume has spiked on different occasions.

This implied that participants’ search for the token was at impressive points. If this metric continues to jump at intervals, then demand for ENA could rise more than it currently has.

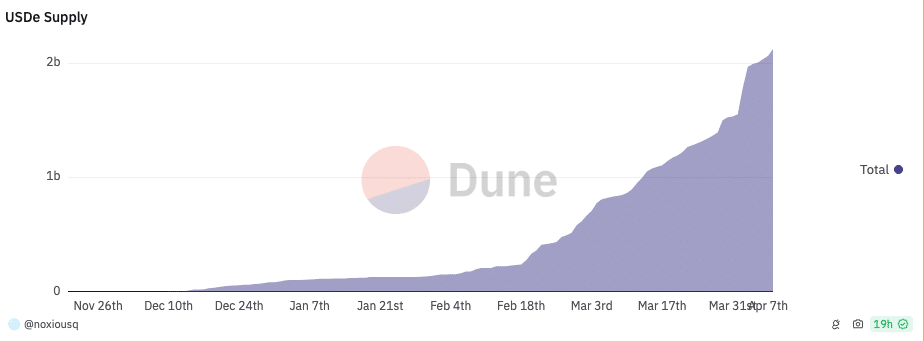

Meanwhile, USDe might also have a say in ENA’s price action. This was because of the way the adoption of the stablecoin has been rising.

According to Dune Analytics, USDe’s supply was about $1.55 billion on the 4th of April. But at press time, the metric had increased to $2.13 billion.

A surge like this, combined with a total holder count of 11,257 could put other DeFi stablecoins like DAI under pressure. Should the momentum continue this way, ENA might maintain its performance when the forthcoming altcoin season begins.

Not all parties will place big bets

Interestingly, Arthur Hayes revealed that he was bullish on the token. According to Hayes, the co-founder of BitMEX, ENA can reach $10.

However, other founders in the industry have raised concerns about the project. For instance, Andre Cronje, co-founder of Fantom [FTM] warned about the risks of the yield Ethena offered. Cronje wrote in his newsletter,

“The core issue I see with this protocol is the assumptions around the persistence of yield – they rely on the short leg paying out bigly, and this is far from a guarantee.”

He, however, admitted that the project is an interesting and ambitious one, wishing them success in the process. For the time being, it seemed participants were unconcerned about that.

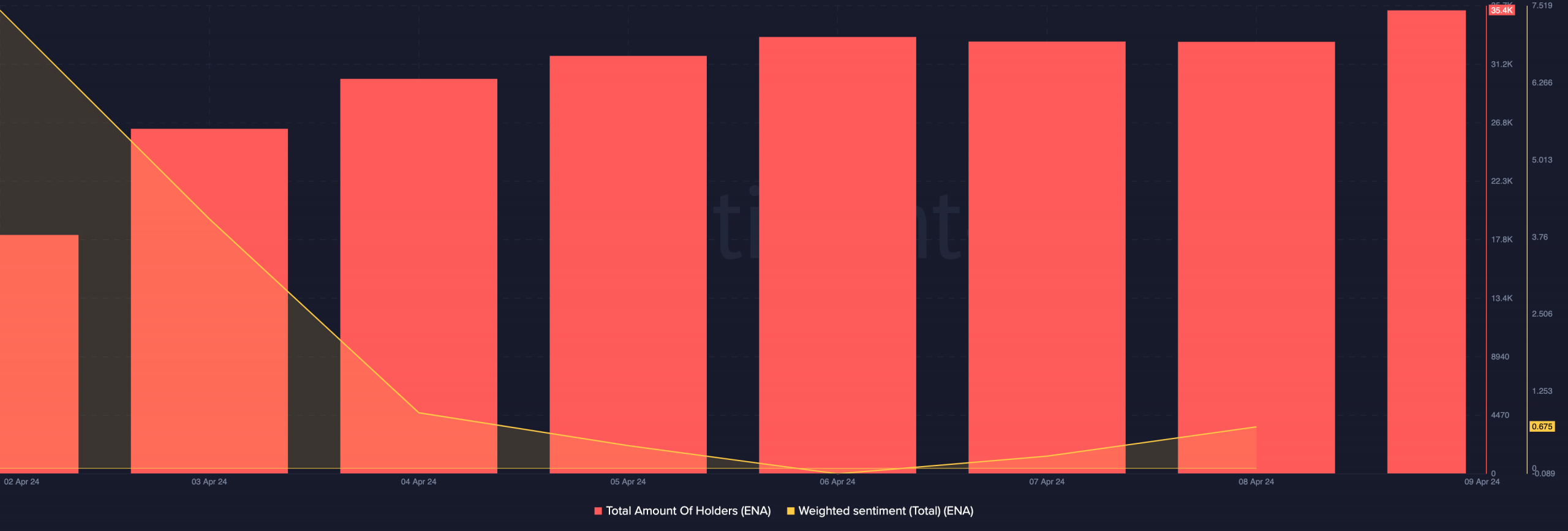

Instead, on-chain data showed an increase in the number of holders. Apart from that, the Weighted Sentiment around ENA remained positive.

Realistic to not, here’s ENA’s market cap in BTC terms

If things stand this way going forward, ENA’s price might be one to watch out for. In a case where the project stays to its promise, an unprecedented rally could take it to amazing heights.

However, this does not mean that the value would not undergo a downtime,