Ethena: THIS signals 60% rally ahead – Time to buy ENA?

- ENA’s Long/Short Ratio in the past 12 hours stood at 1.69, indicating strong bullish sentiment.

- The major liquidation levels were near $0.395 and $0.409, with traders over-leveraged at these levels.

The majority of cryptocurrencies across the digital asset landscape are either experiencing notable price surges or price corrections.

Amid this, the popular Telegram-linked Ethena [ENA] appears bullish, as it has recently retested its bullish price action pattern and is poised for a notable upside rally in the coming days.

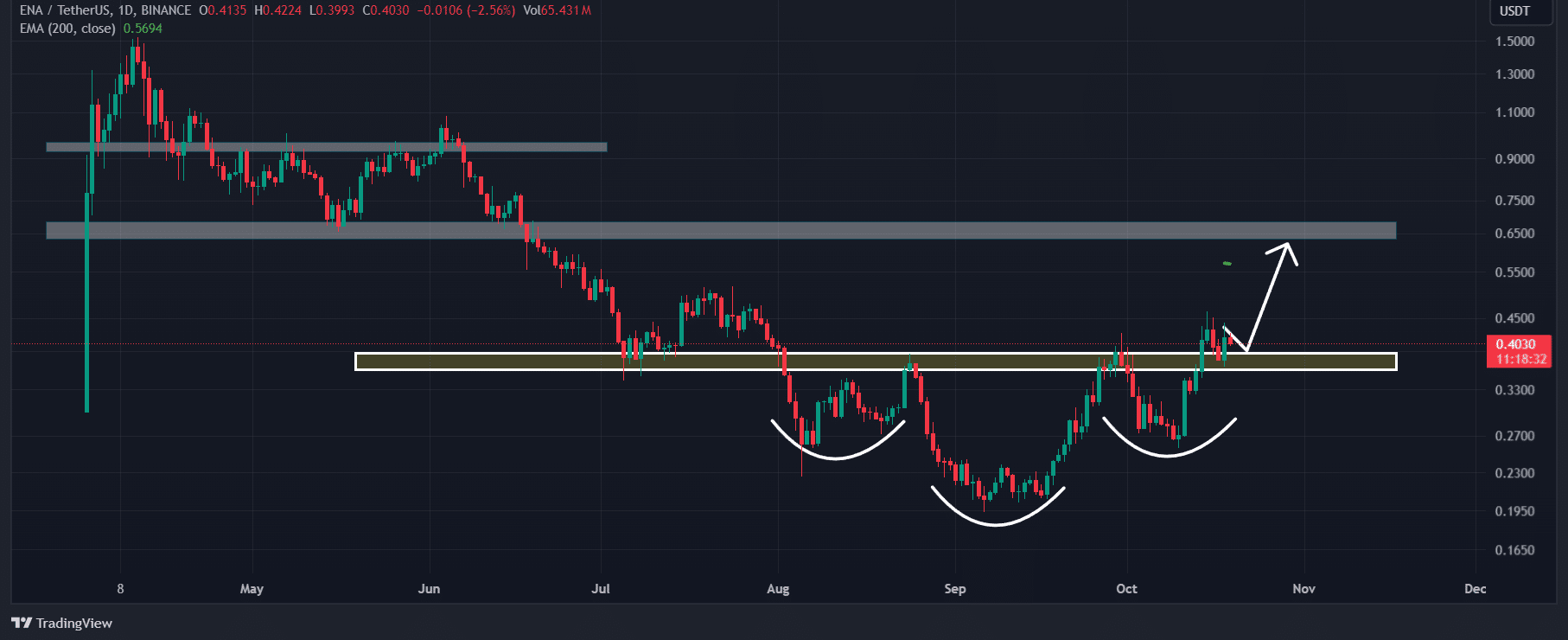

Ethena’s successful breakout

According to AMBCrypto’s technical analysis, Ethena has recently broken out from a bullish inverted head-and-shoulder price action pattern and has successfully retested the breakout level of $0.362.

Following the retest of the breakout level, ENA has begun moving in an upward direction, which is a positive sign for token holders.

Based on the recent price momentum, there is a strong possibility that ENA could soar by 60% to reach the $0.65 level in the coming days.

However, the asset’s recent performance has already gained massive attention from investors and traders, and there is a similar expectation that ENA has generated in the past week.

Investors and traders often see the breakout of an inverted head and shoulder pattern, along with a retest, as a bullish sign and believe this indicates a successful breakout.

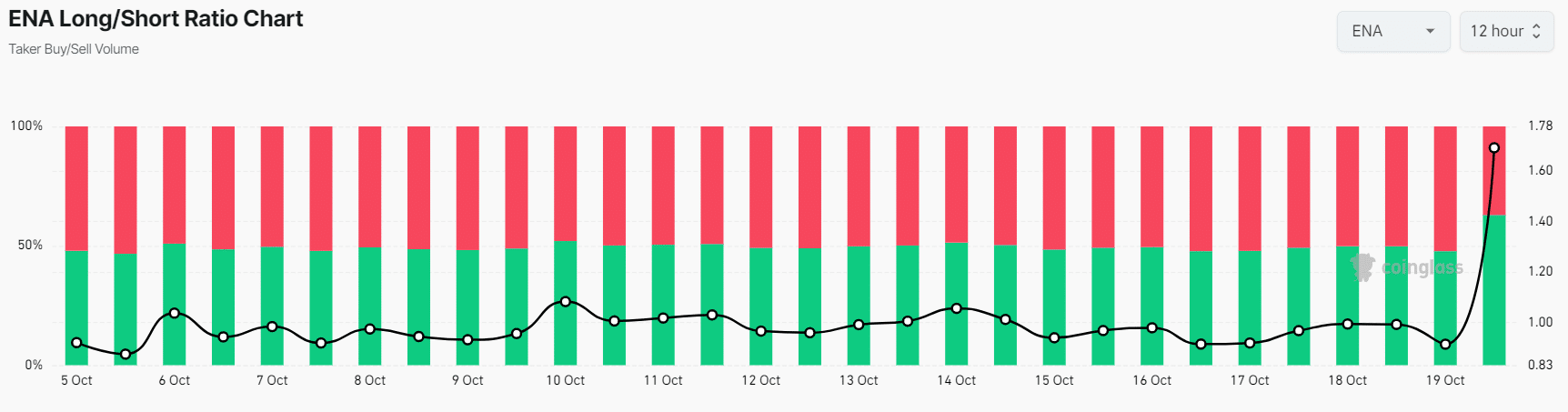

Bullish on-chain metrics

ENA’s positive outlook is further supported by the Long/Short Ratio, which, per Coinglass, stood at 1.69 in the past 12 hours until press time, the highest since late September 2024.

This notable long/short value indicated strong bullish sentiment among traders.

Additionally, ENA’s Open Interest has remained unchanged in the past 24 hours, suggesting traders are waiting for the asset to close a daily candle above the $0.45 level.

At press time, 62.86% of top traders held long positions, while 37.14% held short positions.

Major liquidation levels

Alongside this, major liquidation levels were near $0.395 on the lower side and $0.409 on the upper side, with traders over-leveraged at these levels, according to Coinglass.

If the market sentiment remains unchanged and the price rises to the $0.409 level, nearly $1.87 million worth of short positions will be liquidated.

Conversely, if sentiment shifts and the price drops to the $0.395 level, approximately $1.41 million worth of long positions will be liquidated.

Read Ethena’s [ENA] Price Prediction 2024–2025

This liquidation data suggests that short sellers were active and waiting for the price to fall below the $0.395 level, which is unlikely to happen due to the bullish market sentiment across the cryptocurrency landscape.

Current price momentum

At press time, ENA was trading near $0.402 after a modest price surge of over 0.55% in the past 24 hours. During the same period, its trading volume jumped by 20%, indicating higher participation from investors.