Ethena whales offload 22 mln ENA at $7 mln loss: Crash incoming?

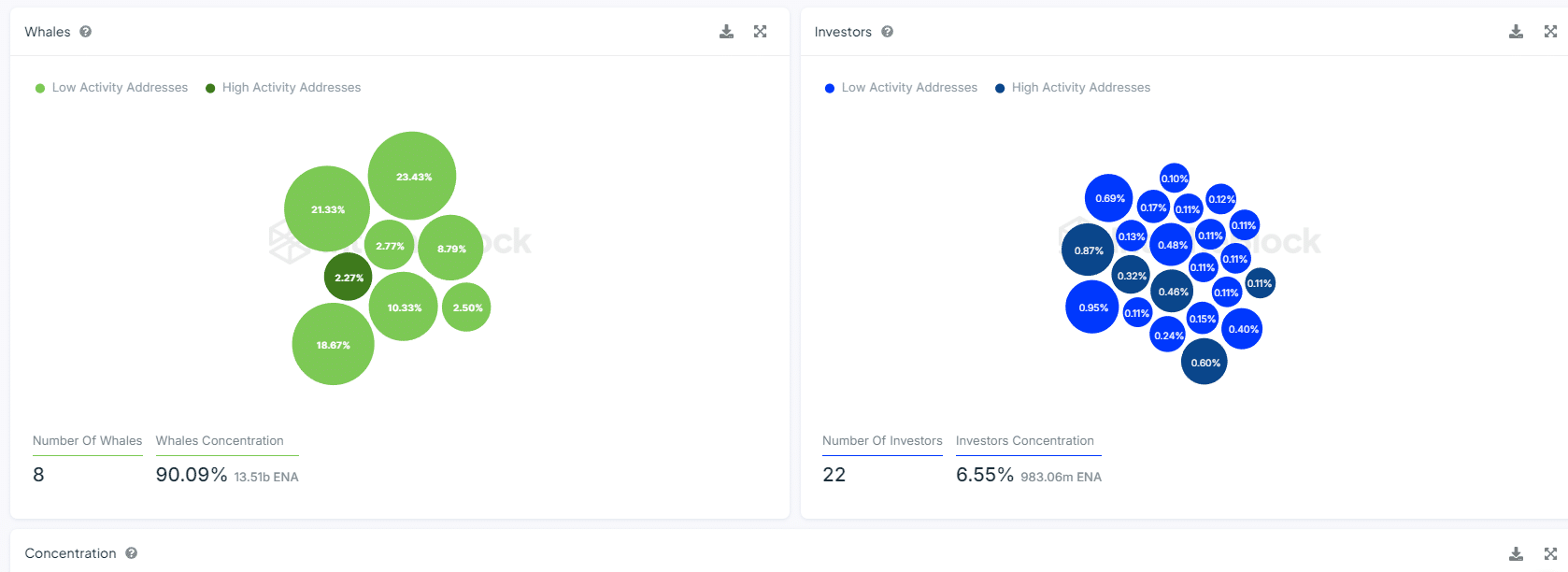

- ENA can be easily manipulated, as eight whales hold 90.09% of Ethena’s total supply.

- If the price rises to the $0.260 level, nearly $2.8 million worth of short positions will be liquidated.

The current market sentiment is quite bearish, with top cryptocurrencies bleeding, including Bitcoin [BTC], Ethereum [ETH], and Solana [SOL].

Amid this market downturn, Ethena whales have dumped a notable 22 million Ethena [ENA], worth $6.9 million, to Binance [BNB].

Whale activity signals alarm for ENA investors

On the 30th of August 2024, the on-chain analytic firm Spotonchain made a post on X (formerly Twitter) that whales unstaked ENA and later dumped on the Binance at a significant loss of over $5 million.

According to data, these whales withdrew ENA from the exchange between April and August 2024. However, they also bought the dip in both July and in August 2024.

Whereas, another Ethena whale wallet address, 0x0A7, dumped 6.49 million ENA worth $1.65 to Binance at a loss of $1.96 million.

The potential behind the extremely bearish outlook for ENA is the market sentiment and its manipulative concentration.

Market manipulation concerns

Data from IntoTheBlock indicated that ENA could be easily manipulated, as eight whales held 90.09% of Ethena’s total supply, and 22 sharks owned 6.55%.

Meanwhile, retailers held only 3.36% of the total supply. This whale concentration potentially makes ENA the most alarming investment option.

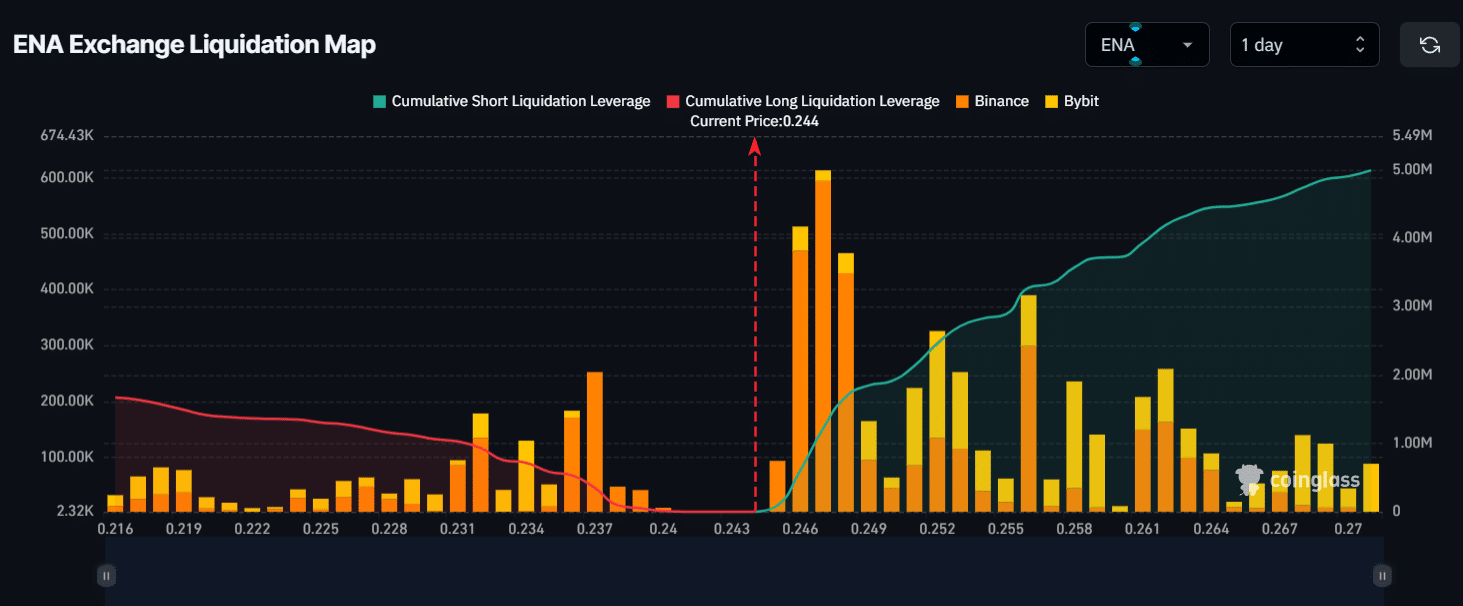

Key liquidation levels

As of now, the major liquidation levels were near $0.232 on the lower side and $0.260 on the upper side, as traders have over-leveraged at these levels in the last seven days, according to the on-chain analytic firm Coinglass.

If this sentiment remains unchanged and the ENA price declines to the $0.232 level, nearly $526,000 worth of long positions will be liquidated.

Conversely, if the sentiment changes and the price rises to the $0.260 level, approximately $2.8 million worth of short positions will be liquidated.

This data indicates short sellers are currently dominating and liquidating the long positions.

ENA price and market performance

At press time, ENA was trading near $0.242, having experienced a price drop of over 4% in the last 24 hours, according to CoinMarketCap data.

Its trading volume dropped by 15% during the same period, indicating lower participation and fear among traders.

Read Ethena’s [ENA] Price Prediction 2024–2025

Whereas, ENA’s Open Interest fell as well, having dropped by 2.5% in the last 24 hours. This decline in Open Interest is likely due to contracts being closed, either out of fear or due to potential liquidation.

Besides ENA, major cryptocurrencies such as BTC, ETH, and SOL also experienced a price decline of over 0.6%, 1.3%, and 4.1% respectively, in the last 24 hours.