Ethereum active addresses jump 36%: Will ETH break $4000 now?

- Ethereum active addresses up 36%, signaling organic demand and solid network activity.

- Breaking $4,100 resistance could propel ETH towards its all-time high of $4,891.

Ethereum [ETH] experienced a major surge earlier this month, briefly touching the $4,000 mark before entering a consolidation phase. While price action has cooled in recent days, analysts remain optimistic, pointing to strong indicators that Ethereum’s bullish momentum is far from over.

Since the US elections on 5th November, ETH has seen a remarkable 70% price increase, fueled by organic demand, as evidenced by a significant rise in active addresses.

This surge, driven by real network activity, suggests that Ethereum’s rally could be sustainable, with the potential for continued growth in the months ahead.

Ethereum price action post-US elections: A deep dive

Ethereum’s price trajectory post-US elections has been nothing short of explosive, with the asset rallying 70% since 5th November.

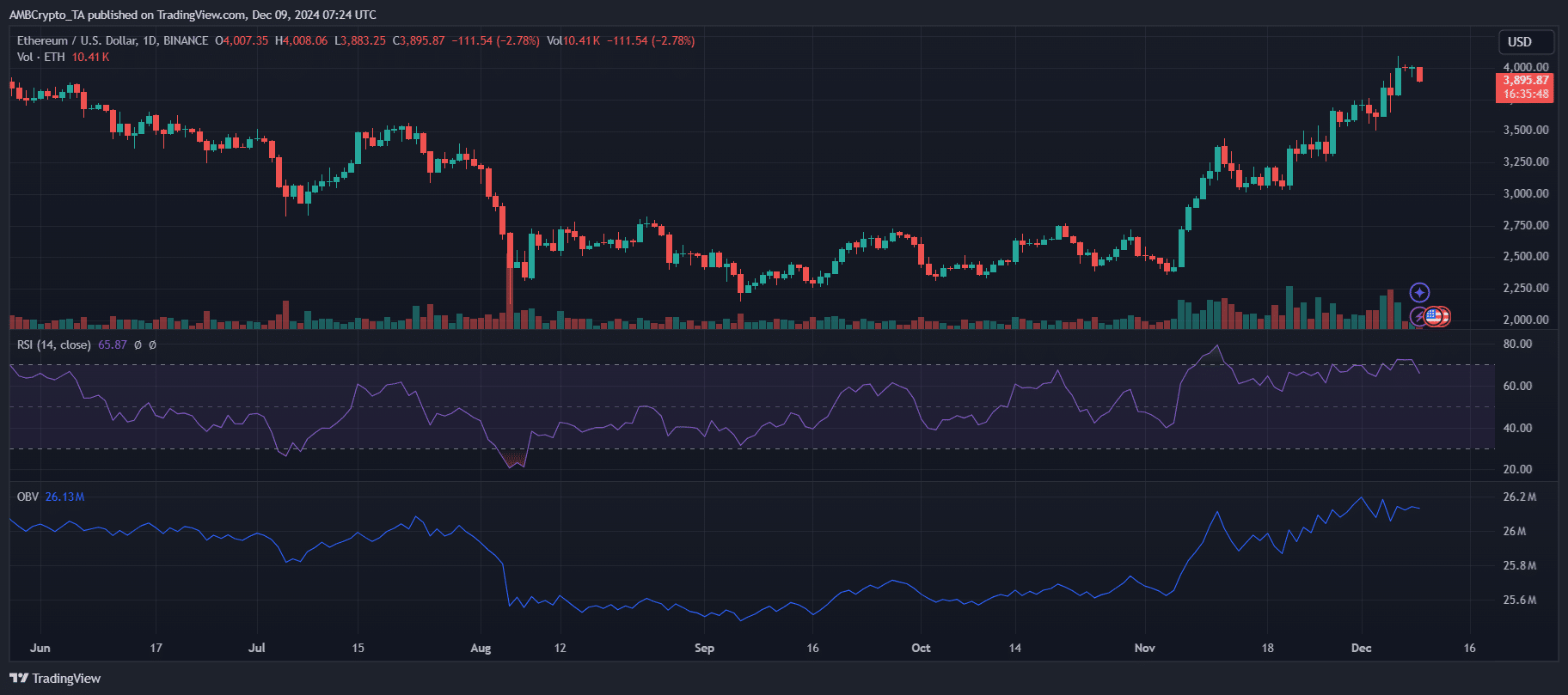

The breakout above the $3,500 resistance signaled a shift in market sentiment, catalyzed by increased institutional activity and DeFi resurgence. TradingView data highlights robust volume accumulation alongside bullish price action, evidenced by a rising OBV metric.

This shows strong buyer interest, not merely speculative hype. Furthermore, the RSI remains below overbought territory, suggesting room for continued upside.

Analysts attribute this momentum to Ethereum’s dominance in Layer-2 scaling solutions and its growing role in facilitating decentralized applications.

Surge in ETH active addresses

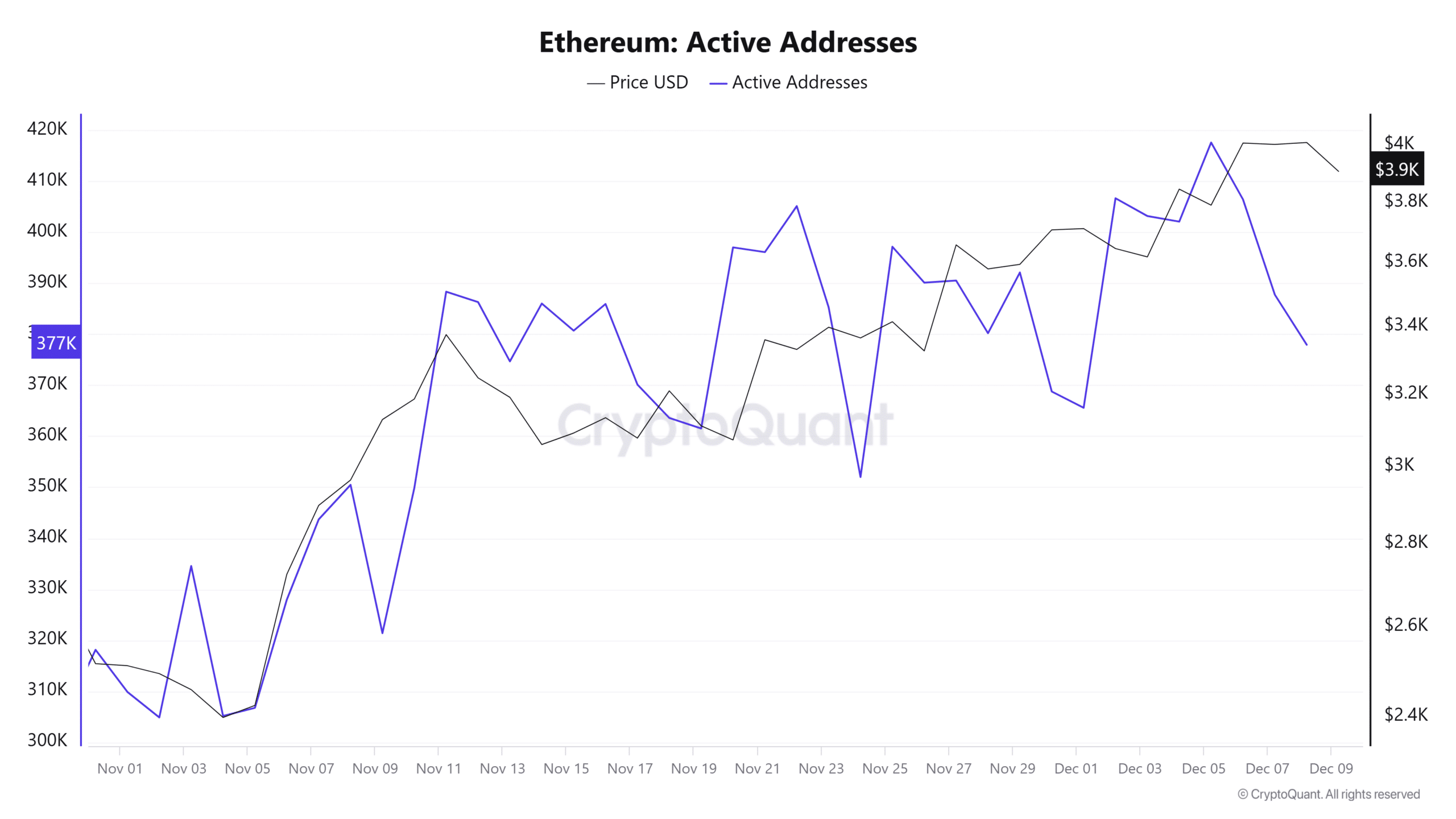

Ethereum’s network activity has seen a substantial uptick since the November 5 elections, with active addresses climbing by over 36% to 417,000.

This surge highlights organic demand rather than speculative trading, underscoring a “healthy and sustainable” rally, according to CryptoQuant analyst Burak Kesmeci.

The increase in active addresses reflects heightened investor interest and broader blockchain usage. This metric, often considered a proxy for real network activity, lends credence to Ethereum’s current rally as being grounded in strong fundamentals.

Analysts suggest this growth could signal a continued upward trajectory, particularly with Ethereum’s expanding role in DeFi and NFTs, reinforcing its position as the leading altcoin amidst an evolving market landscape.

Ethereum’s $4,000 consolidation: Bullish or bearish?

Ethereum’s consolidation phase at $4,000 comes with mixed sentiments regarding its next move. While some foresee a potential pullback, Kesmeci remains optimistic, citing healthy fundamentals.

According to him, breaking the $4,100 resistance could propel Ethereum toward its all-time high of $4,891. Key indicators, such as rising active addresses and sustained volume accumulation, suggest bullish momentum remains intact.

However, the $4,100 level presents a psychological barrier. Analysts also highlight the possibility of external factors, like macroeconomic conditions or regulatory developments, influencing Ethereum’s trajectory.

For long-term investors, Ethereum remains profitable, with gains of over 39% in the past month, positioning it as a cornerstone of the altcoin rally.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum’s growing institutional adoption is evident from the rising inflows into spot ETFs, which now boast a cumulative net inflow of $1.41 billion.

The timing of these inflows aligns with Ethereum’s recent rally, amplifying bullish sentiment around the asset.