Analysis

Ethereum aims for $2000, but there are some obstacles

The MVRV ratio rose to highs not seen since July, meaning that profit-taking activity could kick in soon and initiate a reversal- but such en masse selling was not yet evident.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

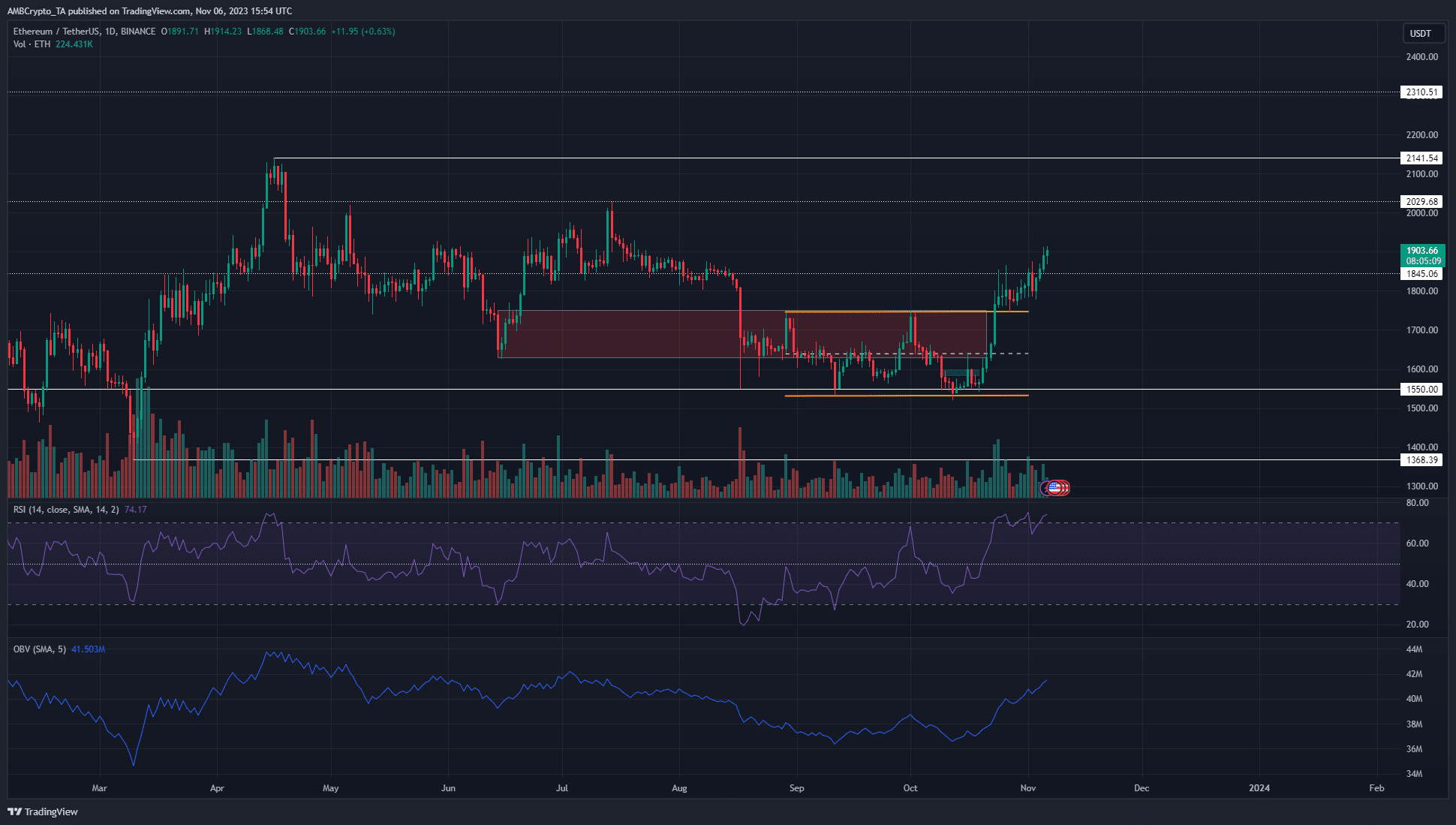

- ETH has a bullish market structure on the daily chart.

- The resistance above $2000 combined with the findings from the liquidation levels heatmap showed a reversal was possible.

Ethereum [ETH] has rallied strongly in the past three weeks and gained close to 25% in three weeks. News that Hong Kong is considering allowing exchange-traded funds (ETFs) that invest directly in crypto such as ETH buoyed investor sentiment.

Analysis of a whale’s transactions in recent hours showed a large amount of ETH left the Binance exchange. Was this a sign that smart whales continued to accumulate ETH?

The $2000 psychological level could rebuff bulls once more

On the one-day chart, the market structure and momentum were firmly bullish. The RSI was at 74 to reflect the same, and the On-Balance Volume has trended higher since mid-October. This underlined the fact that buying volume has been far greater than selling volume in the past three weeks.

To the north, the next levels of interest were at $2039 and $2141, which marked the highs from July and April respectively. A look at the one-week ETH price chart revealed that the $1940-$2140 was a stern zone of resistance, and has been since May 2022.

Therefore, an immediate breakout past this higher timeframe resistance zone was less likely to occur, which meant ETH holders from lower prices could lock in their profits and wait for the next move.

The vast liquidity pool at $2070 was an attractive bullish target

Source: Hyblock

The liquidation levels heatmap from Hyblock highlighted two areas that could be critical for long-term investors. The first was the $2070 mark which coincided with a resistance zone from the earlier technical analysis.

A move just above $2070 to liquidate these positions could be followed by a reversal. The next large accumulation of liquidations was below the lows set in recent months at $1485. Hence a revisit to the $1500 area would likely be a juicy buying opportunity.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2023-24

The 180-day mean coin age continued to trend higher as ETH prices climbed. This showed holders have not yet begun to sell their ETH en masse. The dormant circulation metric didn’t witness a notable spike in recent days either, reinforcing this idea.

On the other hand, the MVRV ratio rose to highs not seen since July, meaning that profit-taking activity could kick in soon and initiate a reversal. For that reason, ETH bulls can lock in their profits and wait for the market to show where it is headed next.