Ethereum apes MicroStrategy’s pattern: What are odds of $14K in 2025?

- Ethereum follows MicroStrategy’s pattern from 2021 to 2025 suggesting thatETH could hit $14K.

- High volatility continues for ETH in the short and long term, creating opportunities.

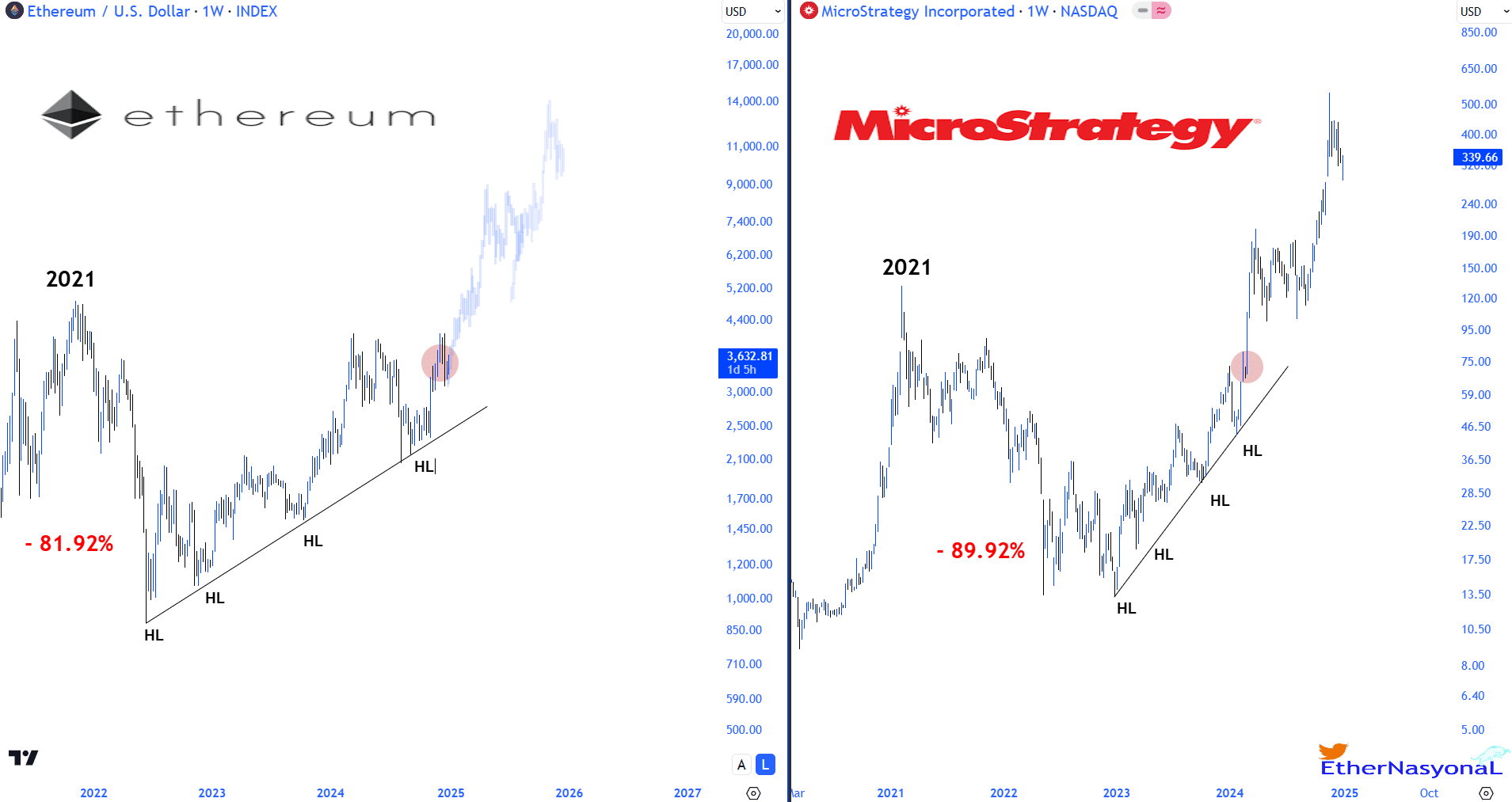

Ethereum’s [ETH] price action, alongside MicroStrategy’s stock performance from 2021 to 2025, showed a similar pattern that could hint at substantial growth for ETH.

In 2021, ETH fell by 81.92%, mirroring MicroStrategy’s 89.92% drop in the same period. However, both charts showed a recovery phase where higher lows suggested strengthening confidence among investors.

ETH, from its low point, showed consolidation and an uptrend, reaching $3,632.81 recently. If ETH continues to mimic MicroStrategy’s recovery pattern, the projection pointed to a potential rise to $14,000.

This projection was based on the visible recovery trends and higher lows marked on the charts. This suggested a resilient rebound in investor sentiment and market value.

The comparative analysis indicated the parallel dynamics between a major corporate backer of Bitcoin and a leading cryptocurrency, indicating possible future trends.

Ethereum’s market order count

Further analysis revealed ETH had a critical breakout from a resistance zone, previously established by high market order counts around $3,650. The resistance was tested multiple times, marked by peaks in trading volume.

This breakout, occurring after a significant accumulation of orders, propelled Ethereum to a higher trading range, suggesting the importance of these levels as pivotal market signals.

Source: Hyblock Capital

Subsequent trading activity stabilized above the former resistance, now acting as support at $3,450.

This shift in market dynamics could suggest further upside potential, leading to new peaks if buyer momentum continues.

Volatility and sentiment

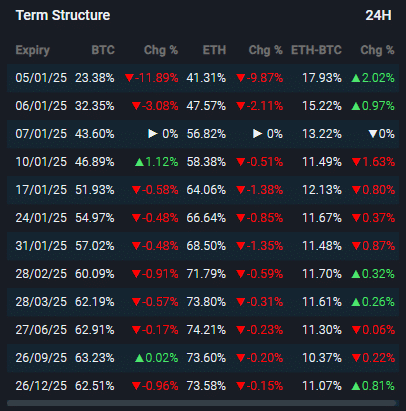

In the context of high volatility in ETH’s term structure, the path to $14K for ETH involved leveraging the sharp price fluctuations.

The term structure showed percentage changes, indicating potential for high-reward setups amid risks.

Ethereum showed a consistent volatility pattern across multiple expiration dates, highlighting key intervals where trader vigilance was heightened.

Investors could utilize these periods of increased change, possibly hedging against Bitcoin’s more stable volatility, to optimize entry and exit points.

This strategy, if executed well, could feasibly support ETH’s ascent towards the $14K mark, especially if market conditions align favorably with bullish sentiment.

However, the crowd and smart money sentiment gauges were bearish as per Market Prophit. The crowd sentiment score stood at -0.55, indicating mild pessimism among general investors.

Read Ethereum’s [ETH] Price Prediction 2025–2026

On the other hand, smart money sentiment, which reflected the outlook of more informed or institutional investors, was considerably lower at -2.03, suggesting a stronger bearish sentiment within this group.

These negative sentiment values could imply cautious or bearish expectations for Ethereum’s price trajectory, potentially influencing its short-term market behavior.