Analysis

Ethereum: Are sellers back in control?

Ethereum’s bullish run faltered at a critical price roadblock, with sellers looking to take advantage.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH bulls looked to cede control back to sellers after the price rejection at resistance level.

- Bulls could still recover despite selling pressure.

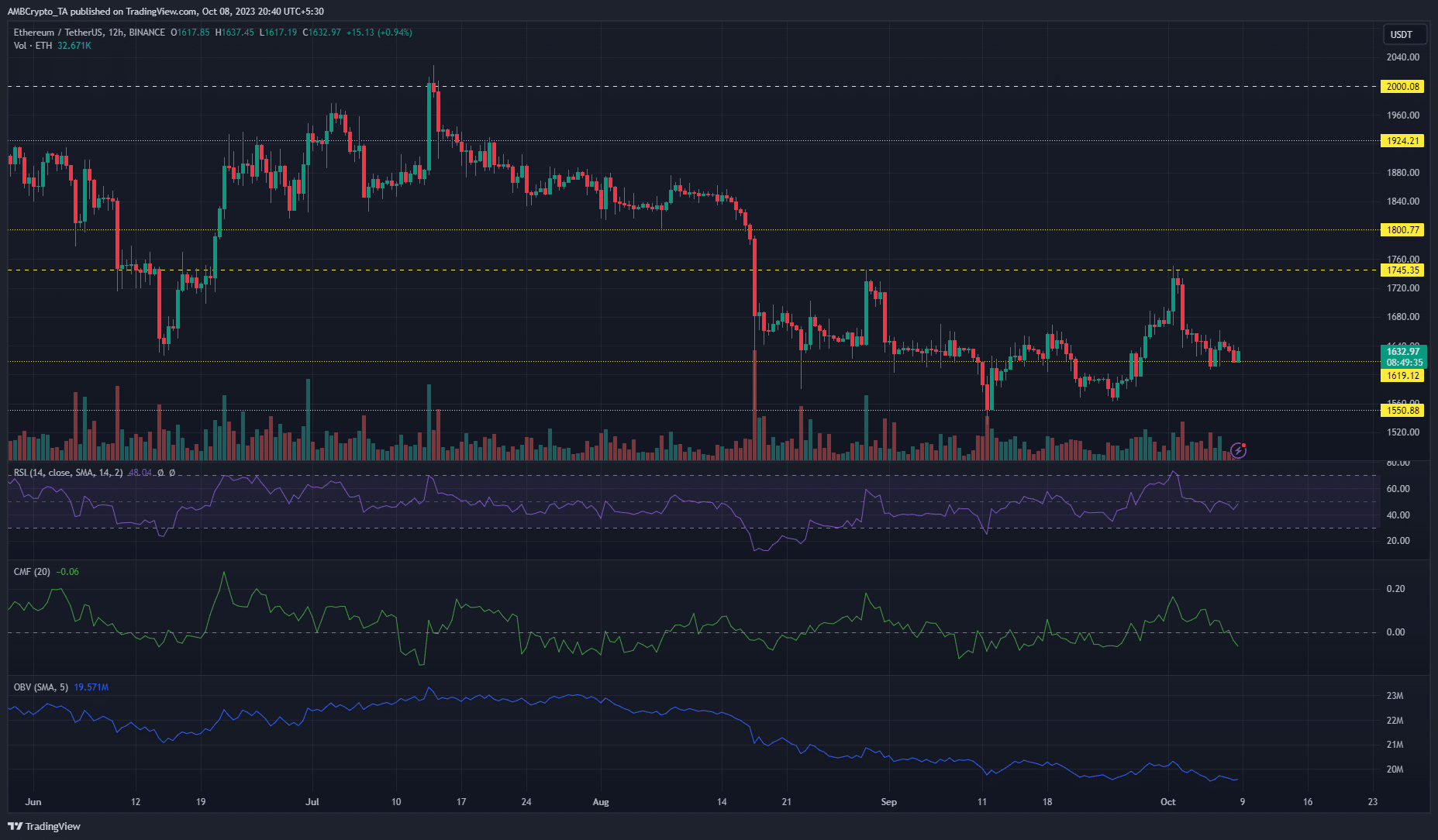

Ethereum’s [ETH] early October bullish run from the $1,619 support level was swiftly curtailed by bears at the $1,745 resistance level.

Read Ethereum’s [ETH] Price Prediction

2023-24A price report by AMBCrypto on 6 October observed that bulls could hit a major roadblock around the $1,750 price zone. This analysis was validated by the significant rejection ETH bulls suffered at the resistance level.

Even though Ethereum found temporary support at the $1,619 level, the on-chart indicators hinted at further bearish activity.

Sellers look to reclaim control after bullish rally

The CMF (Chaikin Money Flow) highlighted the massive outflow of capital from ETH. It dropped from +0.11 to -0.06 and this could be due to profit-taking moves by ETH investors.

This led to a reduction in buying pressure, with the RSI (Relative Strength Index) moving from the upper to the lower range. Similarly, the OBV (On Balance Volume) continued to trend downwards, which could further limit the chances of a sustained bullish uptrend.

Consequently, the selling pressure could persist, leading to a break of the $1,619 support level. This would offer sellers a 5% profit opportunity, with the $1,550 support serving as the bearish target.

Bulls still have a chance to rebound

How much are 1,10,100 ETHs worth today?

The Market Value to Realized Value (MVRV) ratio revealed the contrast between short-term and long-term holders. According to Santiment

, the 30d ratio showed short-term holders with slight profits. However, the 90d ratio showed long-term holders were still in negative territory.This suggested that bulls could still mount a recovery from the support level with long-term holders less likely to join the selling wave.