Analysis

Ethereum at crucial $2.6k support – Can ETH bears beat the bulls?

ETH’s negative Funding Rate was on the verge of shifting, showing bullish speculators- but it might be too little to change the trend.

- Ethereum was trading at a key support zone at $2.6k.

- Coinalyze data showed slight bullishness, but it might not be enough to propel an ETH rally.

Ethereum [ETH] showed a slightly more bullish outlook on-chain, and exchange netflow trends showed more consistent accumulation for ETH than Bitcoin [BTC]. Yet, the $2.6k region was a stiff resistance zone.

A recent report noted a high-value transaction of $32 million worth of Ethereum transferred to Coinbase, which could be the next wave of selling

. Will the bulls be forced to retreat once more?The OBV spiral did not help the bullish case

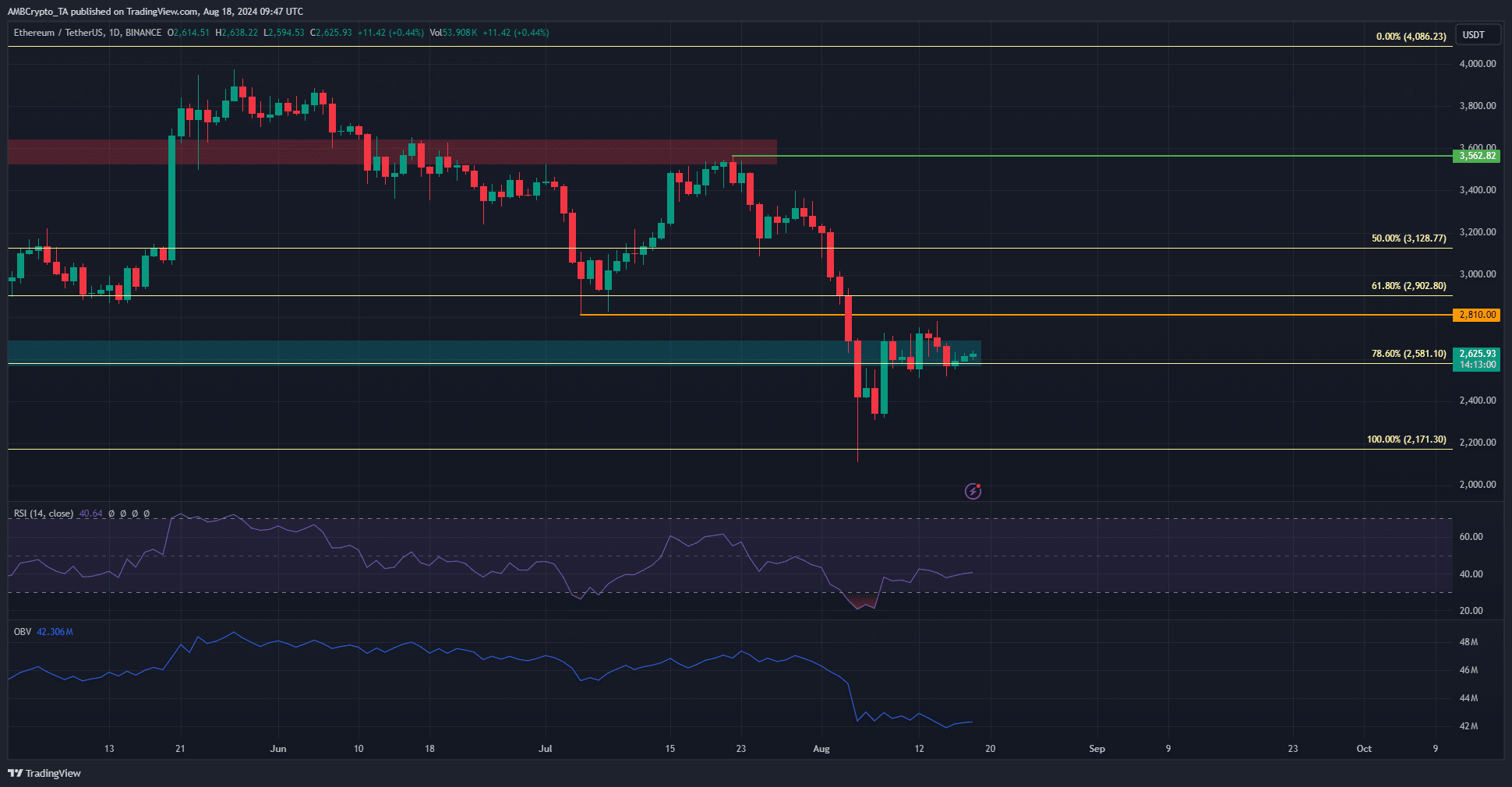

The 1-day timeframe showed a strong bearish market structure for ETH. Additionally, the OBV was in a steady downtrend. Despite the price bounce from $2.2k, the OBV has set lower highs over the past ten days.

This was a strong sign that the token does not have the demand necessary to initiate a rally.

Any price moves higher would likely be unsustainable until the OBV changes trajectory to indicate buying pressure in the market.

Do not expect a quick rally yet

Source: IntoTheBlock

The in/out of the money around price showed the $2540-$2617 was a strong support zone. The resistances above, stretching up to $2.9K, were smaller but still sizeable.

The price bounce above $2.6K meant a slight majority of the addresses that bought in August were in the money.

Source: Coinalyze

The negative Funding Rate was on the verge of shifting, showing bullish speculator numbers were increasing. The rising spot CVD also underlined an increased confidence.

Is your portfolio green? Check out the ETH Profit Calculator

The Open Interest did not see a large uptick, and showed sentiment has been neutral to slightly bullish in the past week.

Buyers were ready to go long on each notable price bounce, but the Ethereum sellers were able to hold on.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion