Ethereum bears gaining ground – Here’s how

- ETH’s MVRV ratio slipped below its 180-day small moving average.

- This is a bearish signal, and it indicated a further price decline might be imminent.

Leading altcoin Ethereum [ETH] is at risk of further decline, as its daily Market Value to Realized Value (MVRV) ratio has fallen below its 180-day small moving average (SMA), Twitter crypto analyst Ali_Charts found.

#Ethereum MVRV Ratio, compared to the 180-day SMA, offers insights into market trends! When MVRV surpasses the 180-day SMA, it indicates macro uptrends; when below, downtrends are suggested.

Notably, after the recent #ETH price decline, MVRV fell beneath the 180-day SMA,… pic.twitter.com/ITvA586HBf

— Ali (@ali_charts) August 25, 2023

The MVRV ratio tracks the ratio between an asset’s current market price and the average price of every coin or token of that asset acquired. A positive MVRV ratio above one signals that an asset is overvalued.

According to Santiment, the more this ratio increases, the more likely traders have historically demonstrated their willingness to sell.

Is your portfolio green? Check out the ETH Profit Calculator

Conversely, a negative MVRV value shows that the asset in question is undervalued, as if holders sold at the asset’s current price, they would realize losses.

As noted by Ali_Charts, when an asset’s MVRV ratio rests above the 180-day SMA, the market capitalization is greater than the total amount of profit realized, which suggests that the market is in an uptrend.

On the other hand, when the MVRV ratio is below the 180-day SMA, the market capitalization is less than the total amount of realized profit, which suggests that the market is in a downtrend.

Regarding ETH, its MVRV ratio recently fell below the 180-day SMA, suggesting that its recent price decline may not be over.

ETH traders continue to dawdle

With many uncertain of the coin’s next direction, the recent market deleveraging event has caused ETH holders to stay their hands from accumulating the altcoin. Since 17 August, when the market suffered a huge liquidity exit, key momentum indicators have plummeted, suggesting a drop in buying pressure.

Below their respective center lines at press time, ETH’s Relative Strength Index (RSI) and its Money Flow Index (MFI) were 30.44 and 18.54.

Likewise, as of this writing, the alt’s Chaikin Money Flow (CMF) returned a negative value of -0.08, a position it has occupied since the capital exodus. Generally, a CMF value below the zero line is a sign of weakness in the market.

How much are 1,10,100 ETHs worth today?

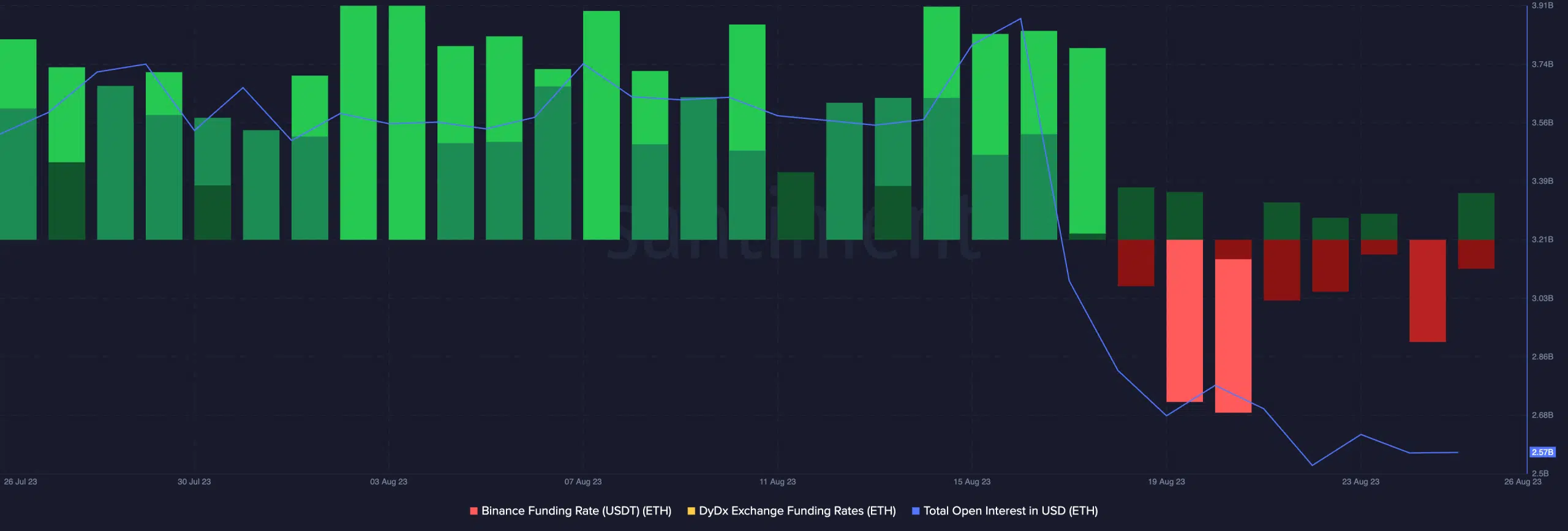

Outside the spot market, reduced ETH trading was also observed in the futures market. Across cryptocurrency exchanges, the total amount of ETH’s Open Interest valued in dollars has trended downwards since 17 August. In the last seven days alone, this has declined by 4%.

Also, on leading exchanges Binance and dYdX, ETH’s funding rates have been predominantly negative for the past two weeks. This signaled where market sentiment lies, showing investors preferred to bet against the alt’s price.