Ethereum: Binance slashes withdrawal time for staked ETH but there’s a catch

- Binance was the third-largest entity in terms of overall ETH withdrawal volume since Shapella.

- The share of staked ETH in loss was more than 75% at the time of writing.

In a major announcement, cryptocurrency exchange Binance stated that the processing period for Ethereum [ETH] staking withdrawal requests would be reduced from 15 days to just 5 days beginning May 18, 2023.

Read Ethereum’s [ETH] Price Prediction 2023-24

The crypto behemoth added that it was working on plans to further minimize the processing time in order to make the process quicker and more convenient for users.

However, Binance dropped a caveat that users won’t be able to cancel their ETH withdrawal requests after submission.

#Binance will reduce the processing time for $ETH Staking withdrawals to 5 days from the original 15 days.https://t.co/2cLwhAHp1m

— Binance (@binance) May 11, 2023

Effect on staking

Contrary to fears of a mass sell-off, the post-Shapella period has spurred staking activity on the Ethereum network. With FUD surrounding staking coming to an end, many investors started to restake their initially withdrawn ETH rewards.

As per Nansen dashboard, the amount of ETH staked on the Beacon chain was 19.81 million at the time of writing, slightly higher than what it was during the time of the Shapella update on 12 April.

Hence, it remains to be seen how Binance’s recent move of facilitating quick withdrawals will play out in the near term as far as ETH’s selling pressure was concerned.

The share of staked ETH in loss was more than 75% at the time of writing, data from Dune revealed.

With ETH’s continuing descent, about 8.25% drop in the last week, it seemed unlikely that stakers would dump withdrawn ETH at prevailing market prices.

Conversely, the reduction in the processing time for withdrawals may provide ETH stakers with more flexibility and liquidity.

Binance was the third-largest entity in terms of overall ETH withdrawal volume since the Shapella Upgrade, accounting for more than 11% of the total share.

Coinbase, another major centralized exchange which offers staking services, earlier refused to provide an exact waiting period but mentioned that it could take weeks to months to process unstaking requests.

Is your portfolio green? Check out the Ethereum Profit Calculator

A look at ETH’s supply metrics

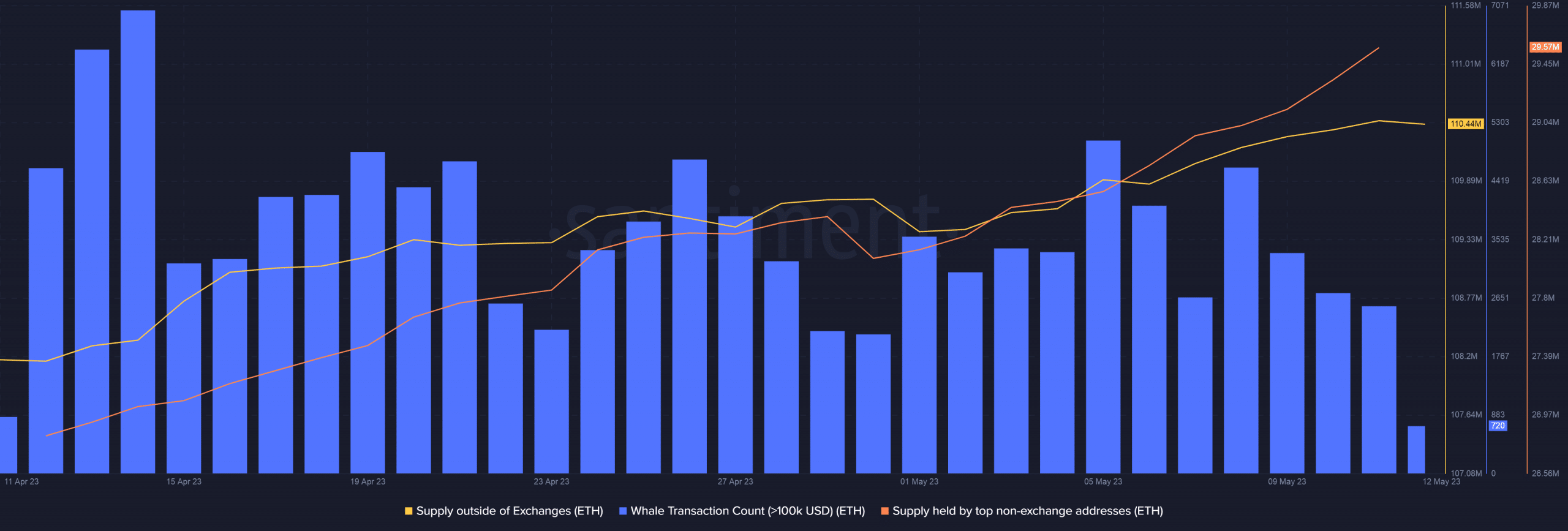

After a sharp uptrend, the supply outside of exchanges dipped marginally in the last 24 hours. However, top non-exchange addresses continued with their accumulation spree, indicating that whales were buying the dip in ETH’s prices.

However, large whale transactions, involving the transfer of ETH worth more than $100k, declined progressively over the last few days.