Ethereum

Ethereum breaks $3,000: Can ETH hold support at THIS level

Ethereum recently surged past the $3,000 mark, backed by record spot ETF inflows and solid investor confidence. As ETH gains bullish traction, traders are eyeing whether this level will hold as new support.

- Ethereum broke the $3,000 price level recently.

- Over 2.8 million addresses bought ETH at the current price level, making it a key level.

While Bitcoin[BTC] captured headlines with its all-time highs, Ethereum[ETH], often called the ‘digital silver’ also made a notable move.

The second-largest cryptocurrency by market capitalization broke above the $3,000 mark, a resistance level that had held strong for months.

This breakthrough coincided with record-breaking positive flows in Ethereum’s spot ETF, marking a new phase of bullish momentum.

Can Ethereum sustain this rally as it navigates a new territory?

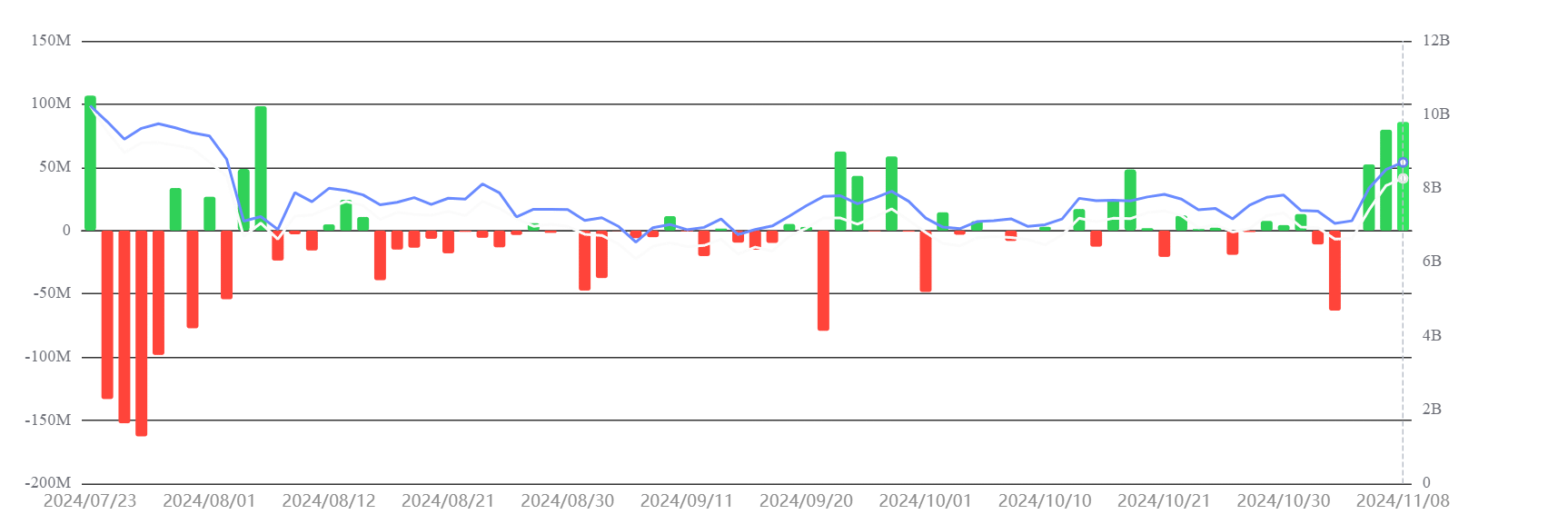

Record spot ETF inflow fuels Ethereum’s breakout

Ethereum’s ETF flow analysis for the past week revealed a net inflow of $154.66 million. This set a new high for weekly positive flows.

Data from SosoValue showed that this is Ethereum’s second consecutive week of net inflows—a historic milestone for the ETF.

The largest weekly net flow for Ethereum’s ETF occurred during its launch week, with a negative flow of $341.35 million. Now, the trend has shifted decisively into positive territory, with consecutive inflows supporting ETH’s price rally.

This surge in institutional support has helped ETH break past the $3,000 barrier, bolstering its upward momentum.

Ethereum moves to secure its position above $3k

At press time, Ethereum surged to $3,027.90, experiencing a strong bullish breakout. It has driven well above both its 50-day and 200-day Moving Averages(MA).

This move marked a significant rally as ETH surpassed the $3,000 psychological resistance. This shows momentum that suggests investor confidence in the asset.

The 50-day MA was positioned at $2,565.64, and the 200-day MA at $2,954.58, both serving as support levels for the current bullish run. The volume also increased, highlighting a strong buying interest.

Given this trend, ETH could target higher levels if it sustains this bullish momentum, with the next resistance zones possibly around $3,200 or higher.

A pullback to test support at the 200-day MA may also be likely, providing a potential entry point for traders watching this trend closely.

Ethereum’s breakthrough of the $3,000 resistance level is a significant achievement, supported by record ETF inflows and strong technical indicators.

If this momentum persists, ETH could continue to rally, establishing $3,000 as a new support level as it heads toward the year’s end.

MVRV ratio shows increasing profitability among holders

The 30-day Market Value to Realized Value (MVRV) ratio for Ethereum indicated that many holders are in profit as ETH trades above $3,000.

A rising MVRV ratio suggested that profit-taking could soon begin, which might introduce selling pressure.

At the time of writing, the MVRV was almost at 15.6%, the highest since May.

Additionally, analysis from IntoTheBlock showed that 2.86 million addresses bought ETH around the current price. This makes the current level very significant, as a rise beyond it could trigger an ATH.

– Is your portfolio green? Check out the Ethereum Profit Calculator

If the MVRV ratio continues to climb, more holders will be in profitable positions, and the market could see natural corrections.

With rising institutional interest, Ethereum’s new support level could be near the $3,000 mark, reducing the impact of minor sell-offs.