Ethereum’s bulls are now focused on flipping this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH crossed above a trendline resistance.

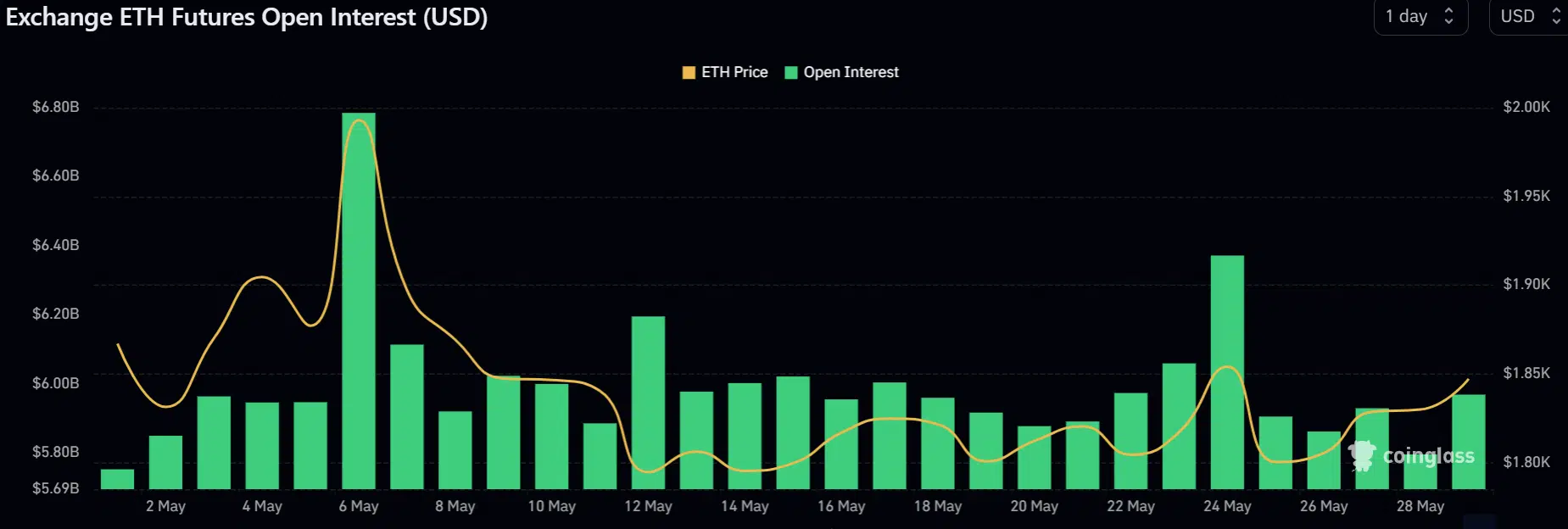

- Longs encouraged; OI wavered near $6 billion.

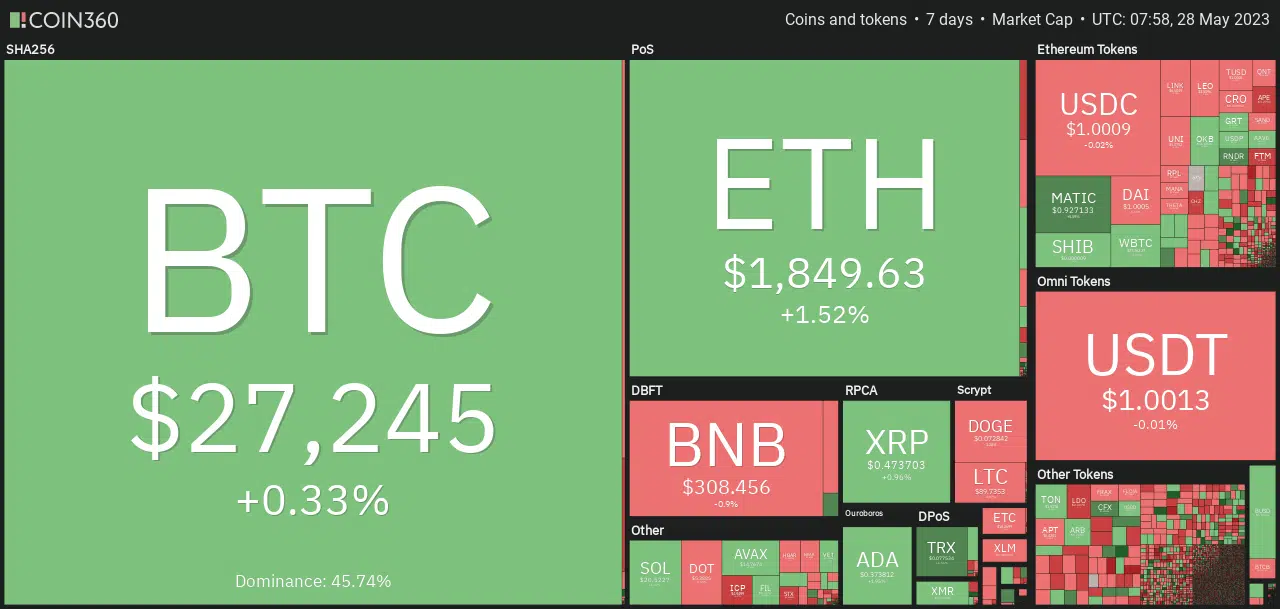

Ethereum [ETH] posted mixed results over the past week. It rallied between Monday and Tuesday (22/23 May), hitting $1873, before reversing the two-day gains on Wednesday (24 May).

Is your portfolio green? Check out the ETH Profit Calculator

However, the Wednesday losses were reversed towards the weekend (27/28 May), as ETH posted an overall 1.5% gain on a weekly basis as of press time.

In the meantime, Bitcoin [BTC] held its ground and reclaimed the $27k mark after a massive options expiry on 26 May and an ongoing US debt ceiling. Will May end on a bullish note?

Is a bullish breakout likely?

Since 9 May, ETH traded in a range, oscillating between $1761 and $1856. When zoomed out, the price action has been on a downtrend after crossing $2100 in mid-April. A trendline resistance (orange line) has been a key roadblock to bulls and had confluence with a key price ceiling in March of $1825.

Although bulls cleared the confluence hurdle, ETH was yet to inflict a bullish breakout from its sideways structure at the time of writing.

A session close above the range high could set the ETH rally to $1,935 or the recent lower high at $1997.

However, ETH could continue its sideways structure if BTC doesn’t surge to $28k. Price could oscillate between range extremes in such a scenario.

Meanwhile, the RSI crossed above the neutral mark, reiterating the recent buying pressure. The CMF (Chaikin Money Flow) also increased higher above the zero mark after wavering in the past few days, highlighting improved capital inflows.

Shorts discouraged; OI steadies

How much are 1,10,100 ETHs worth today?

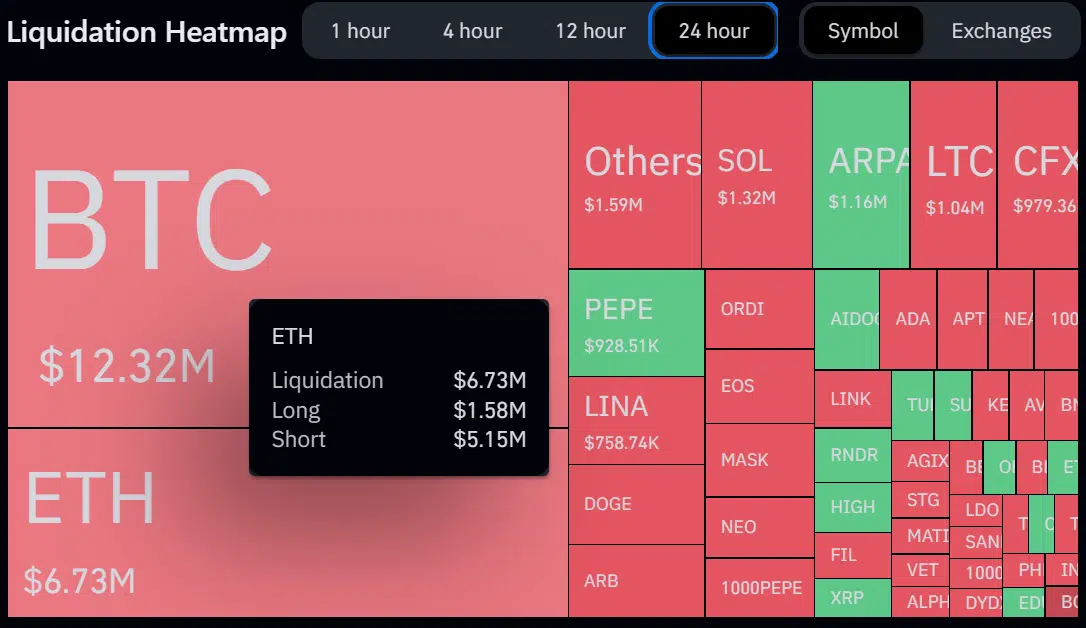

More than $5 million in short-positions were liquidated in the past 24 hours, according to Coinglass. But less than $2 million longs were wrecked in the same period, reiterating the bullish momentum.

However, Ethereum’s open interest (OI) rates averaged about $6 billion apart from 6 to 24 May. This shows that demand for ETH has stagnated. However, an increase in OI could tip ETH bulls to inflict a bullish breakout above the range formation.