Ethereum camp cries ‘centralization’ after Solana fixes critical bug

- Solana quietly fixed a vulnerability that could have enabled unlimited token minting

- However, ETH supporters claimed that SOL’s lack of client diversity meant risk to institutional investors

In mid-April, Solana [SOL] managed to quietly fix a vulnerability that would have allowed an attacker to drain or mint unlimited tokens.

Solana Foundation made the update public on 3 May (two weeks later) for security reasons, as attackers would have leveraged these loopholes had it been shared immediately.

However, the update sparked more debate than accolades. Especially from its rival Ethereum’s [ETH] camp.

Solana vs Ethereum

Ryan Berckmans, an Ethereum community member, slammed the Solana team for “centralization.” He cited a lack of diverse production clients (execution software). He said,

“ETH has client diversity and a protocol spec steered by a meaningful research community. SOL has one client.”

According to Berckmans, this meant zero-day bugs (like the one fixed) on the client were “de facto protocol bugs.”

For those unfamiliar, Solana has two validator clients (software for running nodes). Firedancer is the latest. The other live execution client is the Agave client, although there are others under development.

On the other hand, Ethereum has four live execution clients, something that reduces the risk of a single point of network failure or attack.

Given the aforementioned safety assurance on Ethereum, Berckman added,

“ETH (L1 and L2) is, by far, the best choice for long-term large investment from the world’s corps, institutions, and governments – it’s not even close. Capital flows reflect this.”

For its part, Solana’s leadership downplayed the criticism from ETH supporters. In fact, Solana co-founder Anatoly Yakovenko said,

“It’s the same people to get to 70% on Ethereum. All the Lido validators (chorus one, p2p, etc..) Binance, Coinbase, and Kraken. If Geth needs to push a patch, I’ll be happy to coordinate for them.”

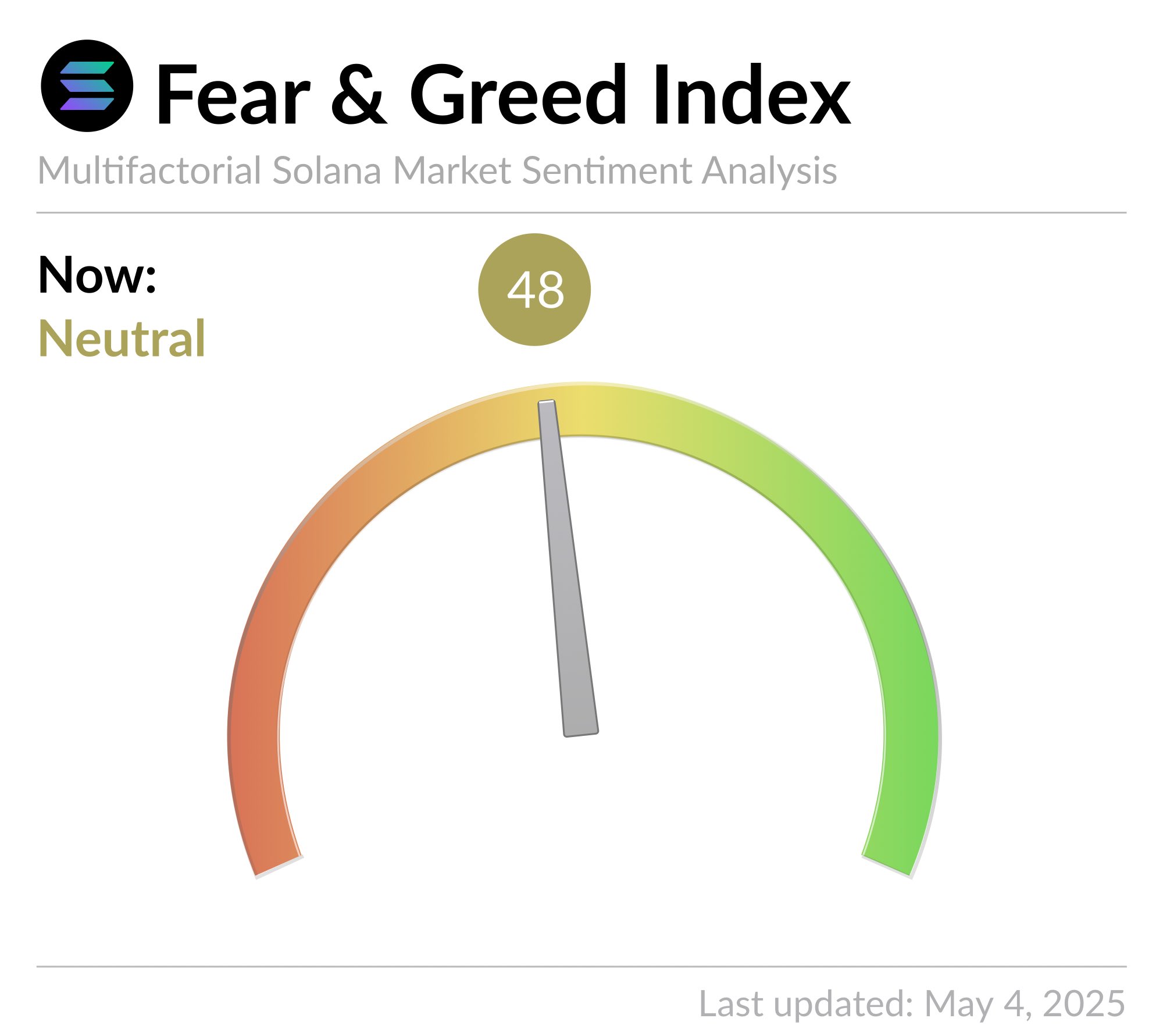

At the time of writing, SOL’s market sentiment was neutral. This meant that the price could go in either direction this week.

Simply put, should sentiment sour into “fear” territory, it would hint at a discounted buying opportunity as others panic.

Source: Solana greed and fear index

On the price charts, SOL gave back part of its recovery gains from mid-April. It was down nearly 10% from a recent $157 high to trade at $143. This pullback could be a buying opportunity if it doesn’t go beyond the short-term moving averages at $141 or $132.

However, a sustained drop below the averages would suggest a bearish trend. A further dip to the $120-zone could be feasible in such a scenario.