Ethereum Classic and its mini-rally reveal ETC’s long-term outlook to be…

Ethereum Classic would have been a healthy choice if you were on the hunt for a bullish cryptocurrency this week. ETC is among the few cryptocurrencies that have experienced significant upside in the last few days but its rally might be short-lived.

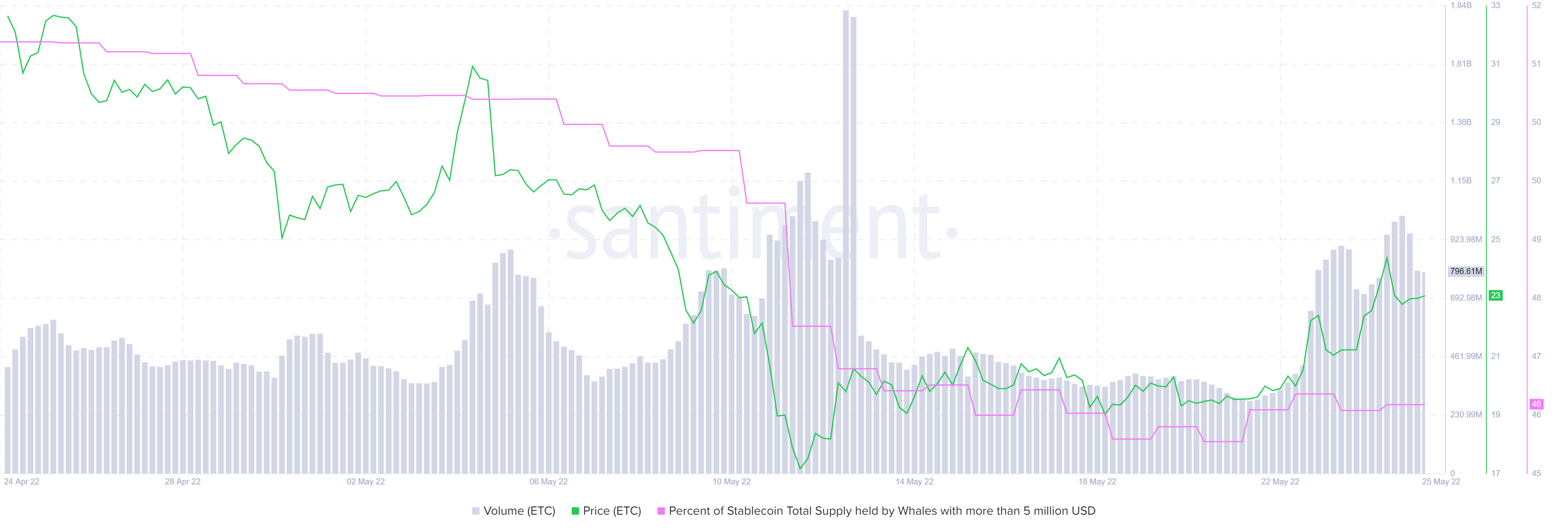

ETC achieved 4 consecutive green daily candles from 21 May to 24 May, thanks to strong accumulation during the weekend. The ETC bears pushed ETC from sub-$20 prices to a weekly high of $25.69, before encountering some resistance. Note that the $25 price range previously acted as a support range, and it is quite common to see support zones turn into resistance zones.

In ETC’s case, the $25 price range seems to be yielding significant resistance, marking a relief zone for the bulls. It experienced a significant downside at press time, with the price dipping to $22.49 after a 5.23% correction in the last 24 hours.

A closer look at ETC’s indicators reveals that the price experienced resistance and a retracement right on the RSI’s neutral line. The MFI is currently near the 80 upper limit and is currently showing signs of a potential reversal. This aligns with the expectations of some outflows during a bearish retracement.

The current expectation is that more bearish strength will force the MFI to seek more downside. It also looks like the +DI and -DI is currently interacting, as the price encounters a directional momentum change. Zooming out further reveals that ETC’s 50-day MA recently reversed back below the 200-day MA due to the bearish market conditions in the last few weeks.

A look at what’s happening on-chain

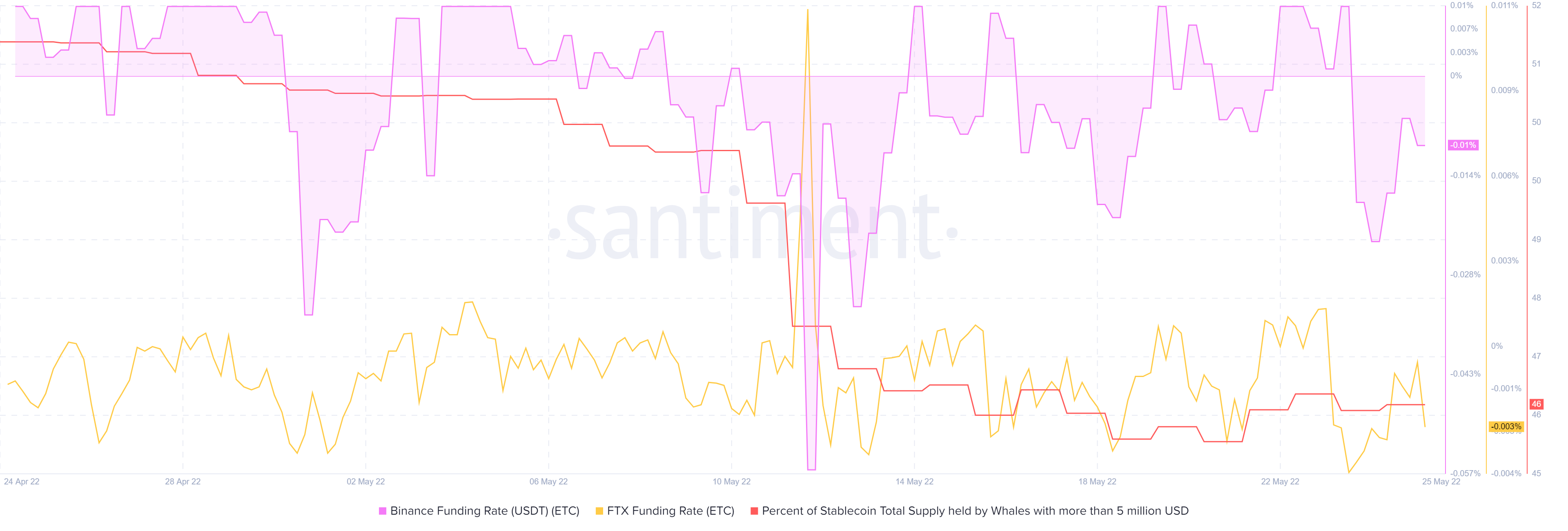

Both the Binance funding rate and FTX funding rates dropped significantly during the trading session on 25 May. The metrics highlighted decreased interest from the derivatives market in the last two days, reflecting the downward pressure on Ethereum Classic’s price action.

ETC’s price pump in the last few days reflected increased trading volumes from 21 May. There was a slight uptick in the Ethereum Classic supply held by whales during the weekend, explaining the bullish performance. The volume metric also recorded increased activity, but it looks like the volume had cooled down slightly at press time.

It is unclear how far the bearish correction will push down the price due to market uncertainties. However, it looks like we might see a sub-$20 price retest and may be lower in case of significant distribution. ETC’s short-term performance looks bearish but its long-term outlook is still bullish considering the massive discount.