Ethereum Classic: As the $16 hurdle persists, will traders short it

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETC’s recovery faltered at the $16 roadblock.

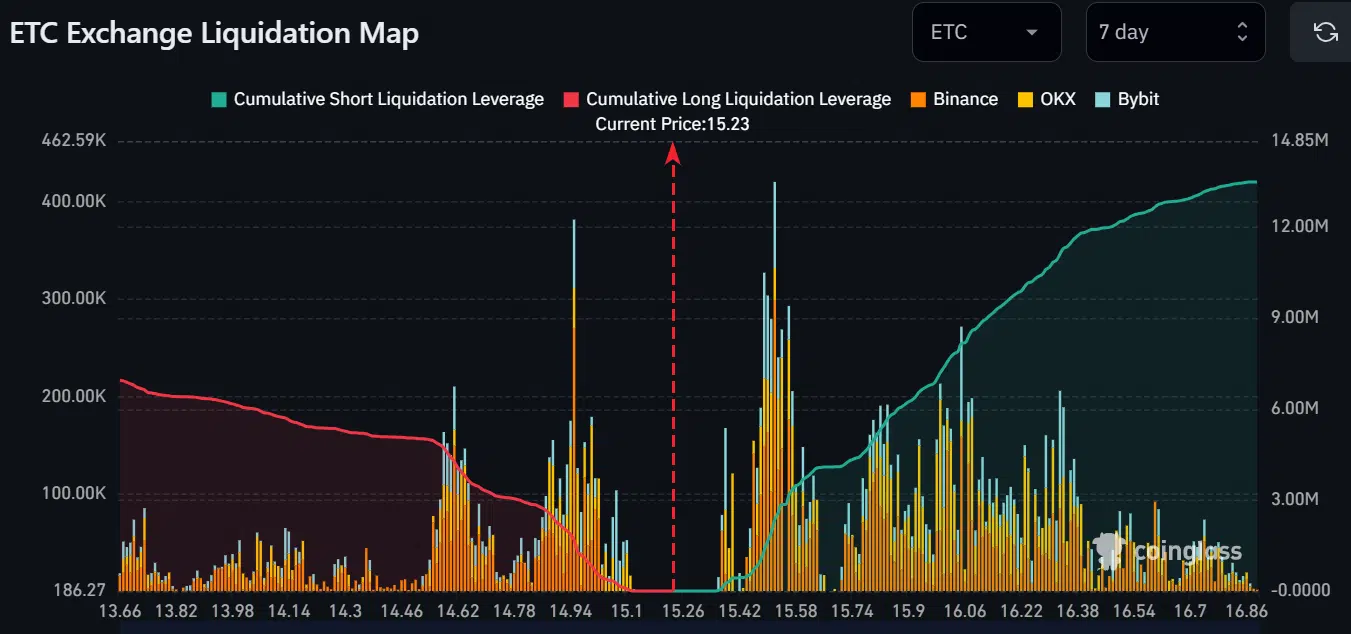

- The $14.9 and $15.5 were key liquidity levels.

Ethereum Classic [ETC] struggled to exceed $16 throughout September, tipping sellers to use it as a re-entry point into the market. The recent recovery from $14.4 to $16.3 allowed buyers to tuck in +10% gains. Similarly, sellers grabbed 5% gains following the reversal at the $16 hurdle to $15.20.

Is your portfolio green? Check out the ETC Profit Calculator

Meanwhile, Bitcoin [BTC] was yet to crack below $26.4k at press time. Any slight BTC bounce towards or above $27k could push ETC toward this roadblock.

Is another reversal likely?

The roadblock is a previously invalidated bullish order block of $15.58 – $16.00 (red). Besides, the 50-EMA (Exponential Moving Average) was in confluence with the hurdle, further cementing it as a bearish zone.

In addition, capital inflows eased while buying pressure eased, as shown by the retreating CMF (Chaikin Money Flow) and RSI (Relative Strength Index). With the H12 market structure firmly bearish at press time, a price reversal could be likely in the bearish zone ($15.58 – $16.00).

If so, the reversal could ease at $15.20 or $14.89, presenting short-sellers with a potential +2% gain for the first target.

However, a move beyond $15.70 and a subsequent close above the roadblock ($16) will invalidate the bearish bias.

Key levels to consider are $14.95 and $15.52

According to the Exchange liquidation map from Coinglass, key liquidity levels exist at $15.5 and $14.9 (high spikes or histograms). For $15.52, there was a Cumulative Short Liquidation Leverage of >$2 million.

How much are 1,10,100 ETCs worth today?

On the other hand, $14.95 had a Cumulative Long Liquidation Leverage of $1.6 million on the weekly charts. The inference is that the high areas or liquidity levels could see a strong price reaction. So, ETC could react at these levels.

Notably, the $15.52 aligns with the 50-EMA at press time and could act as an ideal entry position if price reversal occurs at the level. However, tracking BTC is crucial for risk mitigation.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)