Ethereum Classic: Recovery is in limbo, but this is where traders can be hopeful

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ETC was in a neutral market structure.

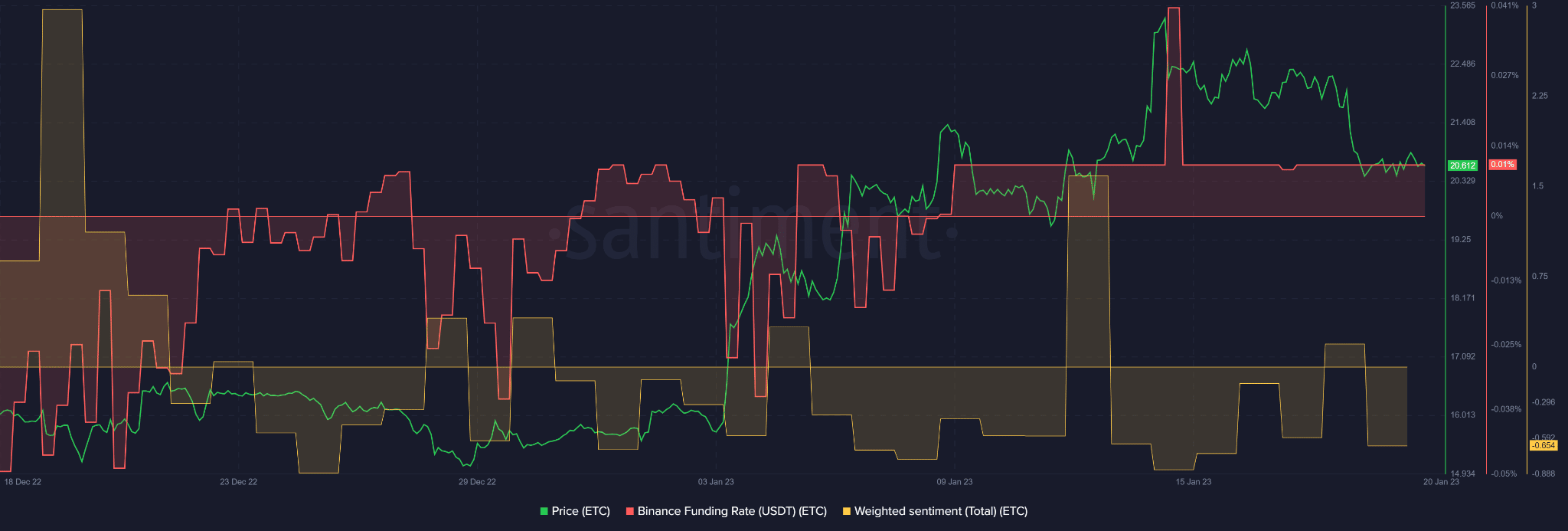

- The sentiment was negative, while the Funding Rate remained positive.

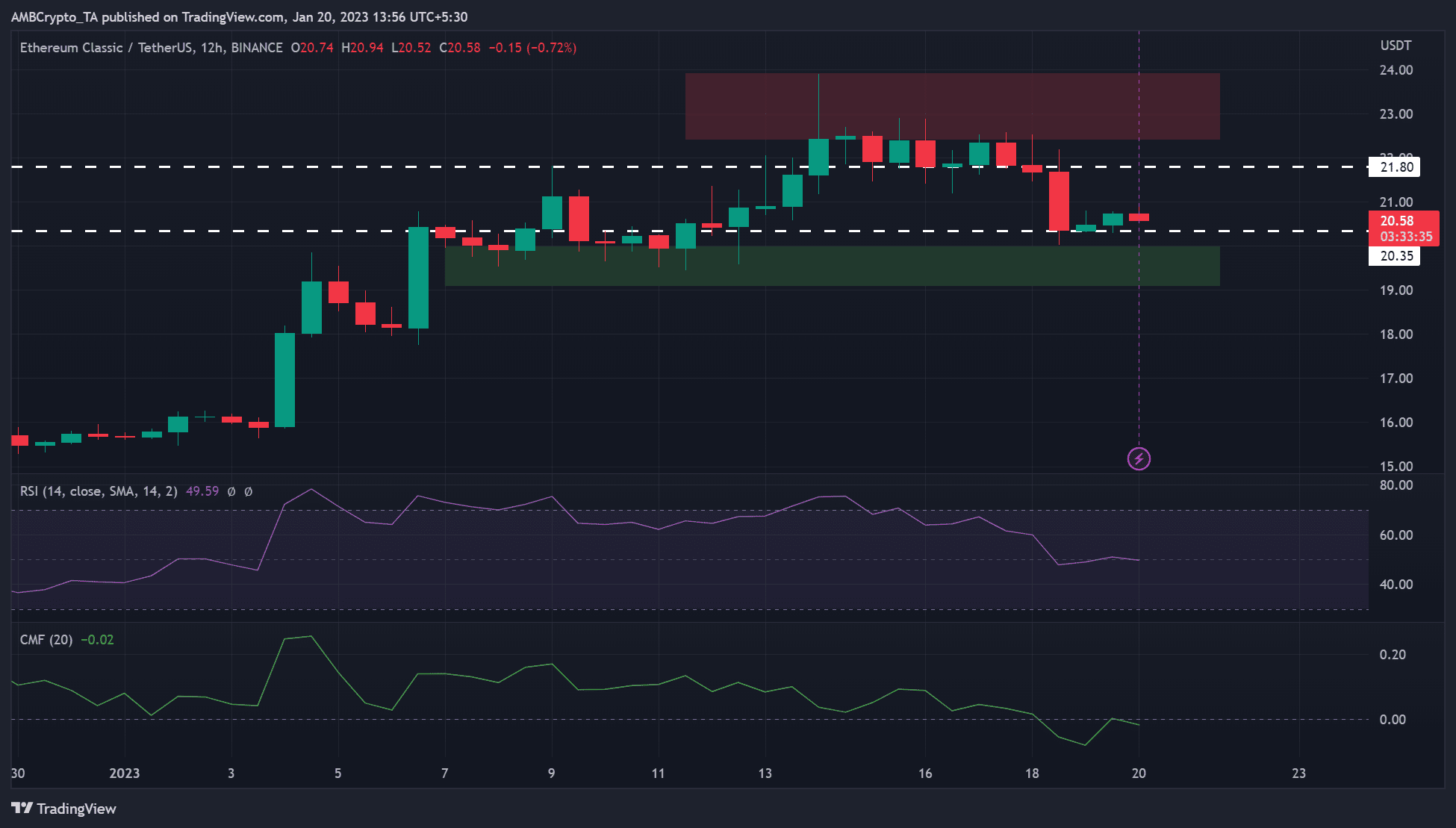

Ethereum Classic [ETC] faced critical resistance at around $23. Attempts to go beyond it have failed, prompting a price correction that found steady support at $20.35.

At press time, ETC traded at $20.62 and flashed red after its mild bullish momentum was subdued as Bitcoin [BTC] struggled to reclaim the $21K zone. ETC could retest this support if BTC secures the $20K support.

Read Ethereum Classic [ETC] Price Prediction 2023-24

The green support zone: Can ETC retest it?

On the 12-hour chart, the Relative Strength Index (RSI) retreated from the overbought zone but faced rejection just below the midrange. At press time, the RSI was at 49.94, showing a neutral position.

However, the Chaikin Money Flow (CMF) was at -0.01 after retreating from the negative side. It faced rejection at the zero level at the time of writing, indicating the bullish momentum wasn’t strong enough to confirm a trend change. This could imply a further weakening of the ETC market.

Therefore, ETC bears could get more leverage and lower prices to retest the $20.35 level or slide into the green support zone of $19 – $20.

Alternatively, ETC bulls could come in and push ETC towards the critical resistance at $23, especially if BTC surges above $21K. But such an upswing will invalidate the bearish bias described above. Nevertheless, bulls must overcome the obstacles at $21.15 and $21.80 to reach the overhead resistance target.

Is your portfolio green? Check out the ETC Profit Calculator

Therefore, investors should track the CMF and BTC price action. If CMF breaks above the midpoint, it will signal a trend change confirmation and could boost uptrend momentum. Similarly, a bullish BTC will prompt CMF to cross over to the positive side and confirm a trend change.

ETC’s Funding Rate was positive, but sentiment and volume declined

According to Santiment, ETC’s Funding Rate has been relatively positive since 9 January. It shows that demand for ETC has remained unchanged since January 9, despite the recent decline in price. More demand could increase ETC prices.

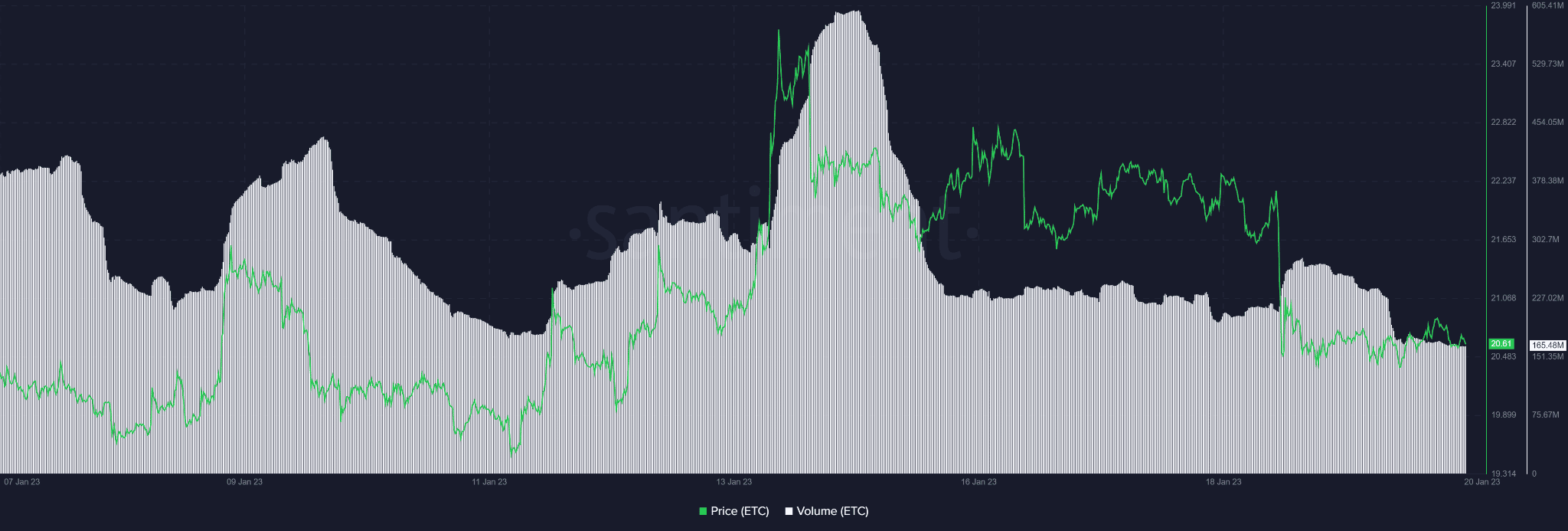

However, the price drop led to negative weighted sentiment, showing a bearish outlook from investors. In addition, ETC’s trading volume dropped slightly and could undermine immediate uptrend momentum. As such, it could force ETC to retest the immediate support level.

However, a bullish BTC could boost the trading volumes and invalidate the bearish forecast. Hence, investors should be cautious and track BTC performance before making decisions.