Ethereum Classic’s [ETC] recovery faced an obstacle – Can bulls bypass it?

![Ethereum Classic’s [ETC] recovery faced an obstacle - Can bulls bypass it?](https://ambcrypto.com/wp-content/uploads/2023/02/ethereum-6851392_1280-e1677398414167.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ETC’s recovery faced a resistance level at 23.6% Fib level.

- Open interest rates rose while more long positions were liquidated in the past 24 hours.

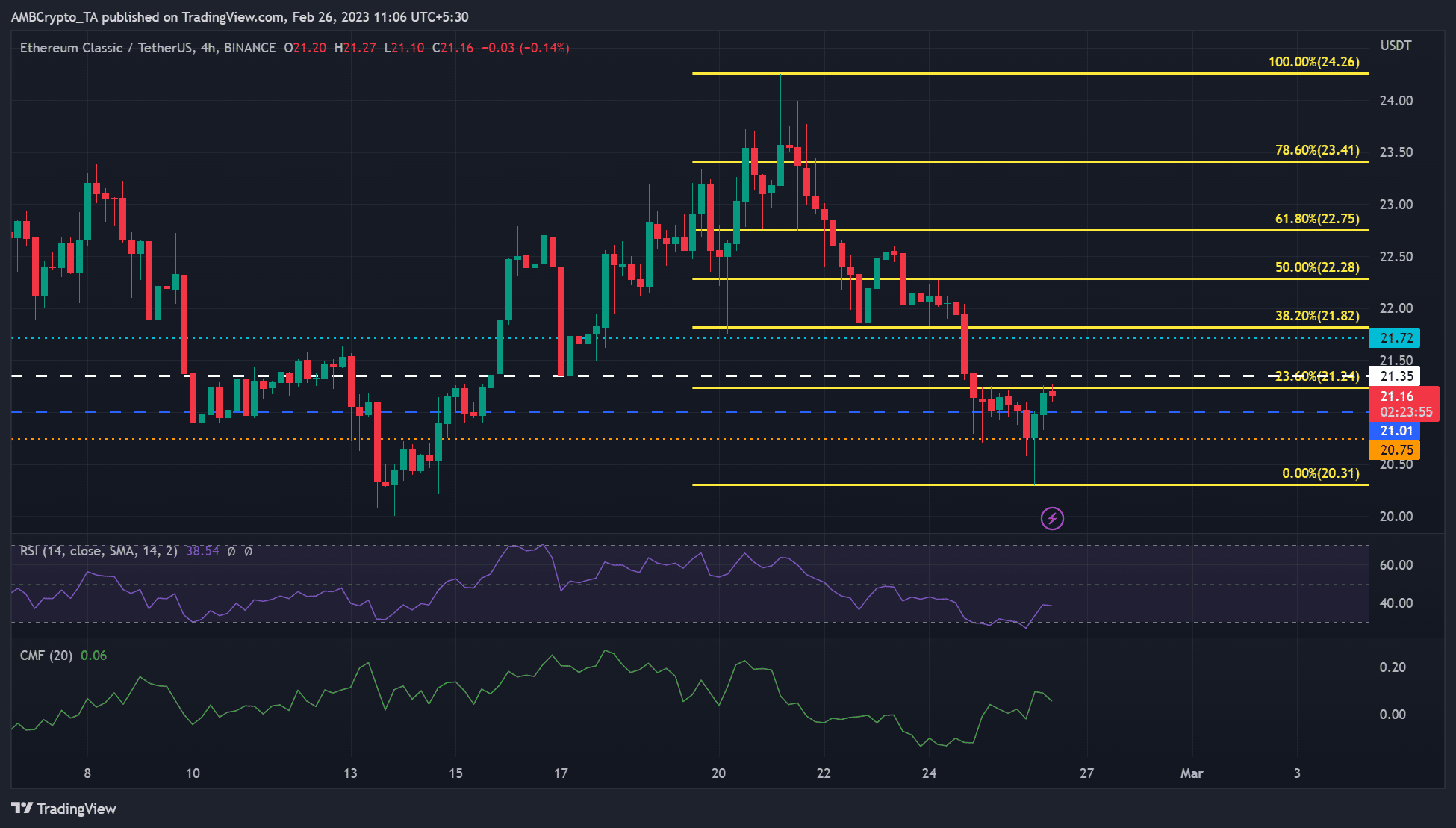

In mid-February, Ethereum Classic [ETC] rose from $20 to $25. But the rejection at the $25 level caused it to fall back to $20 before bulls attempted a recovery. However, this recovery hit a snag at the 23.6% Fib level ($21.24).

Read Ethereum Classic’s [ETC] Price Prediction 2023-24

Can the bulls bypass the obstacle?

The rise from $20 to $25 saw a 20% hike in ETC’s value. However, the rejection of Bitcoin at $25K caused ETC to face rejection at $25 as well. As of press time, BTC has secured the $22.92K support, while ETC managed to defend the $20.75 support.

Is your portfolio green? Check out the ETC Profit Calculator

If BTC fails to close above $23.35K, ETC could fail to bypass the 23.6% Fib level, which could tip bears to push the ETC price down to $20.75 or lower. Short-term sellers are seeking shorting opportunities at $21.01 or $20.31.

Alternatively, near-term bulls could aim for the 38.20% Fib level ($21.82) if ETC closes above the 23.60% Fib level of $21.24. However, the RSI indicates a bearish market structure, with the indicator retreating from the oversold zone and still below 50.

Furthermore, the CMF (Chaikin Money Flow) showed a downtick at the time of writing, further reinforcing the bearish sentiment.

ETC’s OI surged; high liquidations of long positions could undermine the recovery

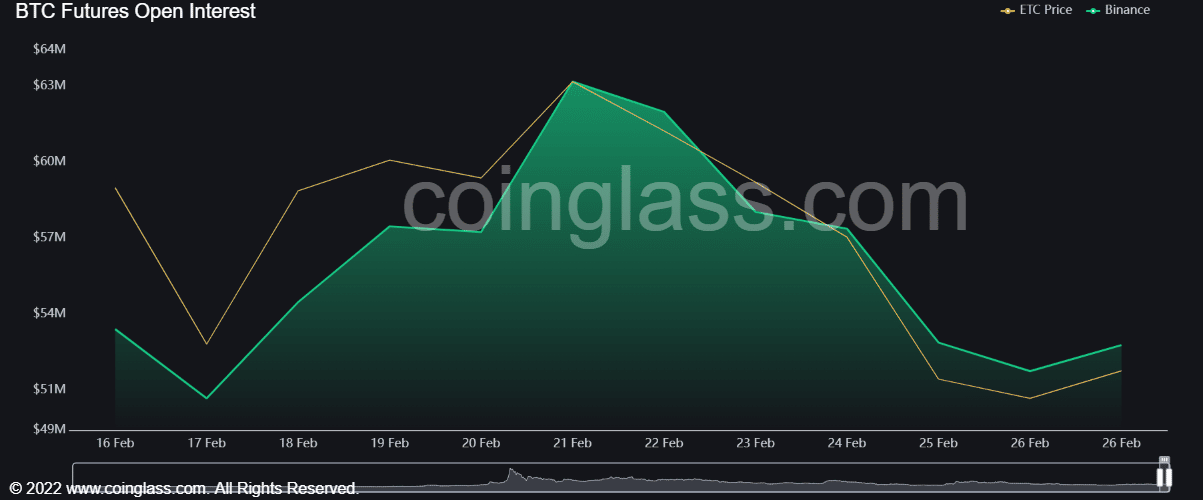

ETC’s open interest has surged, indicating mild bullish momentum in its futures market, but high liquidations of long positions could undermine the recovery.

According to Coinglass, ETC’s dropping OI slowed on 25 February and pivoted at the time of writing, suggesting more money flowing into the futures market.

An extra surge in OI past $21.24 could help clear the obstacle at the 23.6% Fib level and set the recovery’s target to the 38.2% Fib level of $21.84.

However, over $370K worth of long positions have been liquidated in the past 24 hours, compared to only $63K of short positions, according to Coinalyze. This reiterates the bearish sentiment at the time of writing, which could lead to further devaluation of ETC.

Short-term bulls can track BTC’s break above $23.35K, while short sellers can make moves if the king coin faces rejection at the $23.35K area.