Ethereum climbs above $2,000, but could a price drop be coming soon?

- Ethereum’s netflow pattern could see hike in selling pressure in the coming days

- Data from derivatives market revealed that taker volume highlighted bearishness in the market

Ethereum [ETH] saw a 10% price bounce since Tuesday’s lows. Such a bounce ahead of the U.S. Fed Meeting appeared ominous, but there were no unexpected revelations. The economic growth has been slower than expected for the current year, with the same expected for next year. Also, the Federal Reserve signaled two rate cuts this year, with a more uncertain outlook.

This is not terrible news for the crypto market, with Bitcoin [BTC] bouncing to $87.5k before seeing a 1.86% retracement at press time. Ethereum was down 2.36% from its previous day’s high at $2,069. In fact, a recent report noted that Ethereum’s network activity was at its lowest in 2025 – A warning sign for investors.

Piecing together the clues for Ethereum

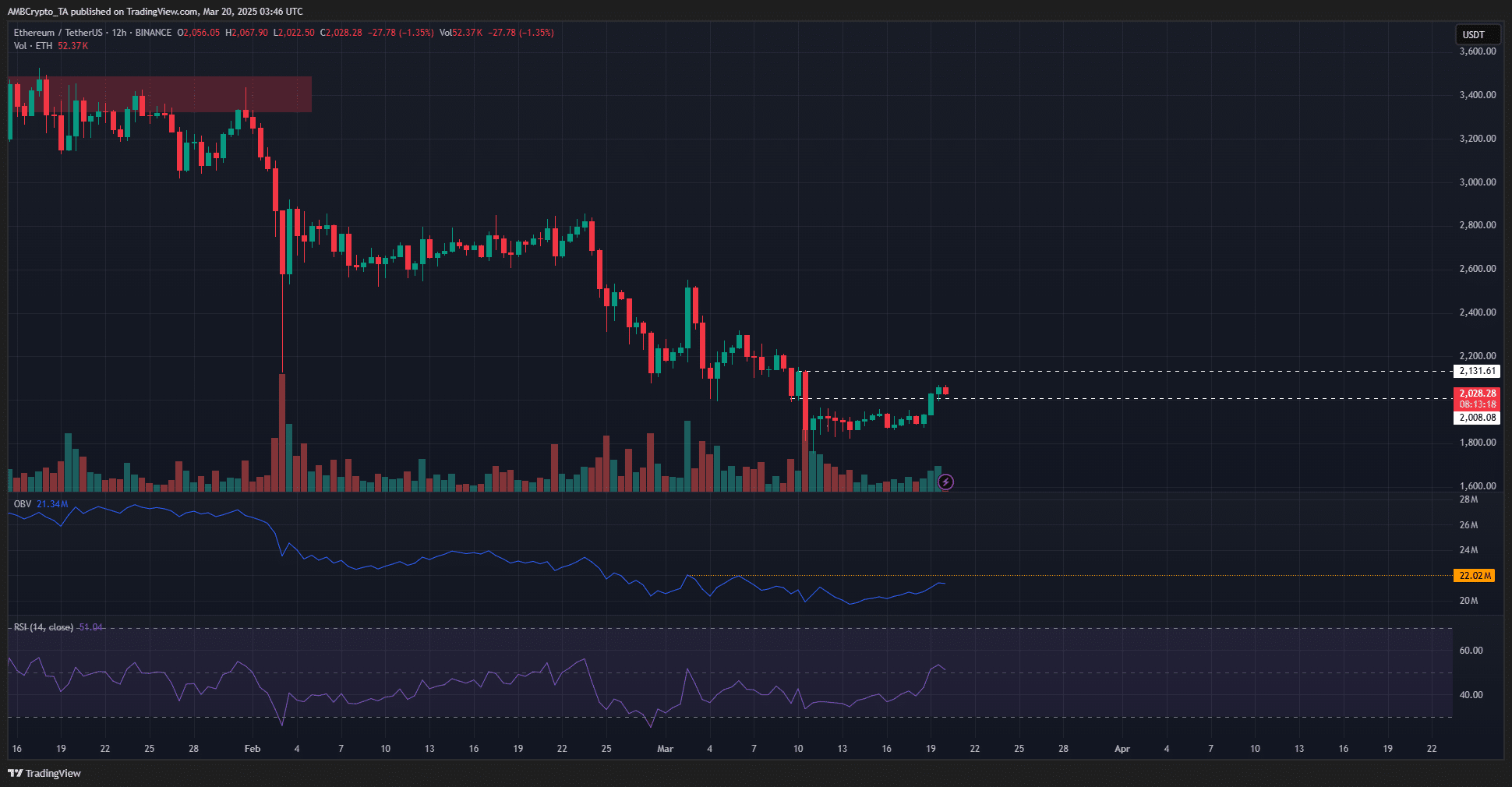

On the 1-day chart, ETH maintained a strong bearish trajectory. The OBV was below local highs, although the RSI appeared to signal a bullish shift. The move beyond $2k appeared to be a statement, but it could also be a liquidity hunt.

Given the structure, it may be likely that the price would head lower once again. The buying volume necessary to drive a bullish structure shift was not yet here, according to the OBV. Market sentiment was also broadly fearful at press time.

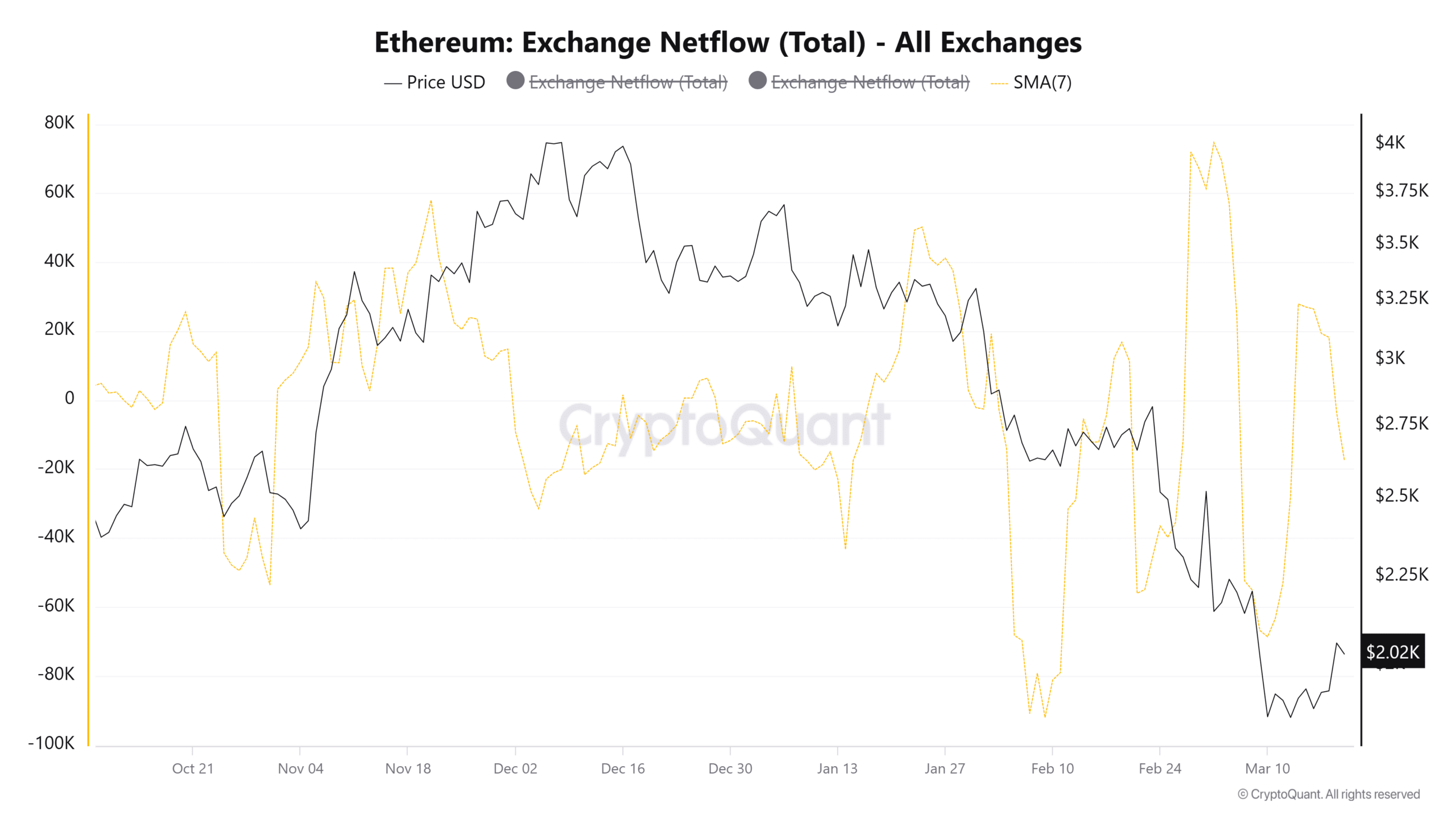

Source: CryptoQuant

Exchange netflows track the flow of ETH into and out of all exchanges. It is the difference between inflows and outflows, and the 7-day moving average to smooth out variance. Higher inflows imply more selling pressure, while hike in outflows imply accumulation among market participants.

Since mid-January, there have been four notable spikes in ETH inflows to exchanges. Local peaks in netflows were seen on 24 January, 19 February, 3 March, and 14 March.

The first three spikes were followed by a sharp price drop within a few days. The early March inflows occurred during Ethereum’s drop from $2.8k to $1.8k.

If this pattern repeats itself, the worries from the price action front are even more likely to be correct. Bears could initiate another price drop in the coming days.

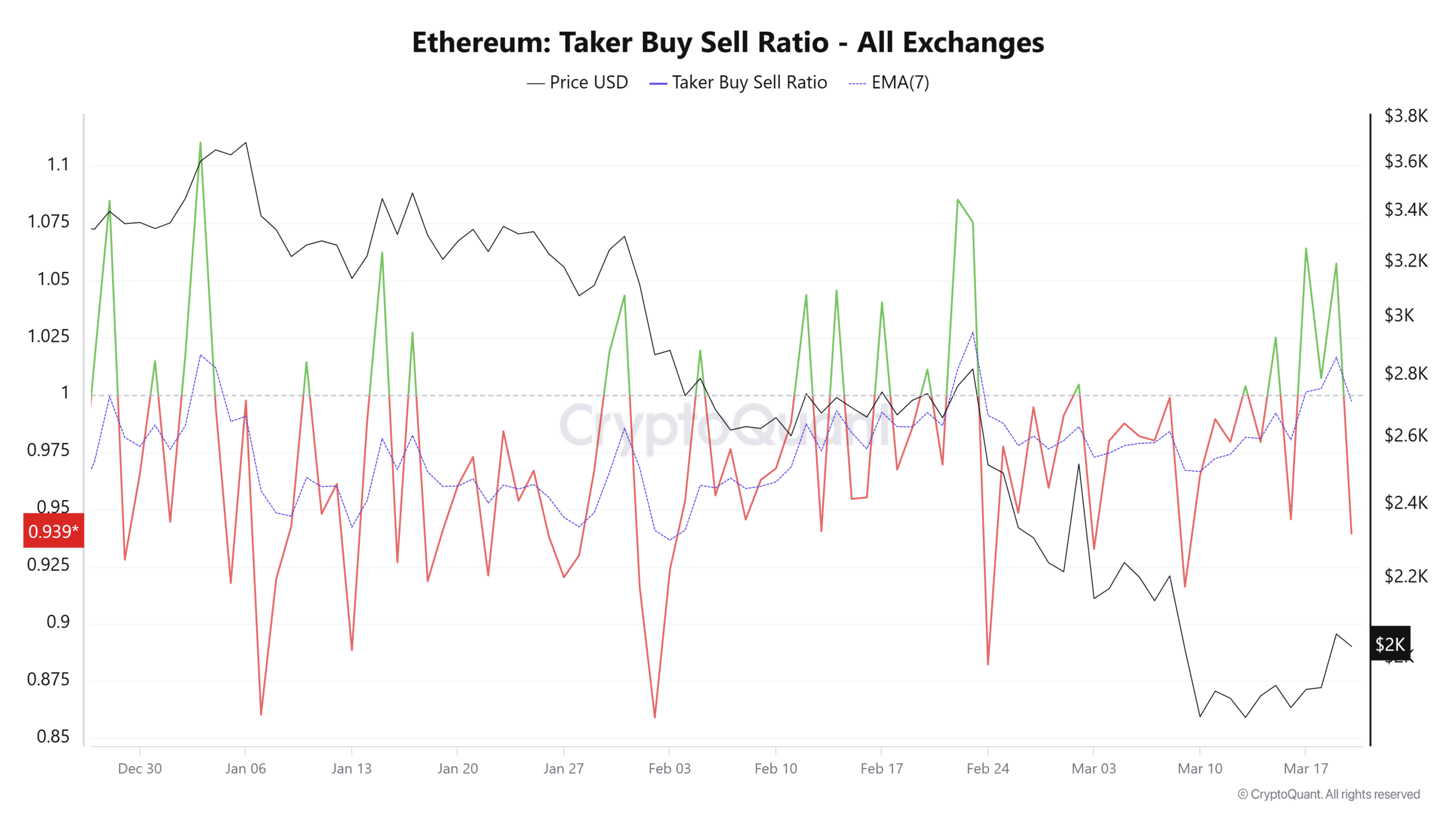

Source: CryptoQuant

The taker buy/sell ratio measured the taker (market order) buy volume to sell volume in perpetual trades. A ratio over 1 meant taker buy orders were dominant – Indicating bullish sentiment.

Over the past three weeks, bearishness has been prevalent. The taker ratio showed selling pressure was stronger. It began to change over the past two days, which in turn saw the 7-EMA (purple) climb above 1.

This ascent was short-lived though. At press time, the 7-EMA of the taker ratio was negative once again, outlining the possibility of a price drop. Combined with the clues from the price action and the exchange netflows, it may be likely that Ethereum would fall to $1,750 or lower.