Analysis

Ethereum crosses $1800 as bulls extend control

Buying pressure on Ethereum saw the second largest crypto scale two price hurdles with the potential for more gains in the long-term.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- ETH extended its bullish rally past the $1,800 price level.

- Supply on exchanges continued to dip, highlighting strong buying pressure.

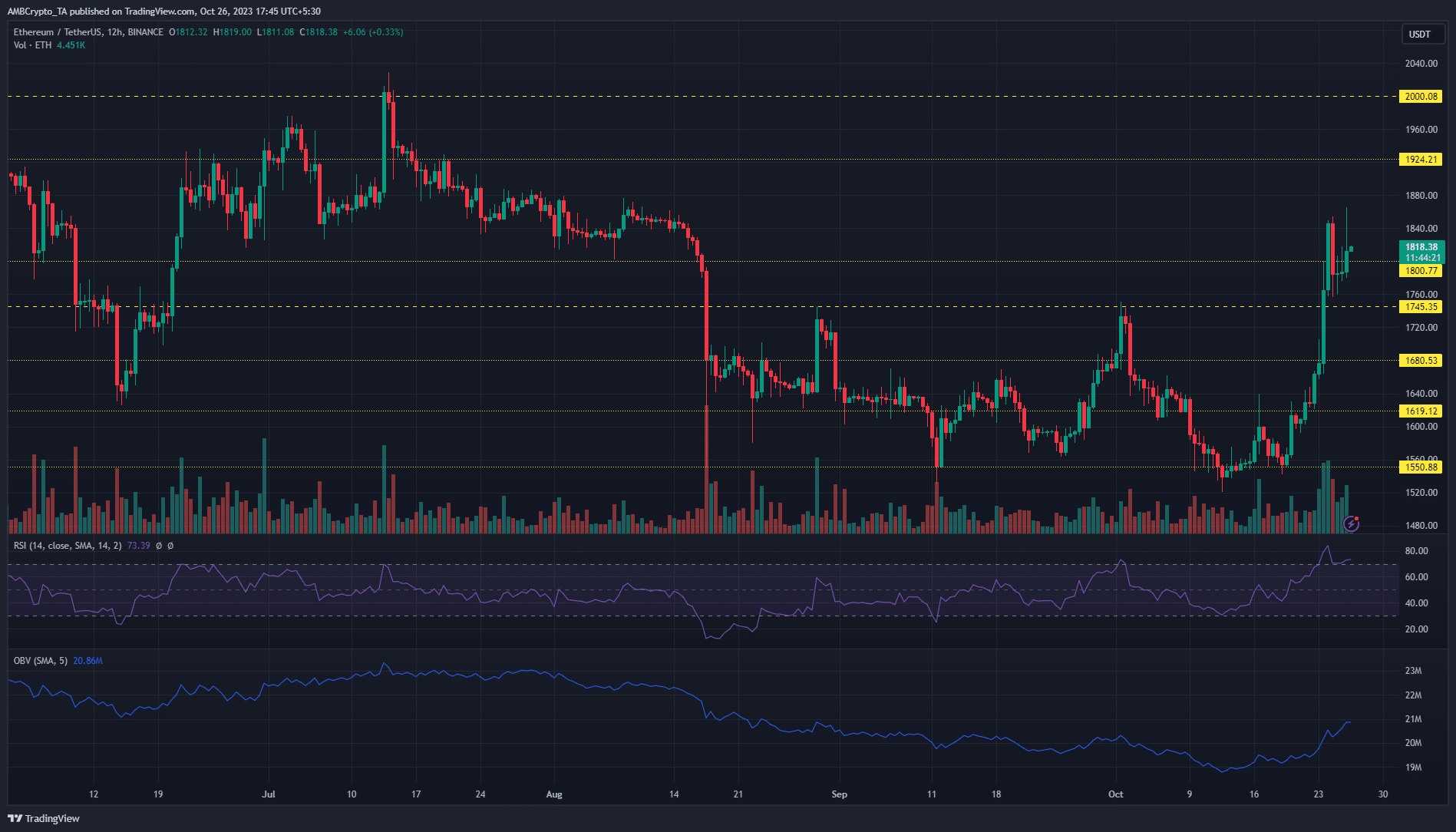

Ethereum [ETH] followed Bitcoin [BTC] in registering significant gains over the past week. ETH’s bullish rally from the $1,550 support level extended its gains to 20% with price trading above the critical $1,800 price level.

Read Ethereum [ETH] Price Prediction 2023-24

This surpassed the $1,700 target AMBCrypto had predicted on 23 October, based on ETH whales’ accumulation. With the $1,800 price level flipped to support, bulls could be looking to hit another price milestone at $1,900.

ETH bulls overwhelmed sellers at multiple price hurdles

After bulls rallied from the $1,550 support and flipped the $1,619 resistance, key price hurdles were identified for the bullish rally at $1,680 and $1,745 respectively.

However, bulls took out both price hurdles with a single bullish candle on the 12H timeframe. This highlighted the strong buying pressure, as seen by the RSI’s (Relative Strength Index) reading of 74.

Furthermore, the uptick in the OBV (On Balance Volume) accelerated the bullish move past a strong bearish price zone at $1,800. Despite the pullback at the level on 24 October, bulls successfully flipped the level to support with a candle close above it over the past 12 hours.

As such, bulls can target further gains with the $1,900 price level achievable in the long term, especially if BTC extends its bullish run past $35k.

Is your portfolio green? Check out the ETH Profit Calculator

Supply on exchanges dipped with long-term holders in profit

Source: Santiment

A look at the 90d Market Value to Realized Value (MVRV) ratio showed that long-term ETH holders (3 months+) were sitting on 9.2% of unrealized profits at the current price. With the potential for more profits, investors could be encouraged to hold their positions.

In addition, the supply on exchanges continued to decline which hinted at waning selling pressure. This could be an added advantage for bulls in the push for $1,900.