Ethereum crosses $4,000 – How long before a new ATH?

- ETH saw an over 3% price increase and traded above $4,000 at press time.

- Over 90% of the supply was in profit.

Following weeks of steady price rise, Ethereum [ETH] has successfully breached the $4,000 price threshold.

This achievement not only marks the reclamation of the $4,000 zone by ETH but also signifies that the king of altcoins might achieve a new all-time high.

Ethereum crosses $4k

AMBCrypto’s examination of Ethereum’s price trend on a daily timeframe showed that, at the time of this writing, it had surged past the $4,000 mark, having risen by over 3.8%.

Going back in history, the last time ETH reached this price range was between October and December 2021, coinciding with its previous all-time high of $4,878.

Additionally, our analysis of its Relative Strength Index (RSI) showed a strong overbought trend, with the RSI surpassing 80. This suggested a strong bullish trend in an overbought state.

Given the press time RSI, a price correction may be imminent before ETH resumes its upward trajectory toward a new all-time high.

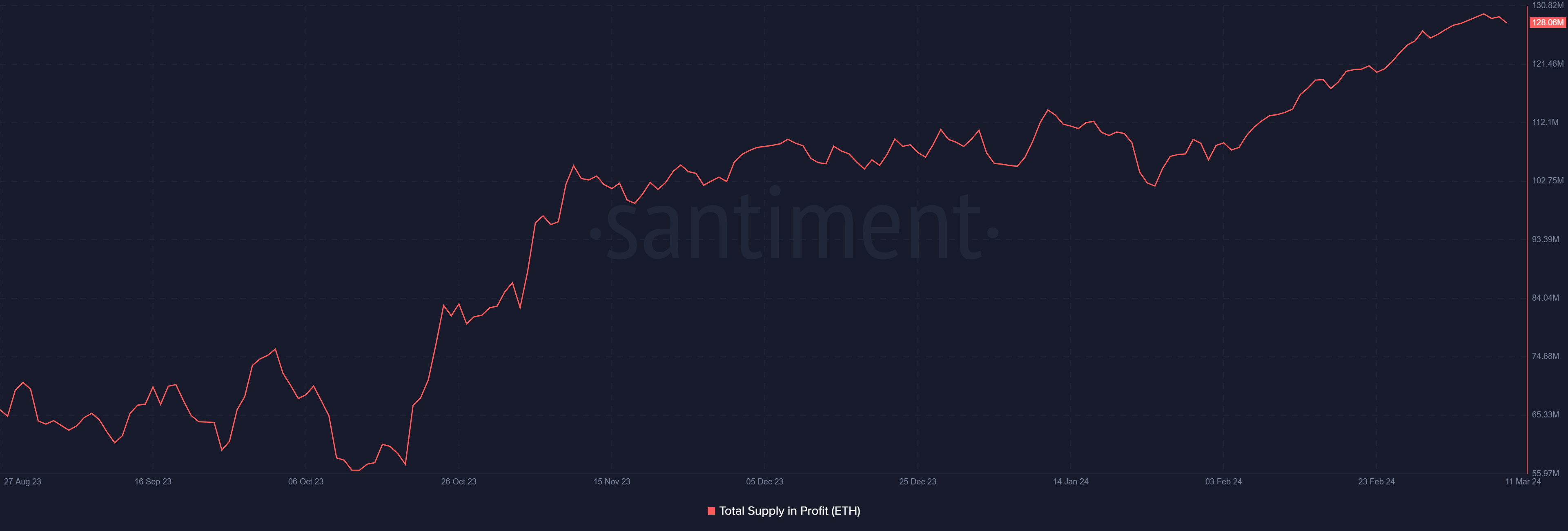

Ethereum in profit crosses 90%

Ethereum’s surge beyond the $4,000 price threshold has had a cascading impact on the overall supply in a profitable state.

AMBCrypto’s look at the Total Supply in Profit via Santiment showed that, at press time, the indicator was over 128 million, accounting for over 95% of the supply.

This marked the first time a substantial portion of ETH’s supply was in a profitable state.

After a decline in 2022, when the majority of the supply was held at a loss, this recent shift signified a significant positive turn in the market sentiment.

More positive Ethereum sentiments

Of late, Ethereum’s Funding Rate spiked as well, reaching its most positive level since the 5th of March.

AMBCrypto’s analysis via Coinglass showed that, at the time of this writing, the Funding Rate was around 0.07%.

This marked the second-highest Funding Rate in nearly a year, signaling an increase in buyer aggression.

Is your portfolio green? Check out the ETH Profit Calculator

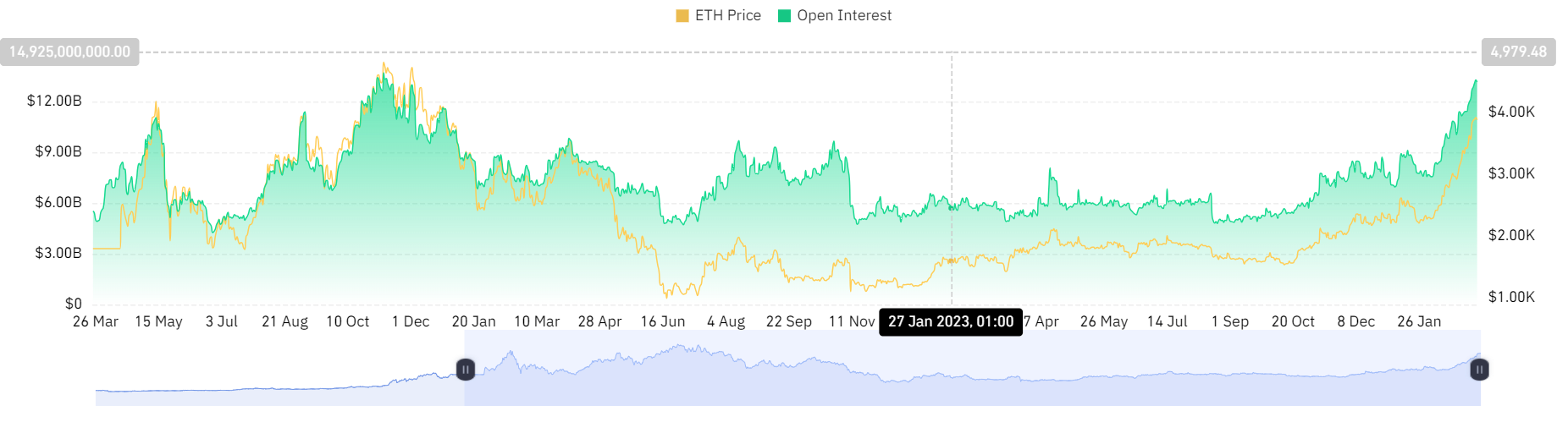

At the same time, Ethereum’s Open Interest soared to its highest level in over a year. At the time of this writing, the Open Interest was over $13 billion.

This surge in derivatives indicated positive sentiment among traders, reflecting increased confidence in Ethereum’s potential to surpass its current price level.