Ethereum: Decoding Shapella Upgrade stats and its technical details

- More than 75,000 ETH have been unstaked as of writing, with more withdrawals than deposits in the last 24 hours.

- Contrary to fears of an imminent price drop, ETH was up 2.62% to $1917.68, at the time of writing.

The highly-anticipated Shanghai Upgrade, also called Shapella, which would enable the withdrawal of staked Ethereum [ETH], was finally launched on the Ethereum mainnet. The event marked an end to a two-year-long wait for stakers since the locking of ETH was introduced in December 2020.

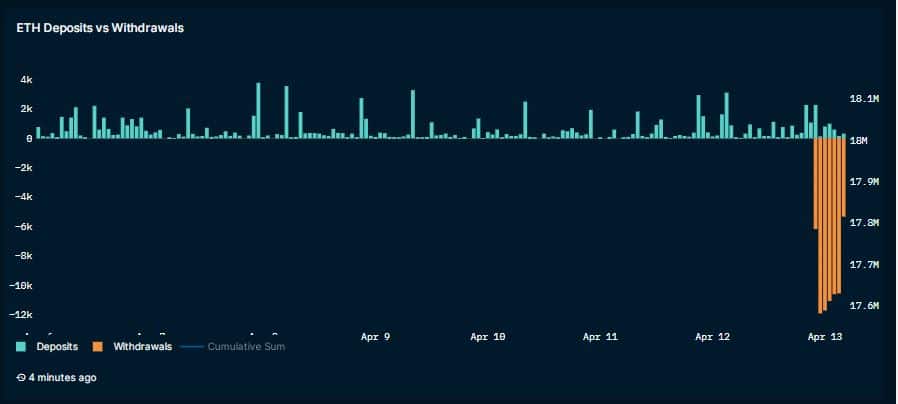

As per data from analytics firm Nansen, more than 75,000 ETH have been unstaked as of writing, with gross withdrawals exceeding gross deposits in the last 24 hours.

Contrary to fears of an imminent price drop, CoinMarketCap data showed that ETH was up 2.62% to $1917.68 at the time of writing.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum’s Holy Grail

The Shapella Upgrade combines changes to Ethereum’s execution layer (Shanghai upgrade), consensus layer (Capella upgrade), and the Engine API.

Stakeholders can now withdraw both their staked ETH and any earned staking incentives, thanks to the upgrade, marking a complete transition from the proof-of-work (PoW) to the proof-of-stake (PoS) algorithm.

The upgrade was also expected to reduce gas fees in certain instances and improve the network’s scalability

At the live stream event of the Shapella Watch Party, Ethereum founder Vitalik Buterin stated,

“The Shapell Upgrade closes the loop on the key aspects of the PoS transition that couldn’t make it to the Merge last year. The immediate next focus is scaling, and a lot of work is going on for EIP-4844.”

As per Nansen, the total amount of ETH staked in the chain’s smart contracts was 18,169,175 at press time. The staking ratio, or the percentage of tokens being staked out of ETH’s circulation supply, was 15.09%, significantly increasing from 13% at the start of the year.

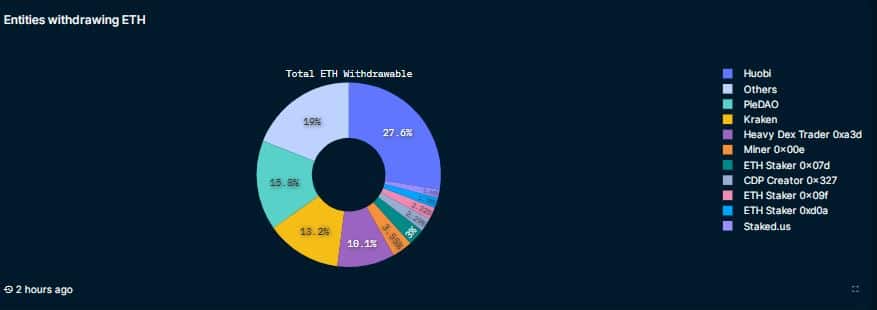

Cryptocurrency exchange Huobi [HT], controlled the highest percentage of the total quantity of withdrawable ETH at 27%, followed by PieDAO, a decentralized autonomous organization, at 15.8%.

The Withdrawal mechanism

As per blockchain analytics firm IntoTheBlock, the withdrawals will be split into two categories – Partial and Full.

In partial withdrawals, only profits can be withdrawn while full withdrawals will enable unlocking of initial deposits plus profits.

Partial withdrawals will have a shorter waiting period. As per estimates, it would have taken roughly four and a half days for these ETH gains to reach the market if all partial withdrawals had been made immediately upon the Shapella fork.

At the time of writing though, about 704,351 ETH was waiting for full exit and it would take a little more than two days to process partial withdrawals as per Nansen’s dashboard.

On the other hand, it was projected that it will take more than 100 days for 1/3 of full withdrawals to happen.

However, there was a caveat. Only validators that have provided 0x01 credentials can process full and partial withdrawals. Less than half of the eligible addresses were updated to the same, as of this writing.

Liquid staking platform Lido [LDO], which accounted for over 30% of the total ETH staking market, stated that withdrawals are expected to go live in May following the completion of testing and audits.

It added that Lido stETH withdrawal functionality has been deployed on Goerli testnet for a few weeks now and is in the process of being tested.

Is your portfolio green? Check out the Ethereum Profit Calculator

What could be expected next

According to IntoTheBlock, ETH’s staking ratio could potentially rise as high as 25%-30% within a year, from the current 15%. Although the network may experience a flurry of withdrawal requests in the beginning, it was anticipated that individual holders who had been hesitant to deposit their money for an ambiguous period of time may now start to gradually stake more.

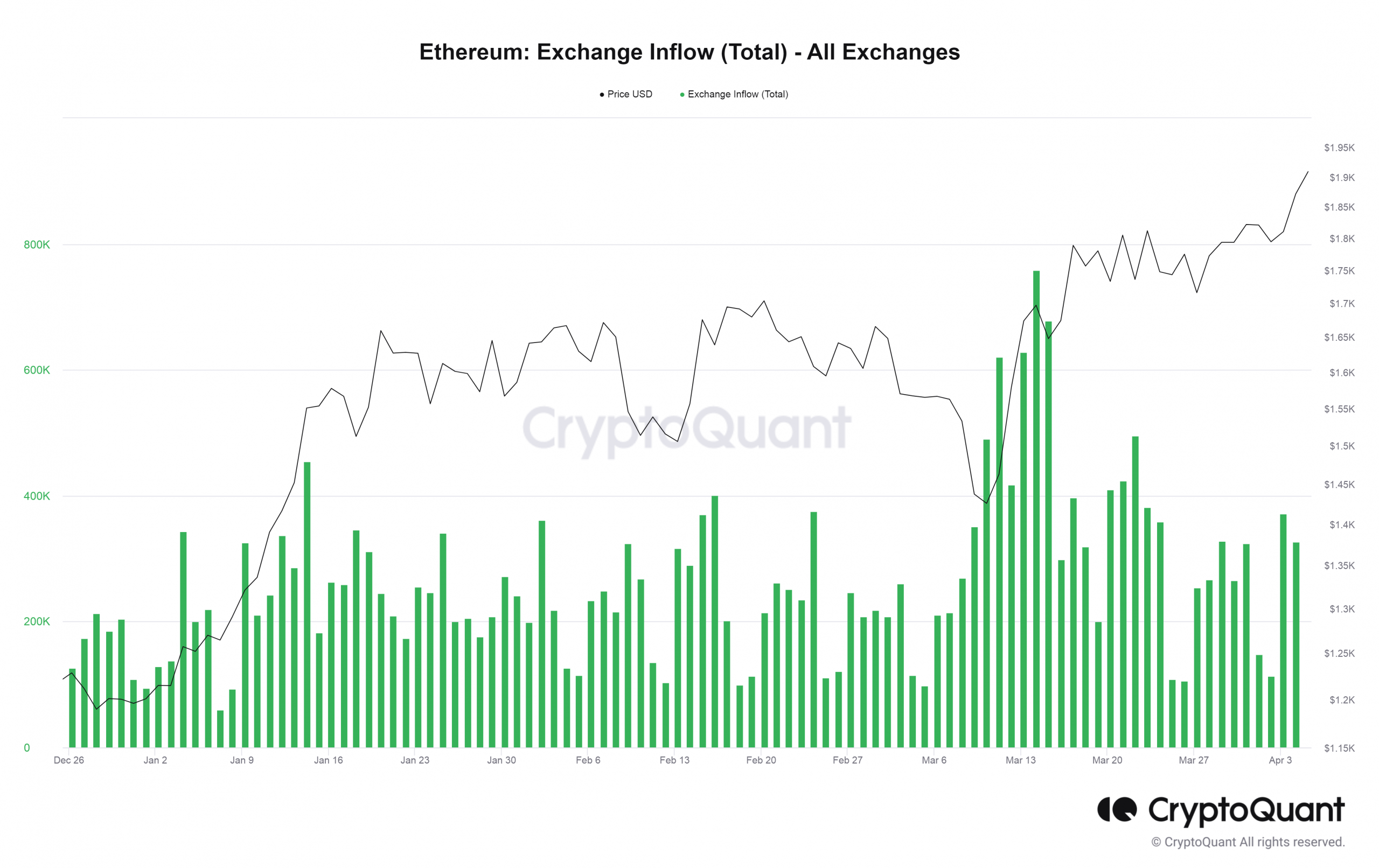

Furthermore, CryptoQuant’s data showed that exchange inflows have decreased steadily, leading to the upgrade. But there was a noticeable spike on 12 April, which could signal the start of a selling wave.

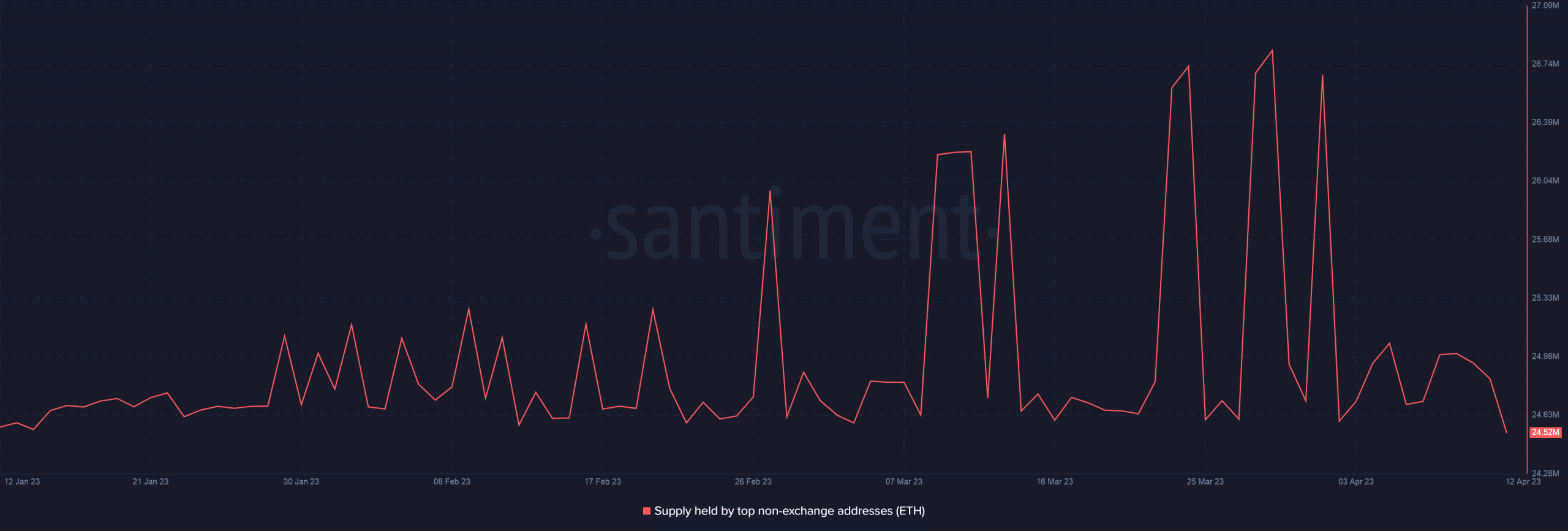

Additionally, data from Santiment illustrated the decreasing supply held by non-exchange addresses, which implied that holders were looking to book profits and ETH could face sell-pressure in the short term.