Ethereum: Derivatives see 2-year high – where does this put ETH?

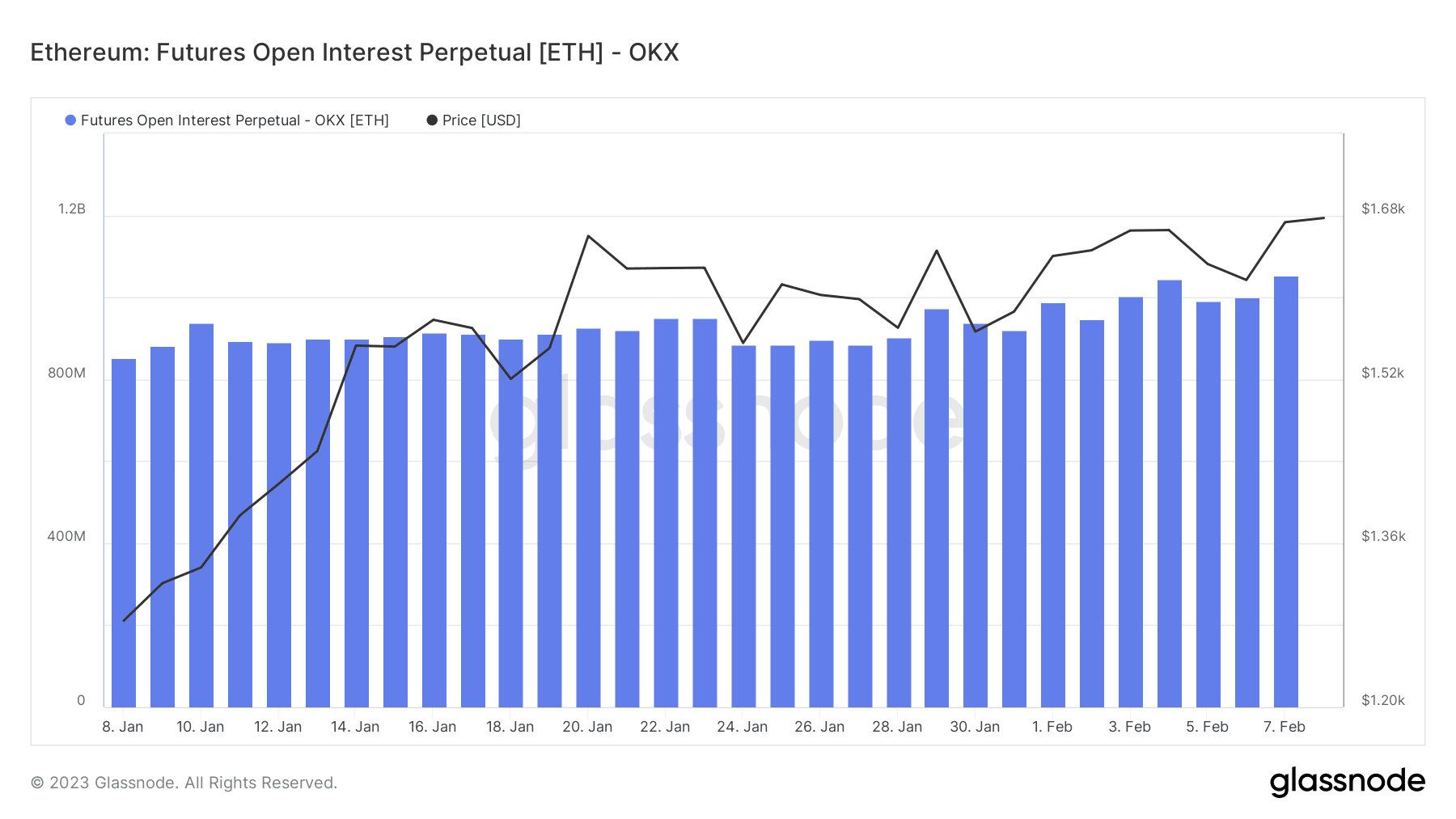

- Ethereum Open Interest in Perpetual Futures Contracts crossed one billion.

- Its price has tried to maintain the $1,500 region as support.

Bulls have been working hard to keep Ethereum [ETH] around the $1,600 range. It held that price range for the last few days, and there were signs that more traders are betting on the asset. In addition, Open Interest in Perpetual Futures Contracts reached a two-year high, according to the latest Glassnode statistics.

Read Ethereum’s [ETH] Price Prediction 2023-24

1 billion in futures and what it means for ETH

Although Ethereum was attempting to hold on to its current price, its Open Futures Interest has recently reached a record high. Statistics from Glassnode show that on 7 January, the volume surpassed 1 billion ETH. Furthermore, at press time, the volume was at its highest in the last two years.

In the context of futures contracts, “Open Interest” refers to the total number of open contracts that have not yet been settled or closed. Contracts for perpetual futures can be held eternally, unlike ordinary futures contracts with a termination date.

Futures market activity, liquidity, and investor attitude can all be gleaned from an Open Interest analysis. Open Interest measures the number of active contracts in the market at any given time.

If Open Interest rises, this may indicate buoyant market activity, liquidity, and a bullish attitude among traders. This is the current bullish state of Ethereum Futures in Perpetual. Conversely, a low Open Interest may reflect a lack of investor confidence and sluggish market activity.

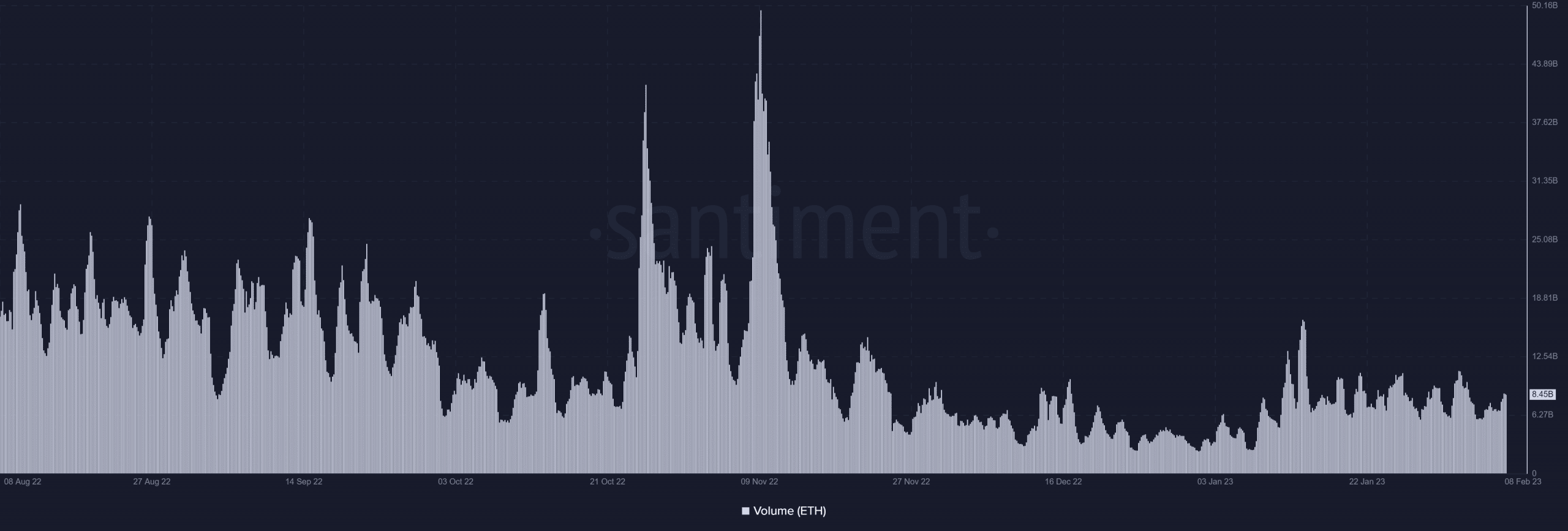

Volume remains decent

A peek at Santiment’s volume measure also revealed that Ethereum was experiencing a comeback of sorts in terms of its volume. Even though the volume is relatively modest compared to other months on the chart, it increased and was trending upward at press time. It had reached over eight billion in volume as of this writing.

Price Converges with OBV and RSI

At the time of this writing, the daily timeframe price of ETH was in the $1,670 area. The data that was shown also showed that it had increased in value by almost 4% during the previous 48 hours. Moreover, it developed support between $1,568 and $1,520. So, the price movement had bounced off the support level twice.

Furthermore, an On Balance Volume (OBV) examination revealed that the price move and OBV had converged. This indicated that ETH’s recent price increase was a legitimate rise in price rather than merely a pump.

Is your portfolio green? Check out the Ethereum Profit Calculator

In addition, both metrics and the Relative Strength Index (RSI) converged. Additional information from the RSI indicated that ETH was still in a bull trend since it was still above 60.

The volume, price change, and Open Interest in Perpetual Futures demonstrated positive movements, showing that Ethereum was enjoying a successful run. Although this is encouraging for ETH owners, there might be better entry points.