Ethereum

Ethereum: Here’s the silver lining to its declining trends

Ethereum’s triumphant ascent breathes new life into the market, yet the dwindling exchange supply adds intrigue. Long-term holders seek profitability amidst challenges.

- ETH price hovered around $1,890, inching closer to the $1,900 price zone.

- ETH supply on exchanges continued to decline, reaching a record low.

Ethereum [ETH] trended sideways for weeks and eventually slid. However, it has embarked on an upward trajectory, breathing new life into the market. Nevertheless, amidst this surge, the available supply of Ethereum on exchanges has been steadily dwindling, adding an intriguing twist to the unfolding narrative.

Read Ethereum’s [ETH] Price Prediction 2023- 24

Ethereum maintains a bull trend

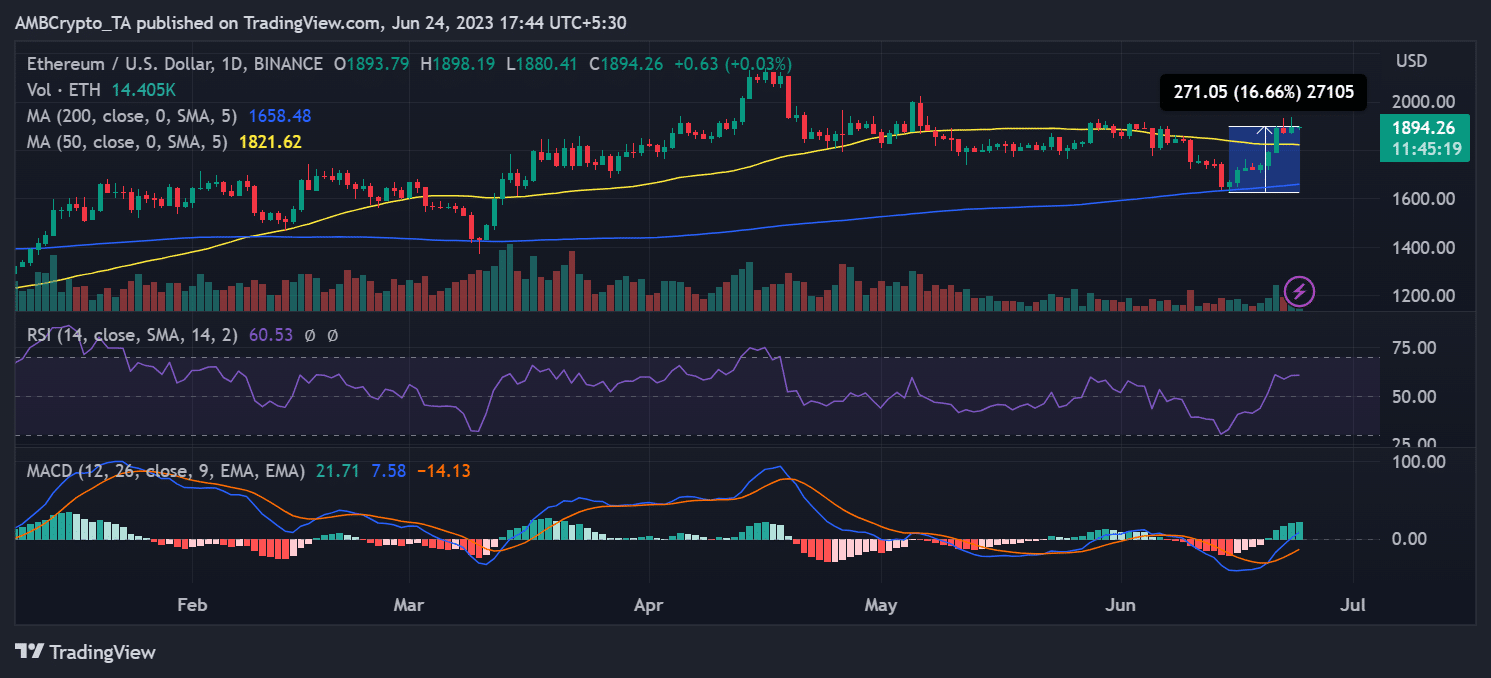

Looking at the daily timeframe chart of Ethereum revealed an intriguing journey that began around 15 June when it initiated its upward surge. Since then, it has accumulated growth of over 16% in value.

As of this writing, Ethereum hovered around the $1,890 mark, exhibiting a slight dip in value.

However, on 23 June, it concluded the trading session with a noteworthy addition of 1.10%. While it has yet to reclaim the $2,000 price range, an exciting development unfolded as it successfully shattered the resistance posed by its short Moving Average (yellow line) around the $1,820 price zone.

This breakthrough indicated a positive shift in the prevailing trend.

The press time price trajectory has also propelled Ethereum into a bull run, as evidenced by its Relative Strength Index (RSI). As of this writing, the RSI line stood above 60, signifying a strong bullish trend.

Ethereum on exchanges declines

Despite Ethereum’s valiant efforts toward recovery, a fascinating phenomenon persists—the dwindling supply of ETH on exchanges. Santiment’s data revealed that the supply on exchanges, as a percentage of the total supply, had reached an all-time low.

As of this writing, this supply had declined to approximately 9.1%, marking its lowest level since Ethereum’s inception.

The decline in supply commenced back in January, but it was during May that a sharp downturn became apparent. This downward trajectory has persisted until now, further deepening the scarcity of Ethereum available on exchanges.

ETH profitability for long-term holders

Examining the profitability of Ethereum for long-term holders revealed that, despite the recent uptrends, they have yet to translate into profitability for these holders.

As of this writing, the two-year Market Value to Realized Value ratio (MVRV) had dipped below zero, standing at -10% at press time. This indicated that individuals who have held onto ETH during this specific held at a loss.

However, there remained a glimmer of hope. A sustained increase in value could potentially propel these holders into a more profitable zone, alleviating their loss position at press time.

Furthermore, traders, as per data provided by CoinGlass, held optimistic expectations for an impending price surge. As of this writing, the funding rate on CoinGlass stood in positive territory.

Is your portfolio green? Check out the Ethereum Profit Calculator

This was a significant indicator of positive sentiment among traders actively taking long positions.

It is worth noting that a price rise could further enhance the positivity of the funding rate, potentially attracting more traders to take long positions. Conversely, a price decline would cause a substantial number of positions to be liquidated.