Ethereum DEX volume loses $2B in 7 days: Bad news for ETH?

- DEX volume fell to $1.03 billion, however, indicators revealed that ETH’s price could jump.

- The liquidation levels suggested that the altcoin could leave more shorts in liquidations.

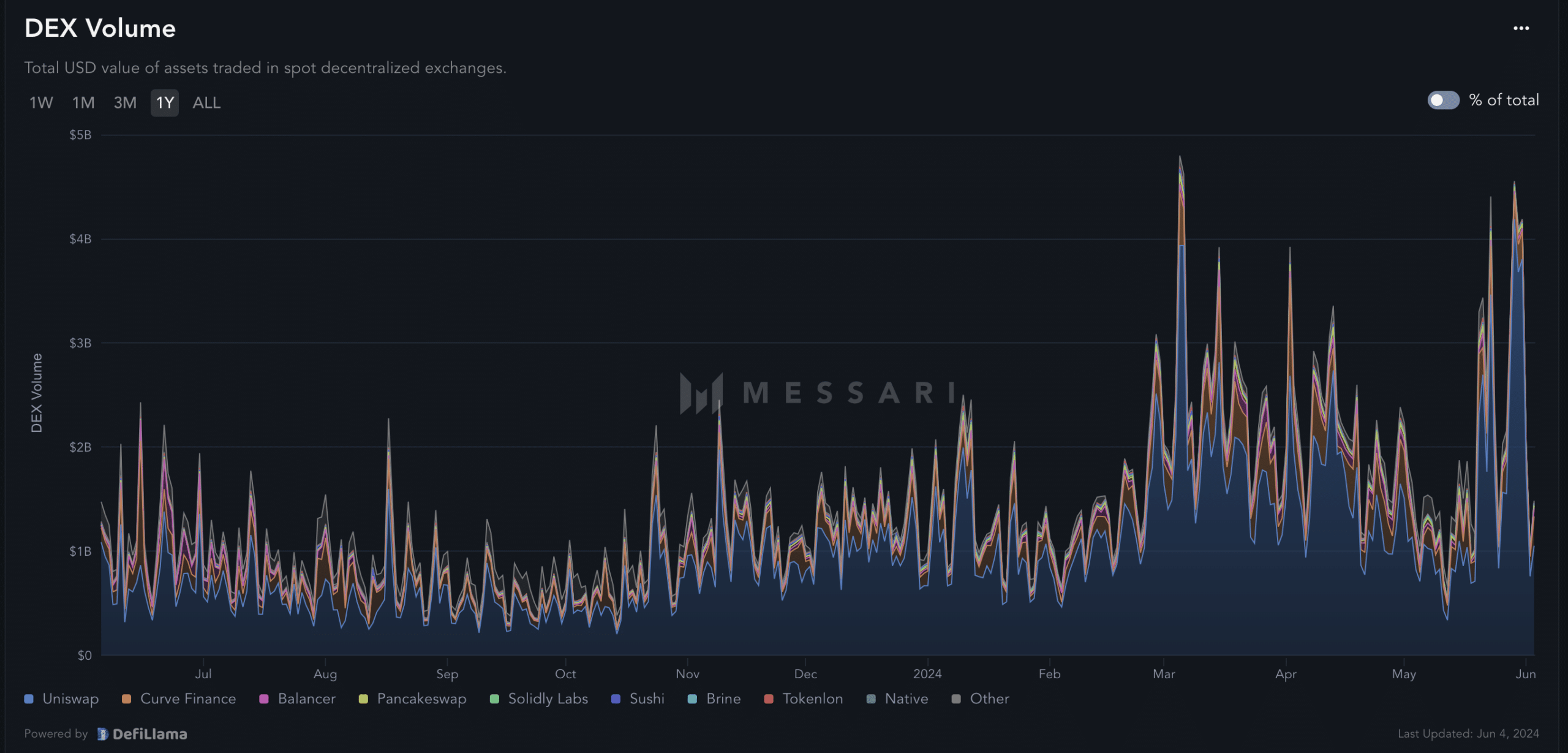

Activity on Ethereum’s [ETH] Decentralized Exchanges has been declining for the past seven days, AMBCrypto confirmed. On the 28th of May, based on data from Messari, the volume was $3.34 billion.

However, press time data showed that the DEX volume was down to $1.03 billion— A $2.21 billion decrease. An increase in the volume on DEXes would have implied more liquidity for Ethereum.

Since it fell, it means that on-chain trades involving ETH were no longer as much as they were last week. Another interpretation points to decreased demand for the altcoin.

A “slight” fall is not the end

With decreasing demand, ETH could find it challenging to experience a major price increase. At press time, the price of ETH was $3,763, representing a 3.50% decrease within the last week.

The underwhelming price action is one of the reasons some participants share the opinion that Ethereum might not be a significant part of the bull market.

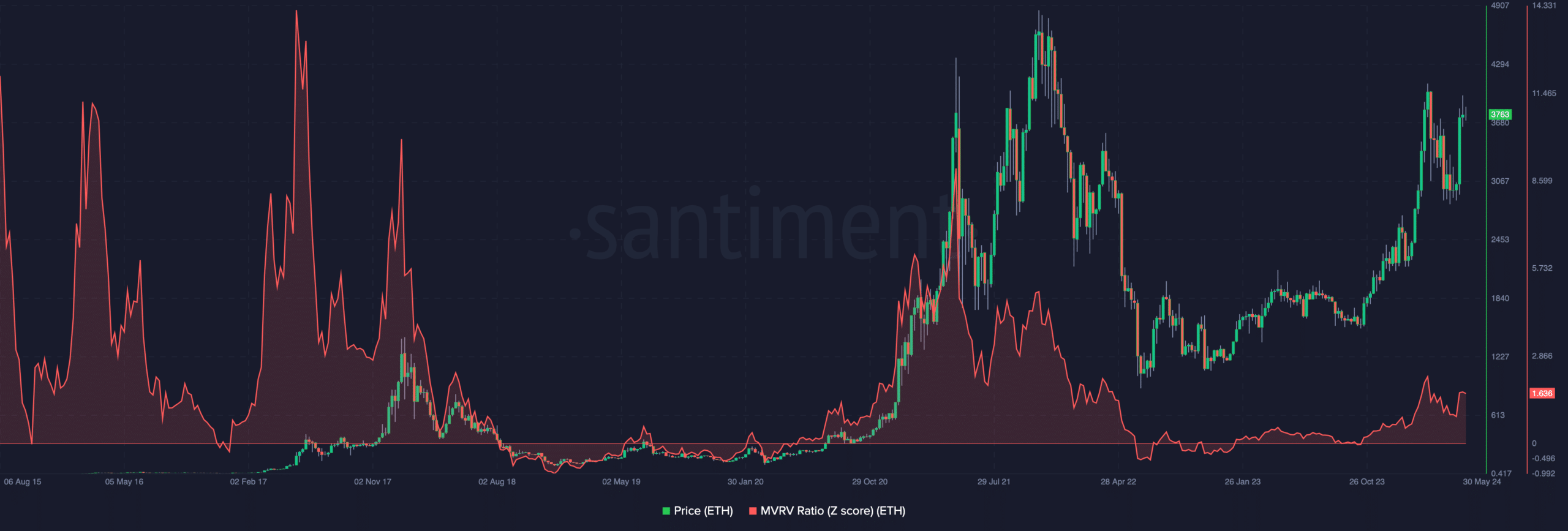

However, AMBCrypto found that the opinion was not factual. This was because of the signals shown by the Market Value to Realized Value (MVRV) Z Score. The MVRV has a strong correlation with price.

As a result, it shows when a cryptocurrency is in bearish or bullish phase. If the score if negative, it means that the asset is in a bear phase. From the chart below, the last time ETH was in such condition was in October 2023, meaning that the token had moved into the bull phase.

At press time, the MVRV Z Score was 1.63. A look at the peak of previous bull cycles like in 2017 and 2021 showed that the metric hit. 14.19 and 4.76 respectively. If the pattern was to repeat itself, then it mean Ethereum’s price could climb higher.

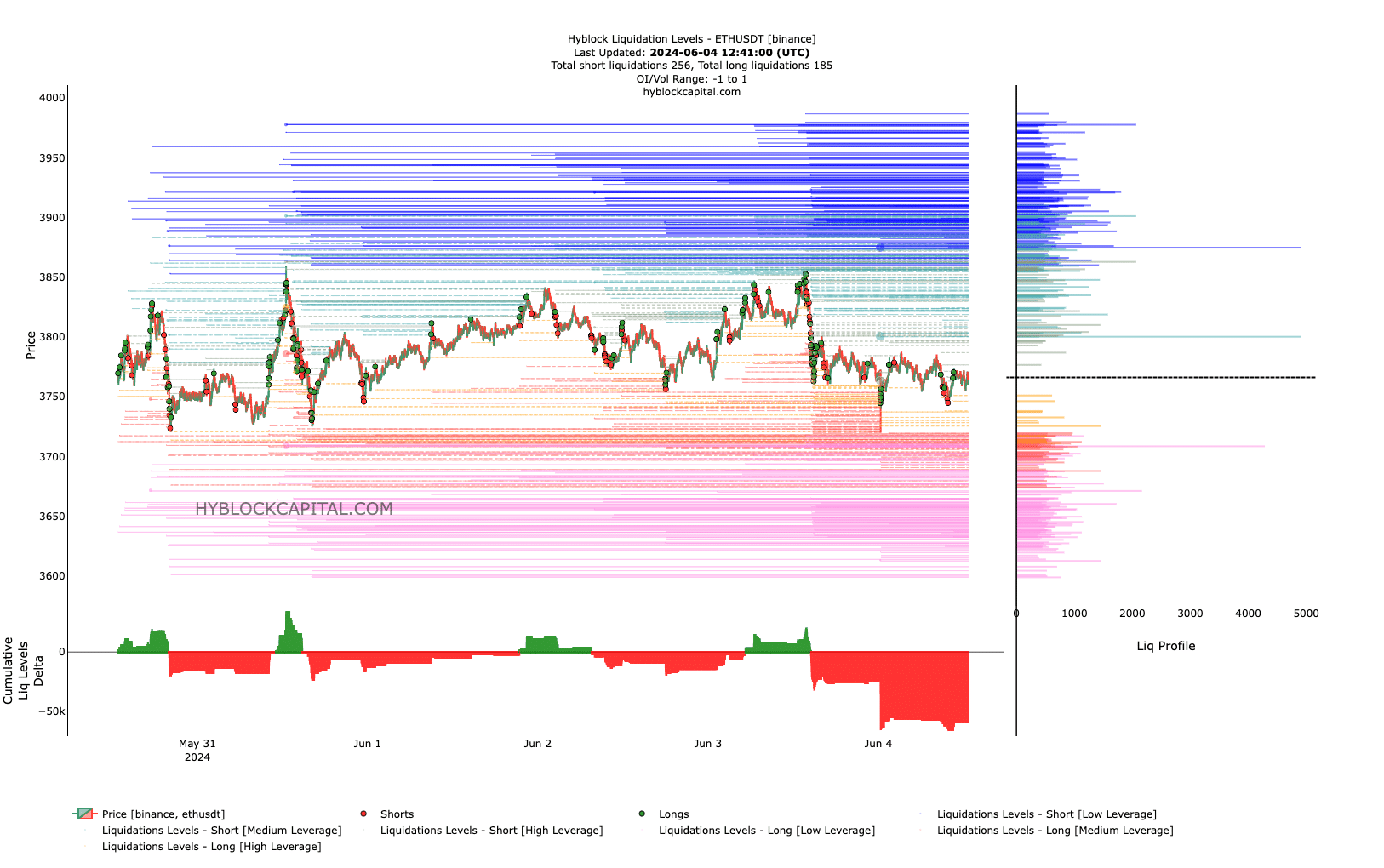

But that is for the long term. In the short term, AMBCrypto analyzed the liquidation levels. The liquidation level is the price an exchange forcefully close a trader’s position.

Bears beware! ETH looks ready to recover

The rationale behind this is to prevent further losses. At press time, Ethereum’s large-scale liquidations could take place between $3,882 up to $3,946. This implied that price could move toward the mentioned region.

Furthermore, we checked the Cumulative Liquidations Levels Delta (CLLD). A positive value of this reading implies that there are more long liquidations. A negative reading suggests that short liquidations were dominance.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Looking at the chart, the CLLD was negative, and short liquidations in the last seven days has been over $59 million.

But concerning the price, the negative CLLD is bullish for ETH as late short might fail to catch the dip. In this instance, ETH might recover, and the projection to $3,946 could be come to pass.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)