Ethereum dips, but demand rises: What’s driving investors to ETH?

- ETH saw the biggest 2-day stretch of network expansion since October 2022.

- The addresses holding between 0 and 0.1 units of ETH increased significantly.

Ethereum [ETH] continued to fall freely, sinking below $3,000 in the last 24 hours following a 3% drop, data from CoinMarketCap showed. The second-largest cryptocurrency was trading at $2,914 at press time, reflecting a 13.34% discount over the month.

The negative price action, however, did not appear to limit demand for the asset.

Unfazed users continue to snap ETH

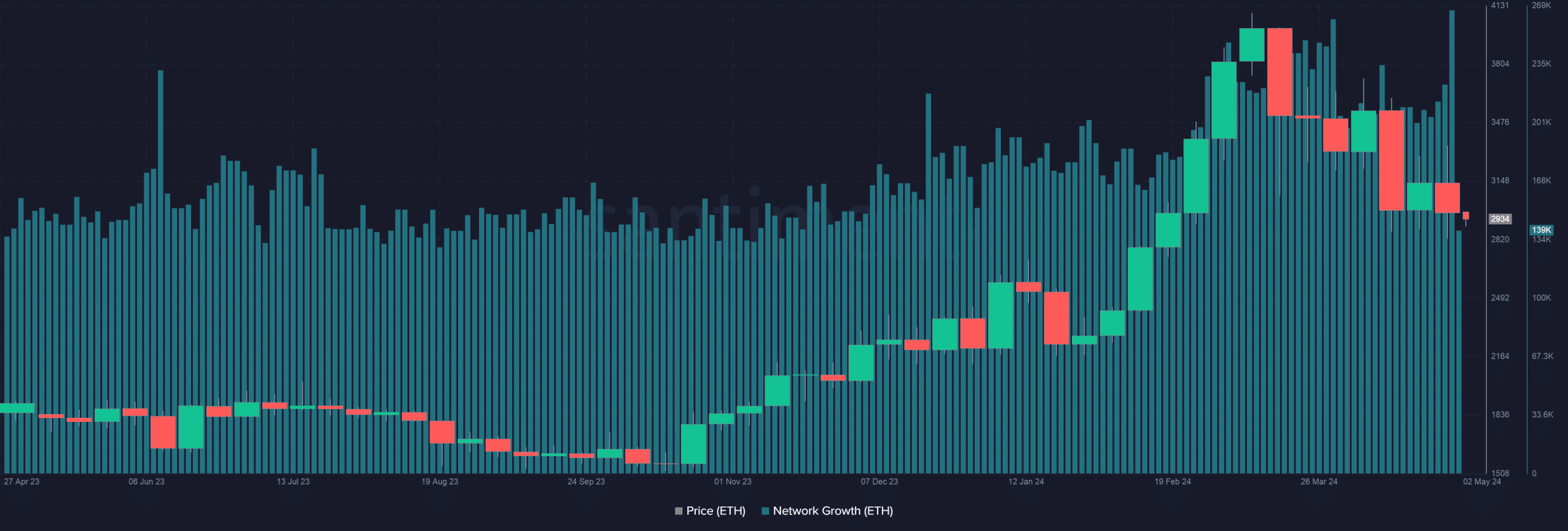

According to on-chain analytics firm Santiment, Ethereum saw a sharp increase in new users joining the network. About 266.6k new wallets were created on the 28th of April and 29th, the biggest 2-day stretch of network expansion since October 2022.

Network expansion is one of the primary measures for determining if a cryptocurrency is gaining or losing traction. The onboarding of new users indicated confidence in ETH’s long-term potential, ignoring short-term blips.

Retail users enter ETH market

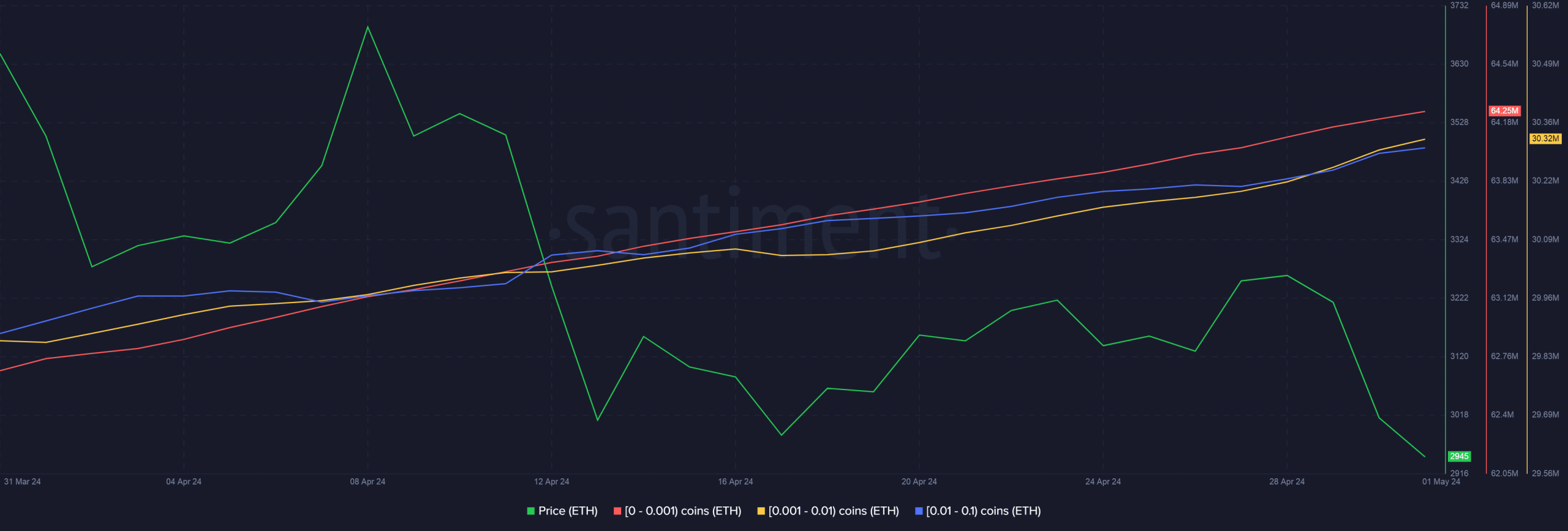

On further scrutiny, it came to light that retail users were jumping on the bandwagon. The addresses holding between 0 and 0.1 units of ETH increased significantly while the prices plunged, as per AMBCrypto’s analysis of Santiment’s data.

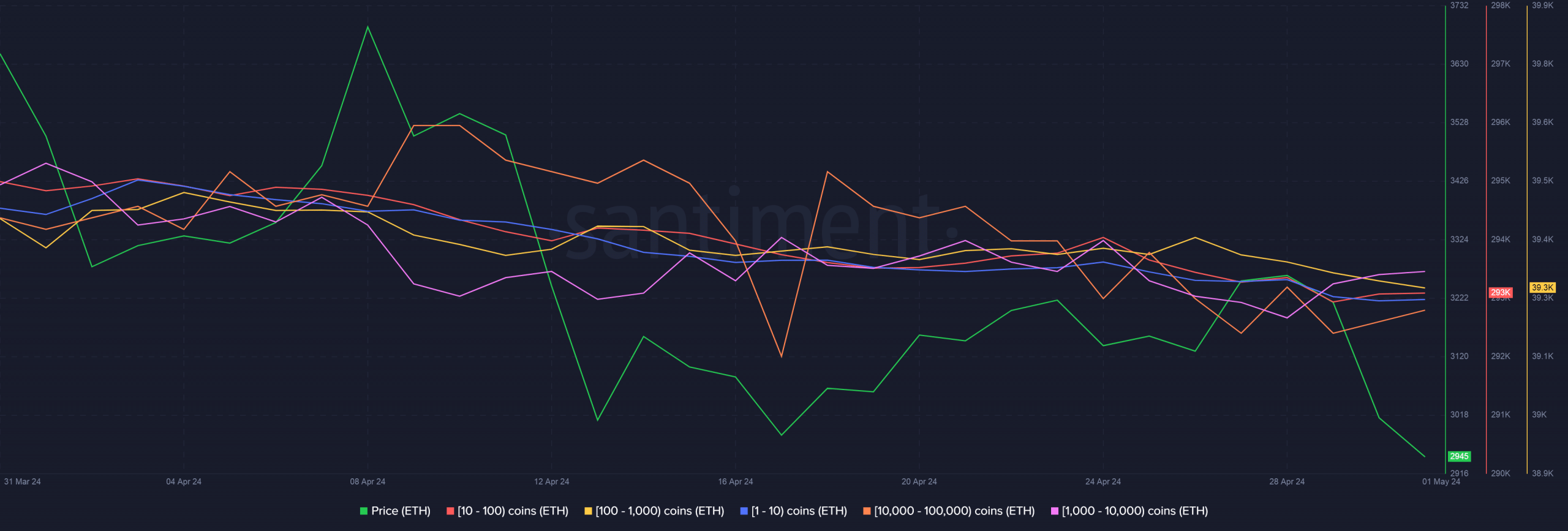

Interestingly, the cohorts holding more than 1 ETH were selling off, as evident in the drop in their ETH reserves.

The aforementioned findings suggested that retail interest was strong for ETH and healthy inflows from this segment could contribute to a relief rally in the days ahead.

Is your portfolio green? Check out the ETH Profit Calculator

Is staking the driving force?

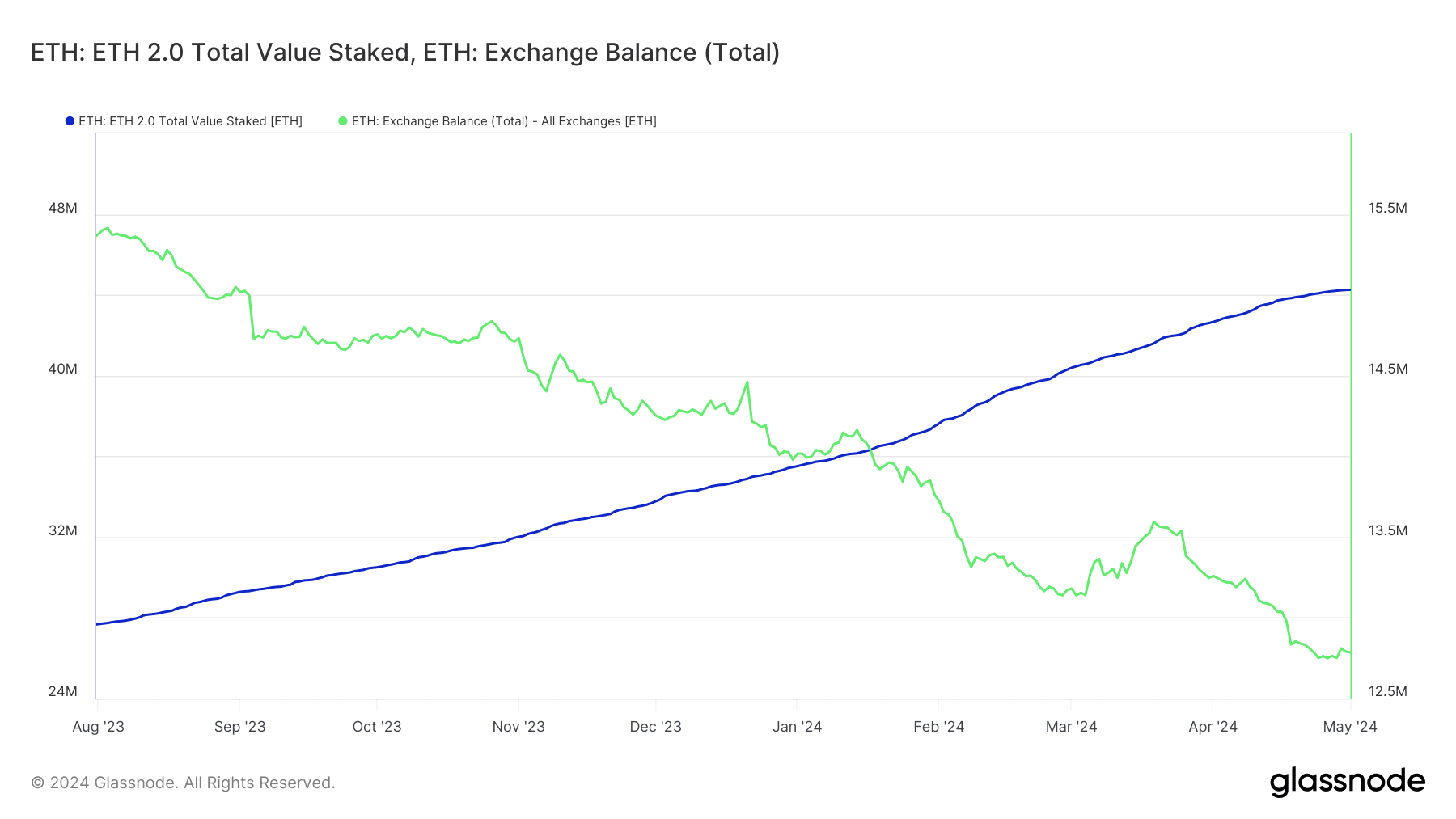

Many of these retail customers buying ETH might be lured by the yields offered by ETH staking services.

The total ETH staked soared to 44.24 million as of this writing, forming 36% of ETH’s total circulating supply, AMBCrypto noted using Glassnode data.

At the same time, the supply of ETH on exchanges continued to shrink, falling to 12.79 million as of this writing, about 10% of total ETH coins in circulation.