Ethereum drops 36%: Can bulls regain control after historic sell-off?

- ETH weekly recap reveals the sharpest decline since FTX days.

- Leveraged liquidations may have had a strong hand in ETH’s performance.

Ethereum [ETH] has experienced quite the roller-coaster of volatile price action in the last 7 days. The outcome has crashed the little bullish optimism that had started to manifest at the end of July, so let’s take a look at how ETH fared.

ETH was bullish overall in July, despite the slight pullback observed in the last week. This was followed by a short-lived recovery attempt thwarted by a robust wave of sell pressure that prevailed last week.

ETH tanked consecutively for the last 7 days, for an overall 36.59% drop.

The last time that ETH experienced such a rapid decline in a short period was in June during the FTX collapse in 2022. ETH traded at $2,277 at press time.

The recent wave of sell pressure triggered concerns that we might witness more downside in the next few weeks. While a more bearish outcome is probable, it is also possible that the bulls may regain control.

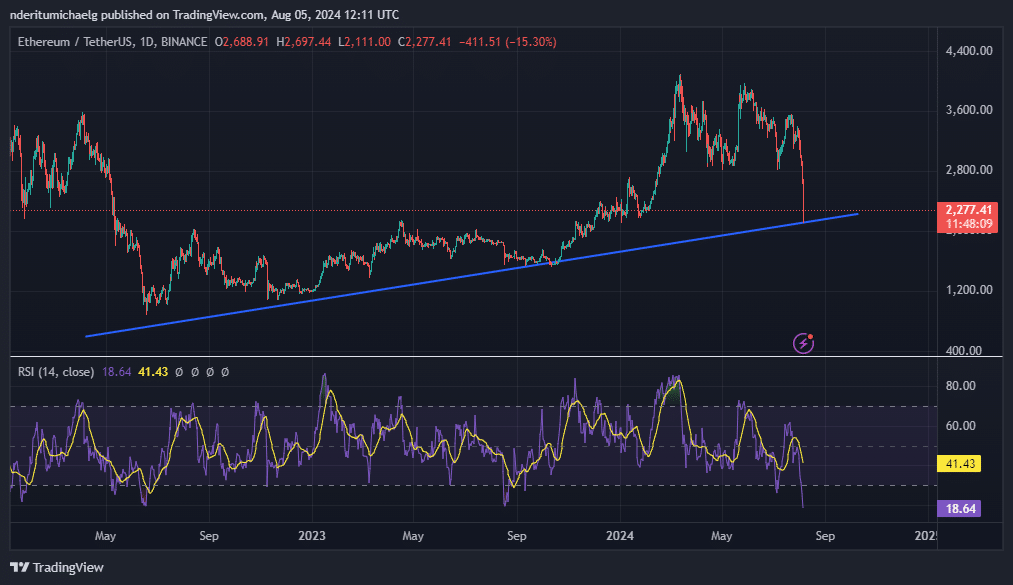

In ETH’s case there were multiple signs pointing towards a potential recovery. For example, the price got extremely oversold according to the RSI.

Second, the recent massive pullback retested a major ascending support level, triggering some accumulation. ETH had already bounced back by 5% from this support level.

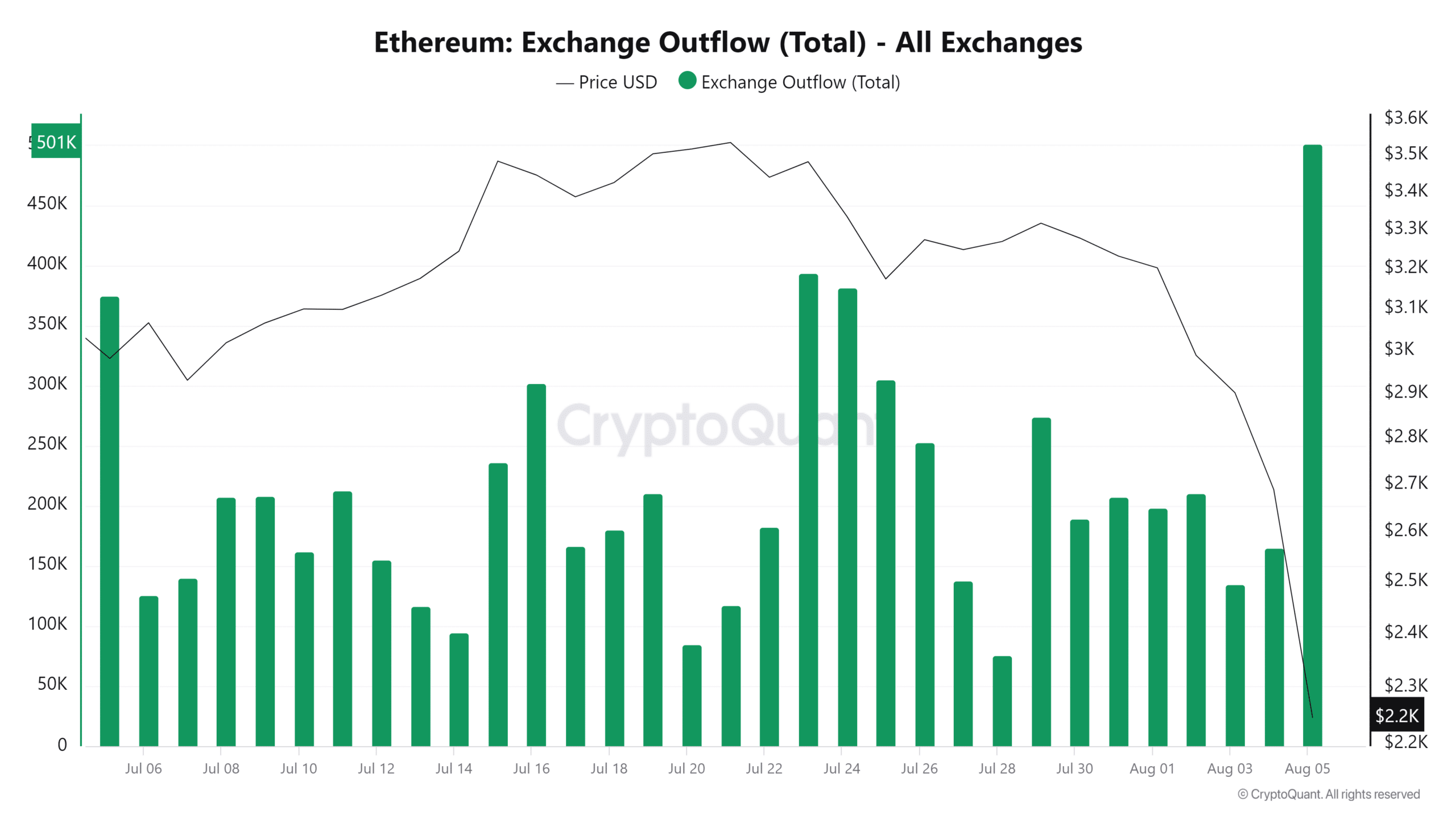

Ethereum exchange flows also revealed some interesting findings. Over 501,000 ETH was moved out of exchanges in the last 24 hours. This was the highest amount of ETH that flowed out of exchanges in a single day within the last 30 days.

For contrast, there was a total 446,877 ETH in exchange inflows that took place during the same period. This was also the highest inflows recorded in the last 30 days.

This means ETH had higher outflows than inflows by roughly $119 million in dollar value.

The exchange flows data may indicate a demand recovery at discounted prices. ETH may achieve a significant bounce back if the sell pressure gets hosed down.

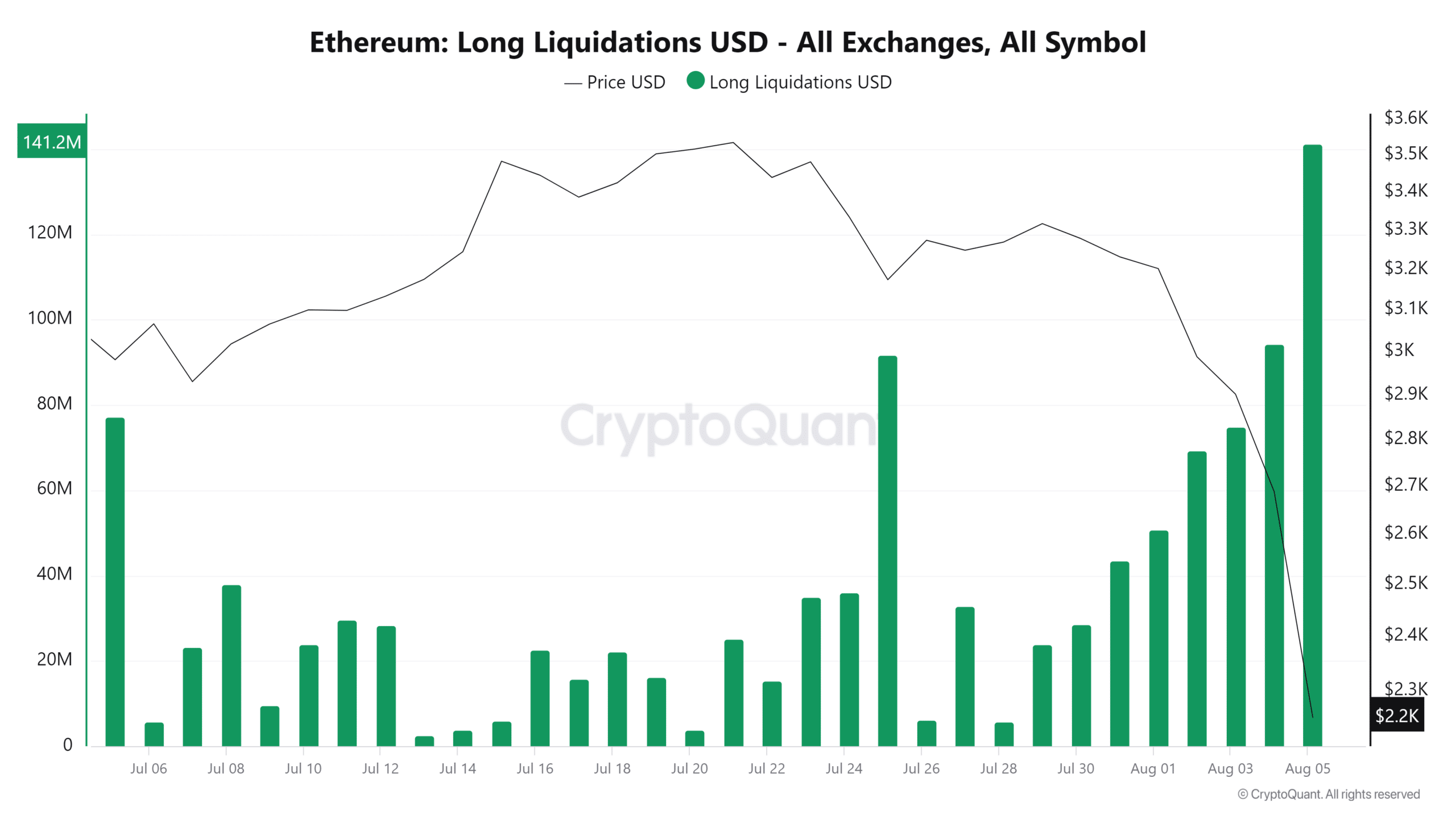

Derivatives data revealed that long liquidations also peaked in the last 24 hours. The total long liquidations amounted to $141.2 million in the last 24 hours. The highest single-day liquidations recorded in the last 30 days.

The total shorts liquidations in the last 24 hours were a fraction at $35.5 million. Margin calls of leveraged longs may have contributed to the additional downside observed in the last 24 hours.

Read Ethereum (ETH) Price Prediction 2024-25

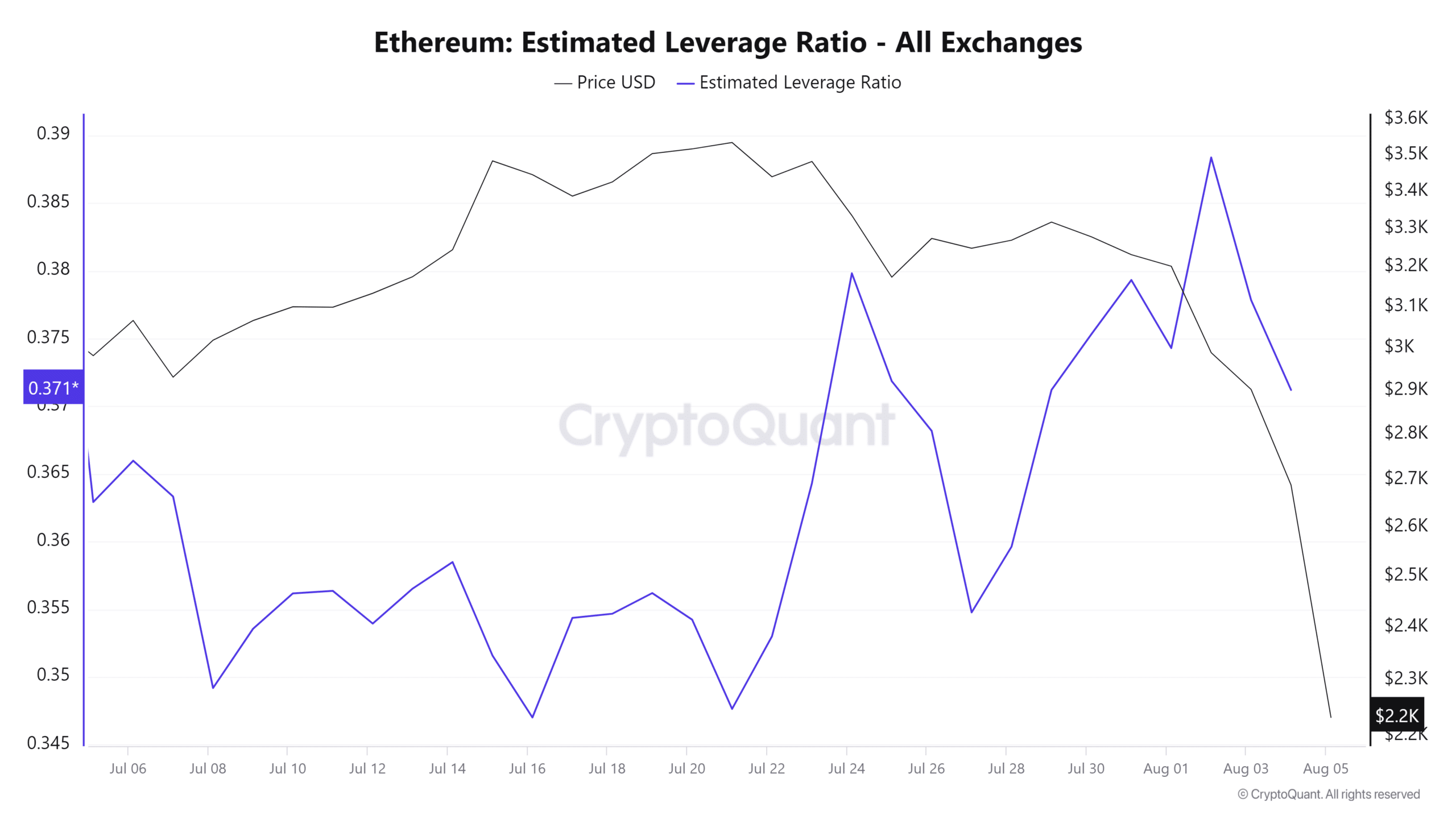

This may have also contributed to the additional volatility considering that appetite for leverage went up in the last week, hence many leveraged positions.

It is likely that volatility will reduce now that the markets have been deleveraged by recent margin calls. However, the possibility of strong demand or continued sell pressure may hinge on external market factors.