Ethereum ETF inflows outpace Bitcoin for the first time! How?

- Ethereum ETFs saw $332.9 million in inflows, surpassing Bitcoin’s ETF performance on the 29th of November.

- Ethereum’s price reached a 5-month high, outperforming Bitcoin in weekly and monthly performance.

After a period of challenges, Spot Ethereum [ETH] exchange-traded funds (ETFs) in the U.S. experienced a surge in daily inflows during its latest trading day — the 29th of November.

This notable uptick signifies growing interest in ETH, highlighting its resurgence as a potential catch-up trade after significantly lagging behind Bitcoin [BTC] in performance this year.

Ethereum ETF update

On the 29th of November, the nine Ethereum-based exchange-traded products saw impressive net inflows totaling $332.9 million, as per data from Farside Investors.

Among these, BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) led the charge, bringing in $250 million and $79 million, respectively.

Grayscale’s Ethereum fund also saw modest inflows of $3.4 million, while other products experienced no additional capital.

This marked the fifth consecutive day of positive inflows, capping off the second-strongest week for the group with $455 million in total inflows, despite the shortened trading week due to Thanksgiving.

In fact, on that very day, Ether ETFs surpassed their spot Bitcoin counterparts, which saw $320 million in inflows but faced net outflows for the week as per Farside Investors.

Remarking on the same, crypto trader Edward Morra noted,

What’s the reason behind this?

The surge in Ethereum ETF inflows follows the election of Donald Trump as the 47th President of the United States.

Along with this momentum, open interest for ETF futures on the Chicago Mercantile Exchange (CME), which targets institutional investors, has reached all-time highs near $3 billion, according to CoinGlass.

This growth reflects a positive shift in sentiment toward Ethereum as a leading asset in the cryptocurrency space.

ETH and BTC recent price trends

While Bitcoin remained in consolidation below the $100,000 mark throughout the week, Ethereum demonstrated notable strength, outperforming its larger counterpart.

That being said, ETH’s price reached a 5-month high, surpassing $3,700 on the 30th of November, and outperformed Bitcoin both weekly and monthly, though it still lags behind on a year-on-year basis.

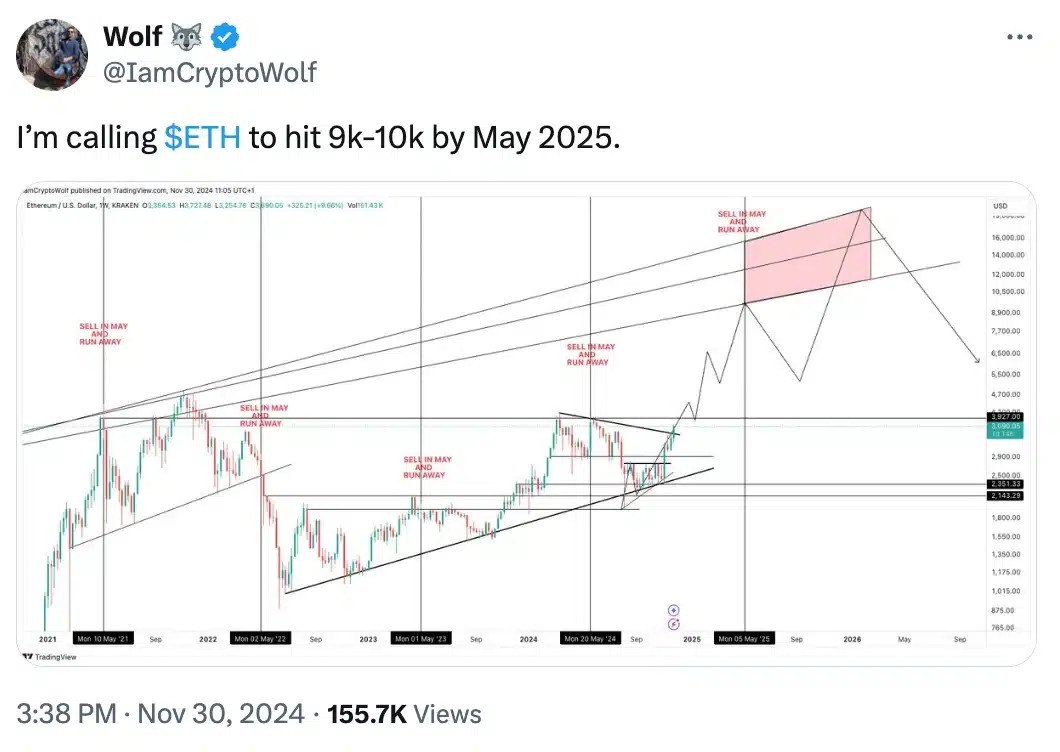

Despite this, analyst Woolf took to X (formerly Twitter) and noted,

As of the most recent update, Ethereum was priced at $3,582.05, reflecting a 3% decline over the past 24 hours.

Meanwhile, Bitcoin stood at $94,936.36, marking a 2.02% drop in the same period, according to CoinMarketCap.

Therefore, despite recent fluctuations, both cryptocurrencies continue to attract attention, with market dynamics ready to shape and turn bullish in the coming weeks.