Ethereum ETF launch date confirmed? As ETH clears $3400, what happens next

- Spot Ethereum ETFs will potentially begin trading next Tuesday.

- The SEC is in the process of gathering final drafts from prospective spot Ethereum ETF issuers.

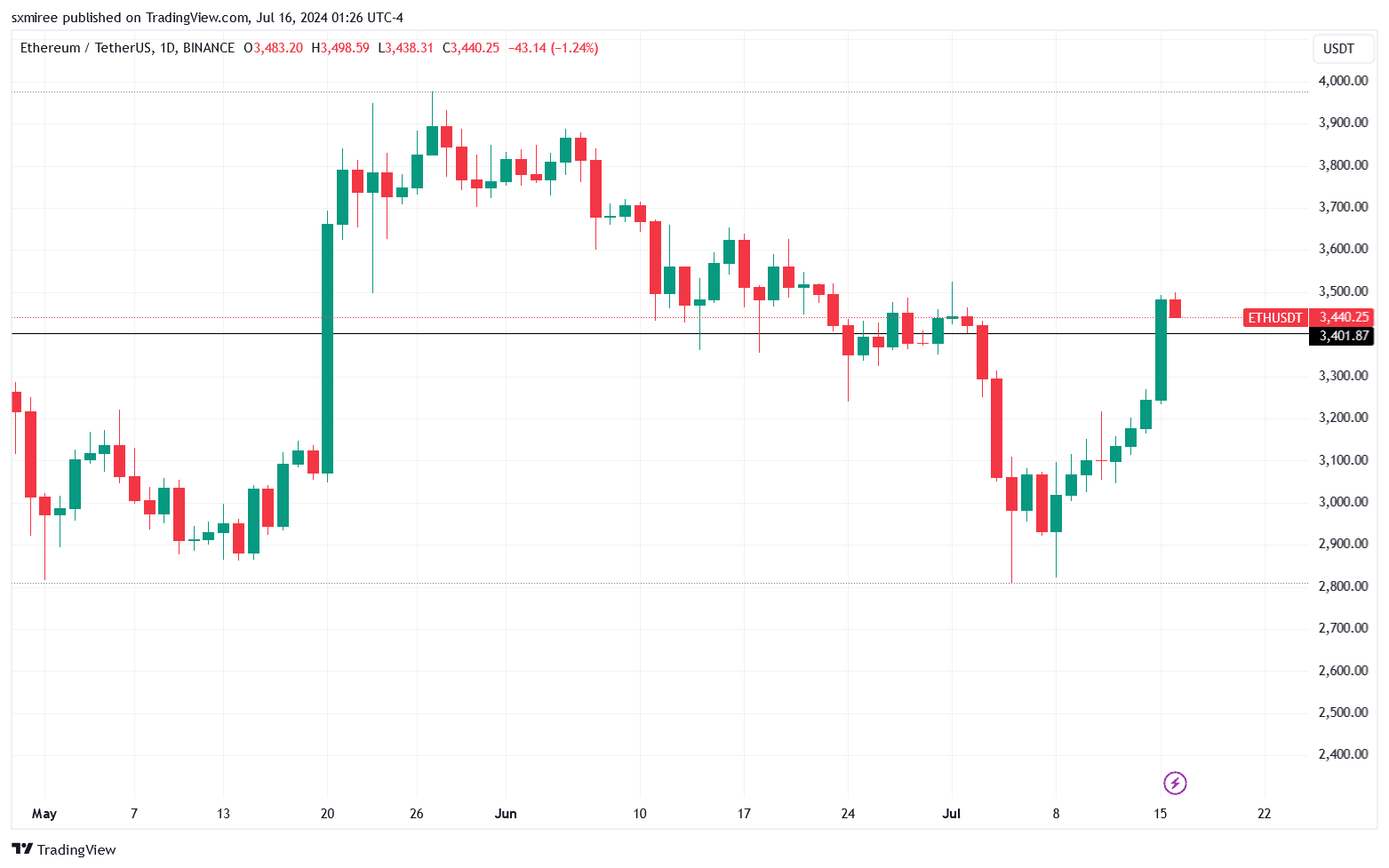

Ethereum [ETH] rose past $3400 earlier today, posting an intraday high of $3,498 on CoinMarketCap before the momentum waned. The leading altcoin was trading at $3,445 at the time of writing – up 3.64% in the last 24 hours.

Though ETH bounced back from its trip below $3,000 last week and was trading 12.8% higher in the last seven days at press time, it remained down 13.2% from its high on the 11th of March.

The latest gains come hot on the heels of reports of an imminent approval of a U.S. spot Ethereum exchange-traded fund (ETF) next week.

Spot Ethereum ETF Update

ETF market commentator Nate Geraci firmly predicted earlier this week that the US Securities and Exchange Commission (SEC) would approve the resubmitted registration statements soon.

In a Sunday post on X (formerly Twitter), Geraci wrote,

“Welcome to spot [ETH] ETF approval week. I’m calling it. Don’t know anything specific, just can’t come up [without] good reason for any further delay at this point. Issuers ready for launch.”

Bloomberg ETF analyst Eric Balchunas seconded Geraci in a separate post, adding that only an unforeseeable last-minute setback could delay the launch. He acknowledged,

“Nate’s instincts were right, hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a Tuesday 7/23 Launch.”

Separately, a report from Reuters, dating the 15th of July, cited three sources indicating that the SEC would likely greenlight the applications of at least three issuers — BlackRock, VanEck, and Franklin Templeton — to begin trading “next Monday.”

This final approval milestone will depend on the issuers submitting final documents before the end of the week, according to the sources in the know.

Market anticipation

Though the specific approval date remains unclear at the moment, excitement has been building up in the market in the last few weeks since the SEC approved applicants’ forms 19b-4 in May.

In June, the US SEC delivered feedback on the filed S-1 forms, highlighting areas needing review.

Last week, the securities regulator asked the eight asset managers seeking approval for their spot Ethereum ETFs to submit amended S-1 registration statements.

The approval of a spot Ethereum ETF is expected to significantly impact the Ethereum market and the broader crypto industry.

The ETF offerings, which are tied to the spot price of Ether, provide investors with a new avenue to gain exposure to the altcoin through a regulated financial product.

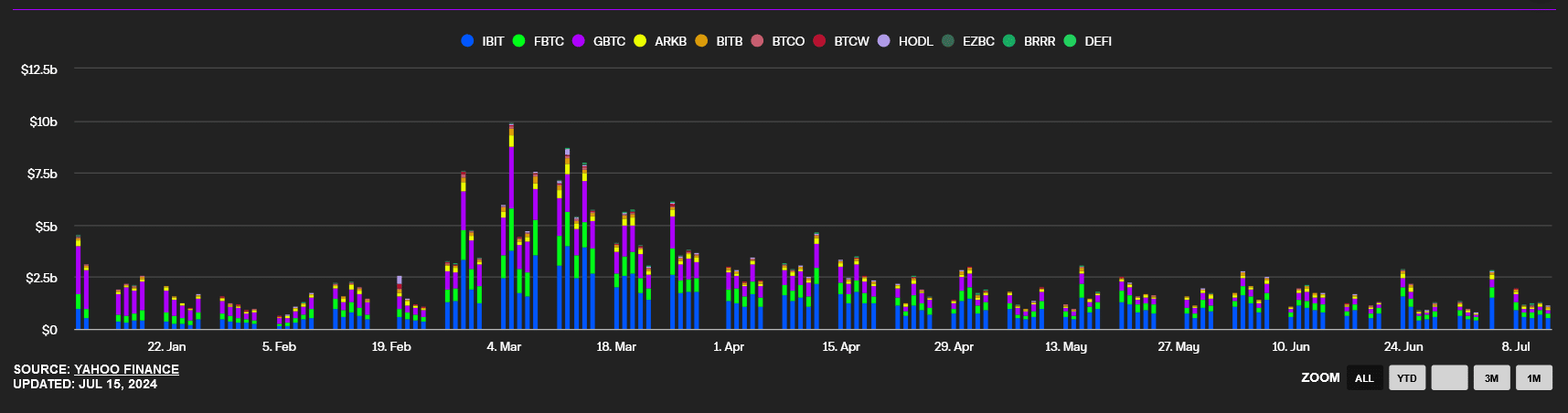

Most market analysts have predicted that the Ether ETFs could attract investment flows from institutional investors, potentially replicating the inflow of spot Bitcoin ETFs observed in the first half of the year.

U.S.-spot Bitcoin ETFs have drawn in $16.12 billion in inflows since their launch earlier this year, data from Farside’s Bitcoin ETF flow table shows.

Read Ethereum’s [ETH] Price Prediction 2024-2025

Worth noting is the fact that the predicted launch date coincides with the week of the 2024 Bitcoin conference at Nashville.

The conference, set for the 25th to the 27th of July, will feature prominent speakers, including MicroStrategy executive chairman Michael Saylor, ARK founder Cathie Wood, independent U.S. Presidential candidate Robert Kennedy Jr, and Republican U.S. presidential candidate Donald Trump.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)