Ethereum ETFs see declining interest: What does it mean for the future?

- Declining on-chain volume in ETH indicates waning interest ahead of ETF verdict.

- A financial institution predicted a delay for Ethereum ETF, but not an outright rejection.

Some major events are due to happen before the end of May. But if there is one that the crypto community places at the top, it is the U.S. SEC’s decision on the numerous Ethereum [ETH] ETF applications.

ETF stands for Exchange Traded Funds. Unlike normal cryptocurrencies like ETH, an Ethereum ETF would only expose investors to the altcoin, not that they would own it directly.

But whether this would come to pass remains a big debate subject. For some, the SEC has no other option than to approve it, since it gave Bitcoin ETFs the green light.

A stumbling block appears

However, others believe that recent developments indicate that the regulator does not share that view. One notable figure that could hinder the Ethereum ETF approval is Gary Gensler.

For some time, Gensler who is the SEC chair, has publicly stated his dislike for the crypto ecosystem. Recently, the SEC served Well Notices to some firms, including Consensys.

A Wells Notice is a formal notice from the SEC written to let a recipient know that the agency is planning to bring enforcement actions against them.

Consensys is a blockchain software company developed to become an Ethereum knowledge center. Since the firm has links with Ethereum, it could be possible that the SEC says a big no to the applications.

However, J.P. Morgan had a contradicting thought to this. While the firm said it does not expect an approval this month, it noted that it won’t be an outright rejection. It explained that,

“Markets do not expect an approval by this month as implied by the significant discount to NAV by the Grayscale Ethereum Trust ETHE.”

The SEC faces a deadline between the 23rd and 24th of May to decide. However, it seemed that the broader market was skeptical of good news coming out of the development.

Interest in ETH falls

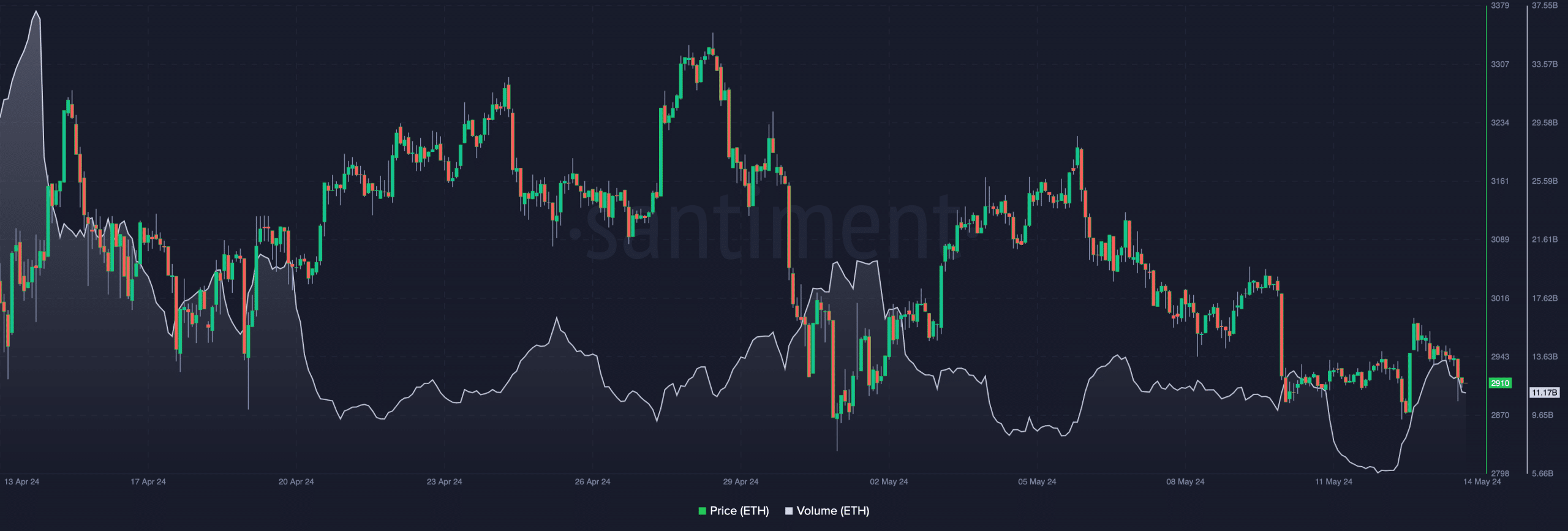

This was evident in the series of outflows from Ethereum investment products which AMBCrypto reported. In terms of the volume, we also assessed the on-chain volume.

As of this writing, the volume was 11.17 billion. This was a significant decrease from the peak in March. Declining volume in ETH is a sign that market participants are losing interest in the altcoin.

If the SEC approves the Ethereum ETF, the price of ETH might also be affected. At press time, ETH’s price was $2,910. A go-ahead could send the cryptocurrency as high as $3,500.

But if this is not the case, the potential decline to $2,700 might come to pass. However, eyes would be on two major applications, which are from VanEck and ARK.

Applicants are closing the loopholes

Previously, ARK and 21 shares, who have a joint application, included staking in their Ethereum ETF filing. But in an amended submission on the 10th of May, they changed it.

The firms had hoped that staking would be included and added it as a feature in February. The rationale for the inclusion was that ETH could have served as part of the company’s income.

But the fact that the SEC still has issues with labeling the cryptocurrency a security or not, left them with no option to be on the safe side. However, this does not imply that the Ethereum ETF would get a nod.

In the meantime, J.P. Morgan also commented on the possibility of a delay.

According to the financial institution, a denial could cause a lawsuit, like the way Grayscale took the regulator to court before the Bitcoin ETFs were approved.

Read Ethereum’s [ETH] Price Prediction 2024-2025

This is because Grayscale had also applied to convert its Ethereum Trust to an ETF. The viewpoint read,

“The template is likely to be similar to bitcoin: with futures-based Ethereum ETFs already approved, the SEC ( if it denies the approval of spot Ethereum ETFs) is likely to face a legal challenge and eventually lose”

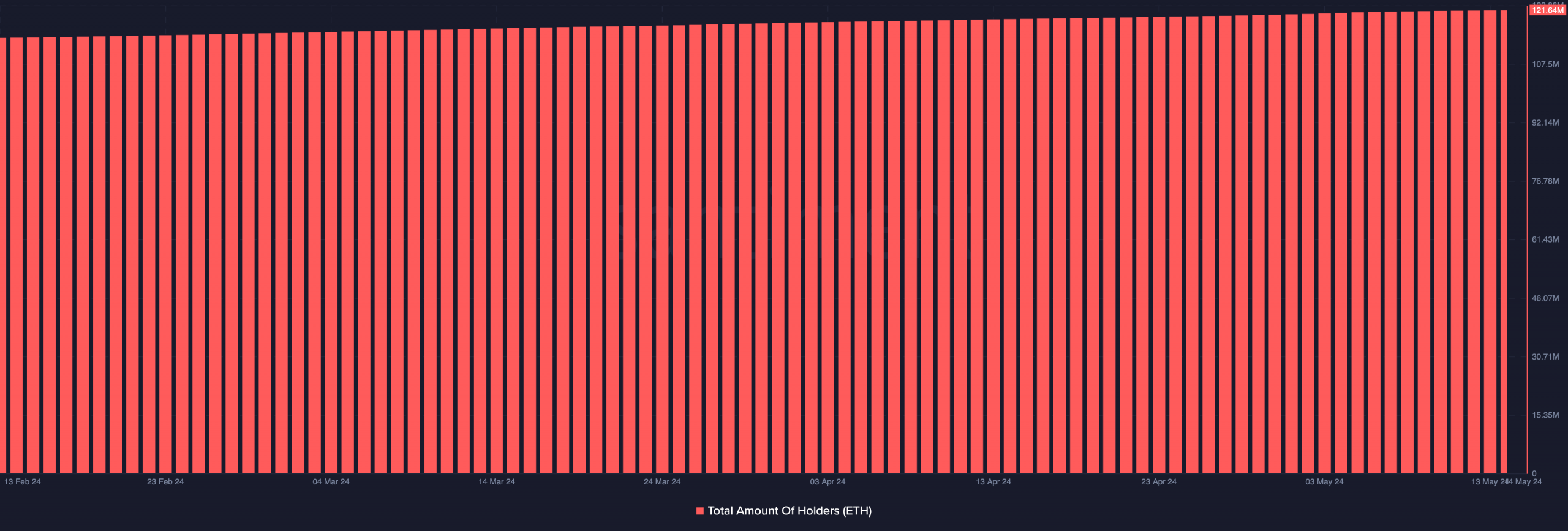

Despite the anticipated verdict, the number of ETH holders has been increasing. According to Santiment, the total amount of participants holding ETH was over 12o million.