Ethereum ETFs approved! ETH prices to hike by 28% now?

- The U.S. SEC has approved all the applications for ETH spot ETF filed before it.

- This approval has come with a series of anticipated impacts on the broader cryptocurrency market.

In a surprising turn of events, the U.S. Securities and Exchange Commission (SEC) approved eight applications for spot Ethereum [ETH] exchange-traded funds (ETFs) on 23rd May.

The regulator approved 19b-4 forms for the ETF applications filed by BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

Before this week, it appeared that the SEC was unlikely to approve the Ethereum ETFs due to a lack of communication with issuers. However, this changed earlier this week when the SEC began engaging with issuers and requested the submission of 19b-4 forms.

This approval does not, however, mean that spot ETH ETF will immediately become tradable. In a post on X (formerly Twitter), Bloomberg ETF expert James Seyffart noted that ETF issuers must get their S-1 forms approved.

On the timeline for this, Seyffart said:

“Typically, this process takes months. Like up to 5 months in some examples, but Eric Balchunas and I think this will be at least somewhat accelerated. Bitcoin ETFs were at least 90 days. “

Now that Ethereum ETF has been approved…

Just like with Bitcoin [BTC] spot ETF, the approval of ETH ETF is expected to lead to substantial capital inflows.

According to a Citi analysis, net inflows into BTC spot ETFs totaled $13 billion between 4th January, when they were approved, and 20th May.

These inflows led to a surge in BTC’s price, pushing it to a new all-time high of $73,750 by 14th March. This suggested that the coin recorded a 6% price increase per $1 billion inflow.

If similar market-cap-adjusted flows are applied to ETH, Citi estimates that inflows could range between $3.8 billion and $4.5 billion, potentially driving ETH prices up by 23%-28%.

According to CoinMarketCap’s data, ETH exchanged hands at $3,798 at press time. A 28% rally in value would cause it to exchange hands at $4,861.

This would represent a price level still below its all-time high of $4,891, which the leading altcoin recorded three years ago.

Some analysts believe that the spot ETF approval will push ETH’s price past its current all-time high.

Ethereum ETF to send ETH to $10,000?

In a recent interview with Cointelegraph, Andrey Stoychev, the head of prime brokerage at Nexo, opined that ETF approvals may push ETH’s price to $10,000 by the end of the year.

Stoychev said,

“ETH ETFs in the USA and similar products in Asia could be the driver that helps the asset reach $10,000 by end-2024, catching up with Bitcoin’s performance post-ETF.”

Further, there is an ongoing debate about whether ETH spot ETF approval would result in an uptick in staking rewards on the Ethereum network.

According to Matthew Sigel, the head of Digital Assets at VanEck, yields across staking protocols will soar as ETH moves from these protocols into these ETFs.

However, this shift could have security implications for the broader Ethereum ecosystem. If ETH stakers continue to withdraw their previously staked coins and move them to the newly approved ETFs, it could weaken the security of the Ethereum network.

Security on the Ethereum network relies on staked coins. Less staked ETH could mean fewer validators securing the network, making it more vulnerable to attacks.

On the other hand, some believe that this would not be a non-issue, arguing that ETH ETF may not deliver enough returns to investors to entice stakers to move their coins from staking protocols.

In a recently published report, CCData Research noted:

“Hypothetically, if you had opened a 1000 ETH position on January 1st, 2023, with an ETF provider, instead of holding native Ether, which accrues staking rewards, you would have missed out on gains of over $200,000.”

Regarding the impact of this approval on the general cryptocurrency market, broker, Bernstein, in a recent report it sent to its client, had opined that the Biden administration might adopt a more lenient attitude towards crypto in anticipation of the November Presidential Elections.

Hence, the regulator’s approval of the ETH spot ETF signifies a positive shift in its stance on the crypto sector.

Is your portfolio green? Check out the ETH Profit Calculator

The market in the past 24 hours

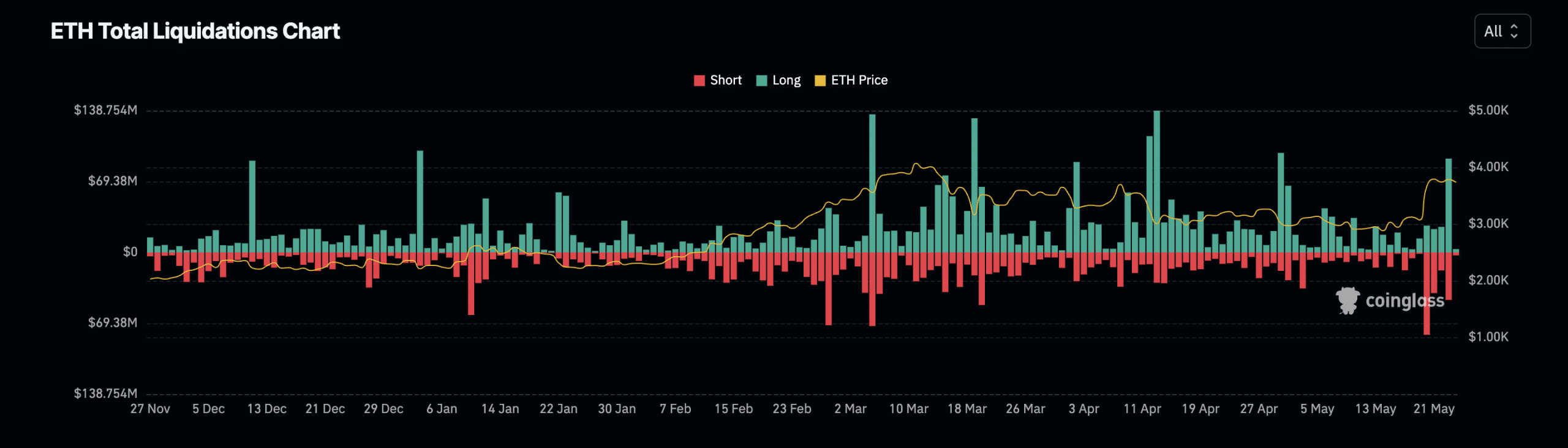

After the news of the approval broke, ETH’s price climbed to a high of $3993 before witnessing a 5% correction, causing it to exchange hands at $3,798 at press time.

This price plunge led to significant liquidations of long ETH positions, totaling $92 million, according to Coinglass data.