Ethereum ETFs are here! Everything to know before you start trading

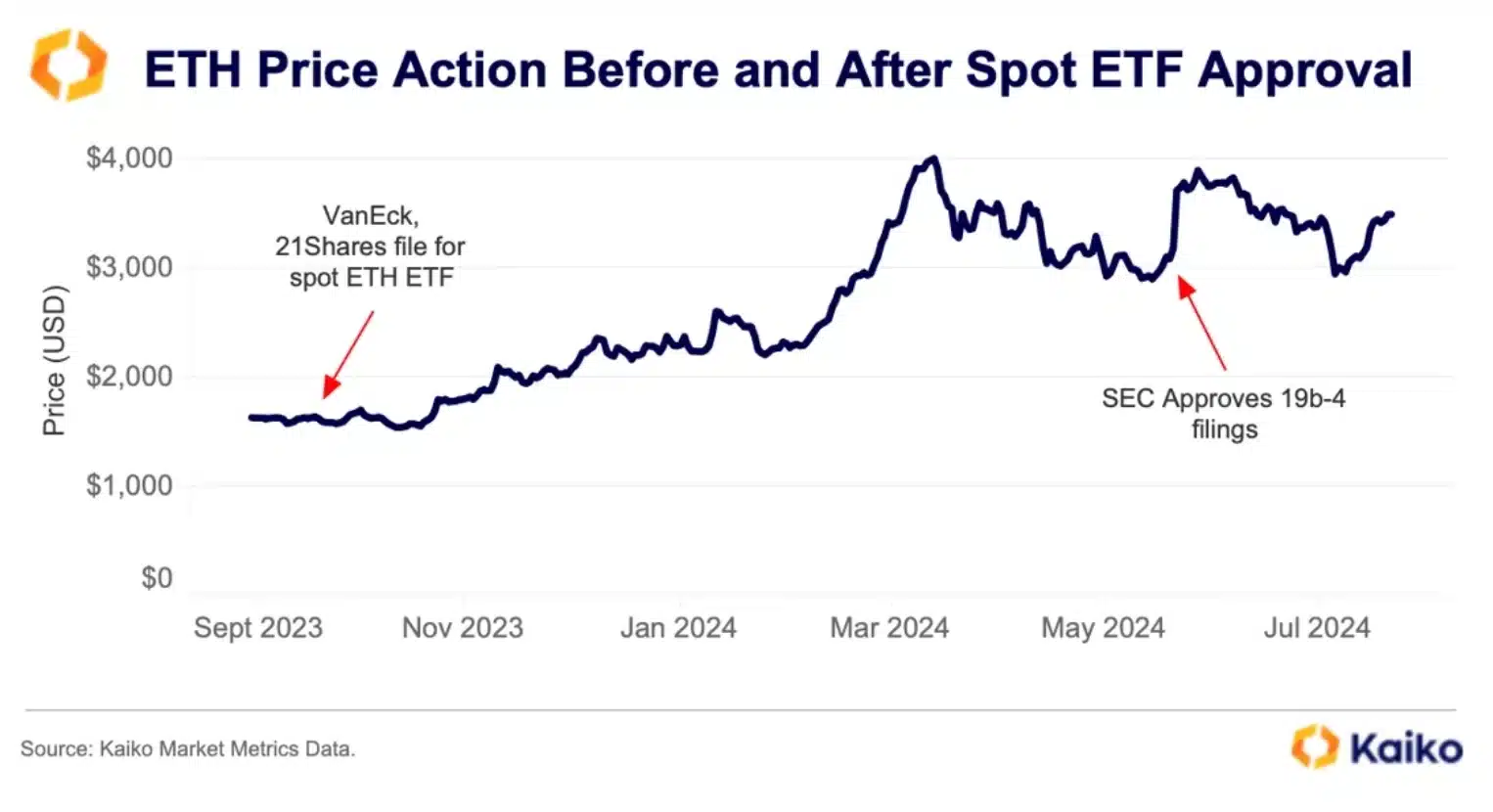

- Spot Ethereum ETFs were approved for trading on 23rd July.

- Despite ETH’s sluggish performance at press time, bullish momentum persists.

After much anticipation and several rounds of revisions, the spot Ethereum [ETH] ETF has finally received full and final approval to commence trading in the United States on 23rd July.

SEC greenlights spot Ethereum ETFs

The Securities and Exchange Commission (SEC) has given the green light to ETH ETFs from firms including BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy.

This approval follows the SEC’s final endorsement of their S-1 registration statements on 22nd July, allowing these ETFs to launch on prominent stock exchanges, including the Nasdaq, New York Stock Exchange, and Chicago Board Options Exchange.

This occurred just a day after President Joe Biden announced his withdrawal from the upcoming election.

ETH’s reaction to be delayed?

However, this news did not have a big impact on Ether’s price at press time.

At the time of writing, ETH was up by just over 1% in the past 24 hours, trading at $3,521 as per CoinMarketCap. Despite this slow performance, investor sentiment remains optimistic.

Encouraging investors to stay strong crypto analyst RunnerXBT said,

“Babe don’t leave, ETH ETF inflows will be better than expected.”

Kaiko’s market prediction

However, Crypto analytics firm Kaiko estimates that ETH price will rise no more than 24% by the end of the year due to underwhelming demand for the spot ETH products.

It is important to note that the Kaiko research was conducted before President Biden’s decision to withdraw from the election.

Remarking on the same, Kaiko’s head of indices Will Cai added,

“The launch of the futures based ETH ETFs in the US late last year was met with underwhelming demand, all eyes are on the spot ETFs’ launch with high hopes on quick asset accumulation. Although a full demand picture may not emerge for several months, ETH price could be sensitive to inflow numbers of the first days.”

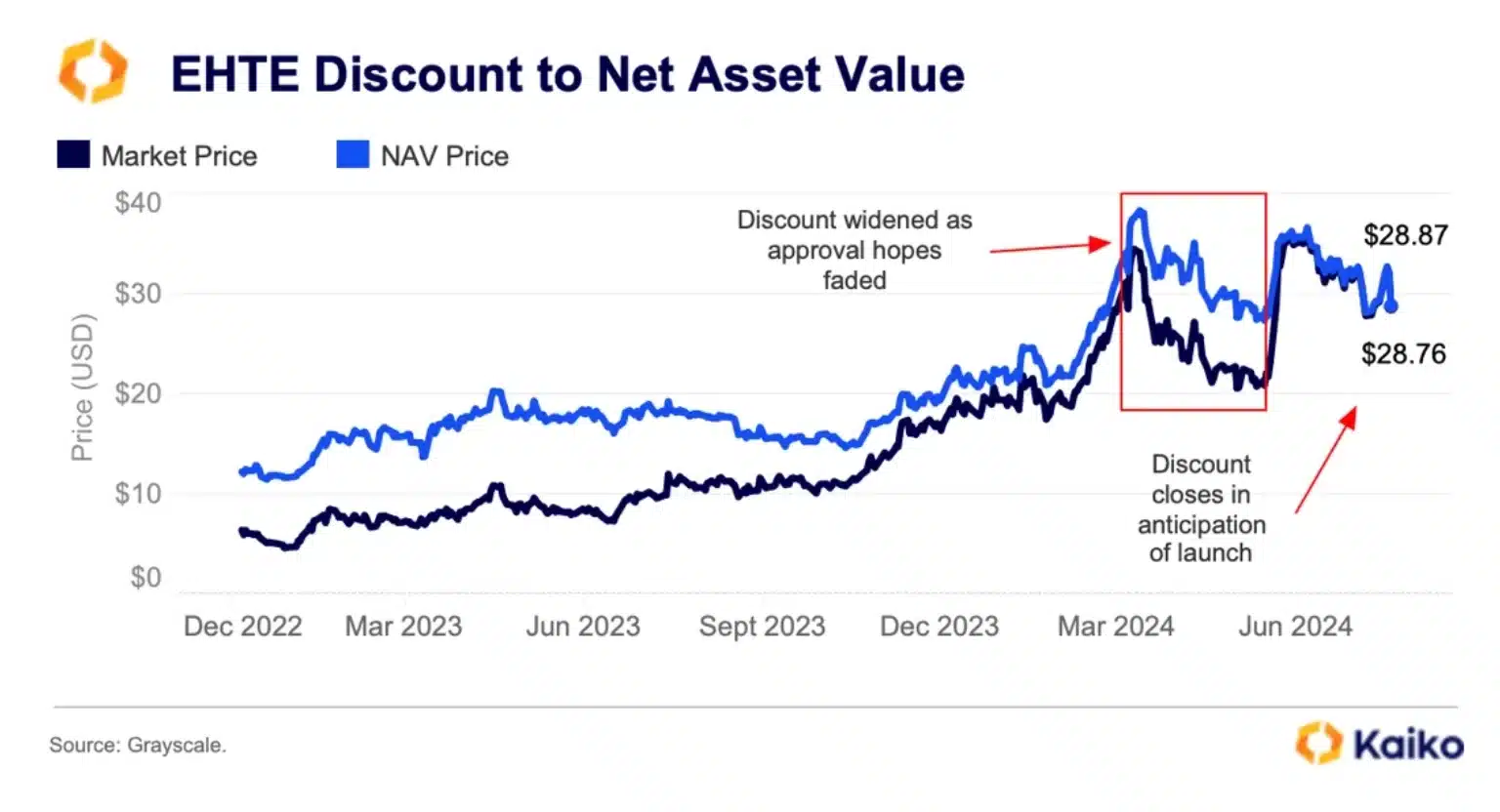

Additionally, Kaiko also analyzed how the approval of spot ETH ETFs is expected to significantly impact the Grayscale Ethereum Trust (ETHE) and its price dynamics.

One notable effect will be the potential outflows from ETHE as investors will shift their funds to the newly launched spot ETFs.

Before the launch, ETHE shares’ discount to NAV narrowed, indicating they were trading closer to their true value. As ETHE transitions to a spot ETF on 23rd July, it will become more liquid, prompting many investors to sell.

This shift, along with the narrowing discount, suggests traders are ready to cash out at full NAV prices, realizing profits.

In conclusion, AMBCrypto’s technical analysis of ETH, including indicators like RSI and CMF, indicates that bullish momentum continues to outpace bearish pressure.