Ethereum ETFs: Time to revamp your ETH strategy before May?

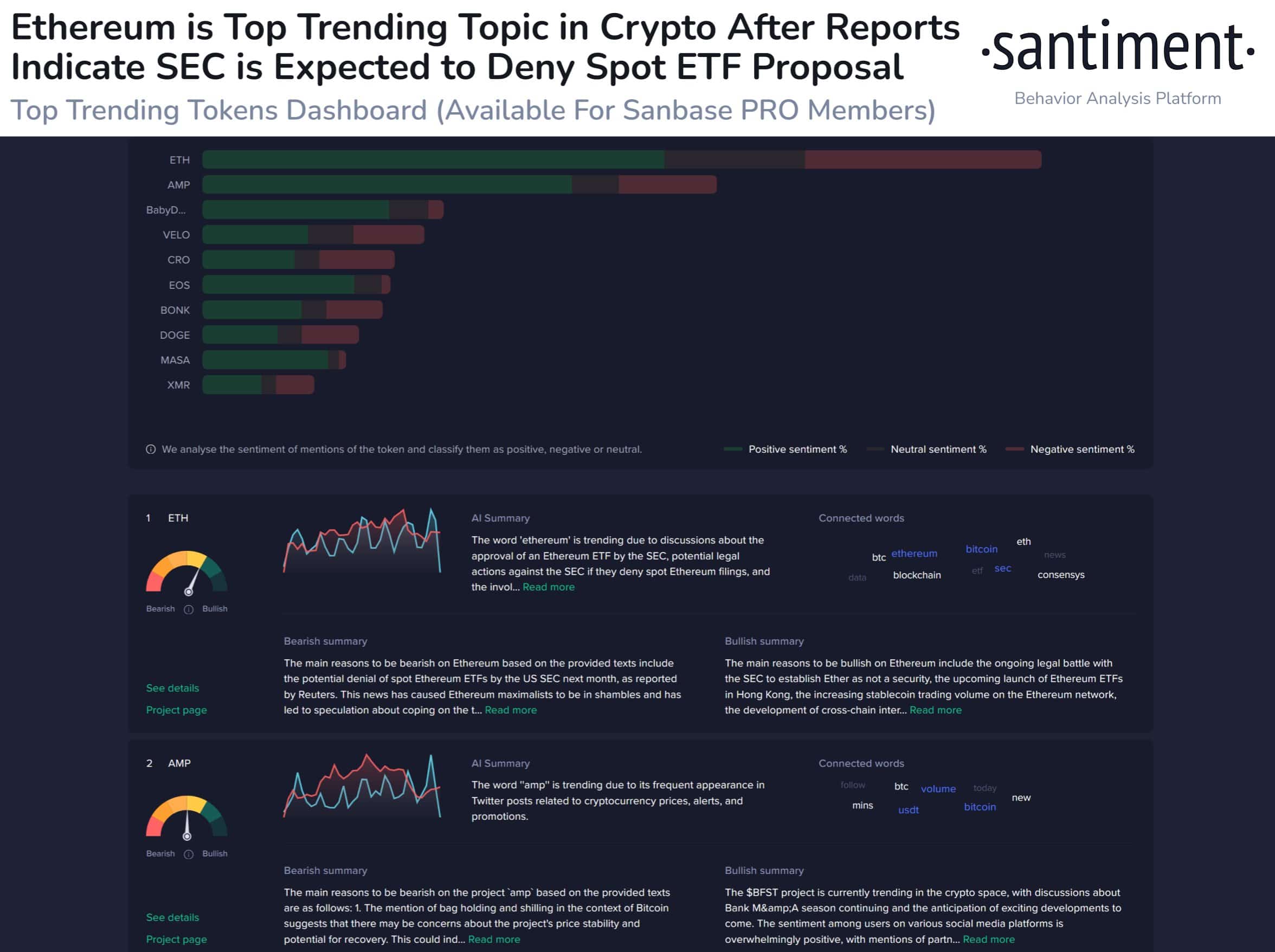

- Cynicism around Ethereum grew on social media due to the expectation of the rejection of Ethereum’s spot ETF.

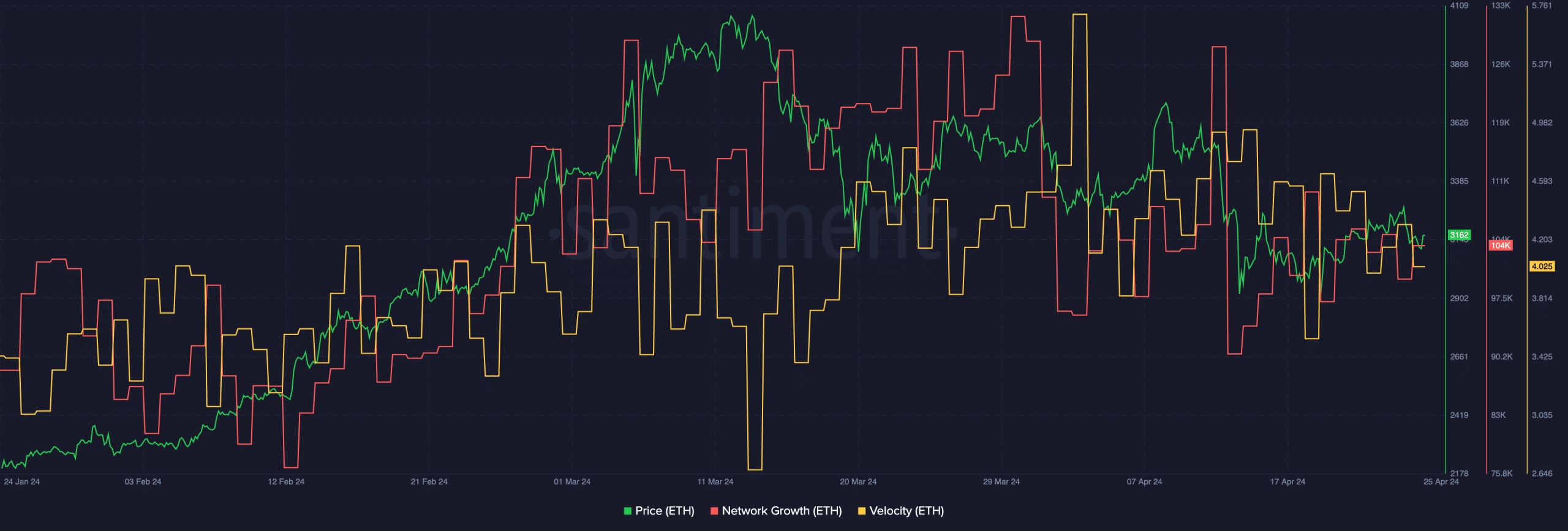

- Price movement of ETH remained stable, and velocity and network growth remained the same.

Ethereum [ETH] has been struggling around the $3,100 to $3,200 mark over the last few weeks after its recent crash.

Word on the street

Despite these factors social activity around Ethereum grew, but not all of it comprised of positive discussions.

Santiment’s data indicated that traders were focusing on recent reports which suggested that the SEC may reject proposals for spot Ethereum ETFs in May.

Much of the community believes that the significant increase in cryptocurrency value since mid-October can be attributed to the positive sentiment resulting from the approval of spot Bitcoin ETFs in January.

However, current indications suggest that the SEC may not be ready to approve other assets at this time.

As regularly observed, historical data suggests that prices often move counter to popular expectations. Increasing fear, uncertainty, and doubt (FUD) due to trader impatience could actually benefit non-Bitcoin assets.

There has already been a notable increase in bearish sentiments among traders, as most assets have retraced considerably since Bitcoin’s all-time high on 14th April. Therefore, there is a higher likelihood of relief bounces occurring in the next week.

While a softened stance or a surprise approval could initially boost Ethereum’s value, overly eager traders’ fear of missing out may lead to a mid-term drop, providing opportunities for large holders to lower prices.

Regardless, if mainstream sentiment is selling the rumor, there historically tends to be a justification for buying the news.

What’s next for ETH?

At press time ETH was trading at $3,151.30 and its price had fallen by 0.35% in the last 24 hours. The volume at which it was trading at had also fallen by 4.04% during the same period.

The network growth had moved sideways over the last few days, implying that new addresses weren’t particularly showing interest in ETH at the time of writing.

Read Ethereum’s [ETH] Price Prediction 2024-25

The velocity at which ETH was trading was also moving sideways indicating that the frequency at which ETH was being traded at had remained stagnant.

The network growth and velocity moving sideways suggest that there may not be any significant fluctuations in price in the near short term for ETH.

![Why Jupiter [JUP] could drop to $0.41: Analyzing price action](https://ambcrypto.com/wp-content/uploads/2025/03/Editors-25-400x240.webp)