Ethereum [ETH]: As ARR for stakers rises, will the network reap benefits

- The ARR for ETH staking reached new highs.

- ETH’s price declined, along with selling pressure.

After the Shanghai Upgrade, Ethereum’s [ETH] prices faced some volatility for a short period. However, the overall interest surrounding ETH staking grew as withdrawals came into the picture.

Is your portfolio green? Check out the Ethereum Profit Calculator

ARR stakers ready for this?

It appears that the interest in ETH staking will not be decreasing any time soon. According to Token Unlock’s data, the present annualized rate of return (ARR) for ETH staking stood at 8.6%, representing a historical peak. This implies that ETH stakers will soon earn higher returns on their staked assets.

This may encourage more users to stake their ETH, which could lead to further network growth and increased positive sentiment.

Furthermore, ETH 2.0 contracts observed a deposit of 3.4 million ETH and a withdrawal of 2.67 million ETH, resulting in a net commitment of 734.92k ETH (equivalent to $1.4 billion). The influx of ETH deposits and net pledges of ETH into the ETH2.0 contracts could be seen as a sign of confidence in the Ethereum network and its potential for growth.

The total value of these ETH2.0 deposits has reached an all-time high, according to Glassnode.

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 20,772,057 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/rzck7Bcx2Z

— glassnode alerts (@glassnodealerts) May 14, 2023

The high number of deposits on ETH2.0 contracts means that there is a lot of staking activity happening on the network, which could be beneficial for validators as they earn rewards for securing the network and processing transactions.

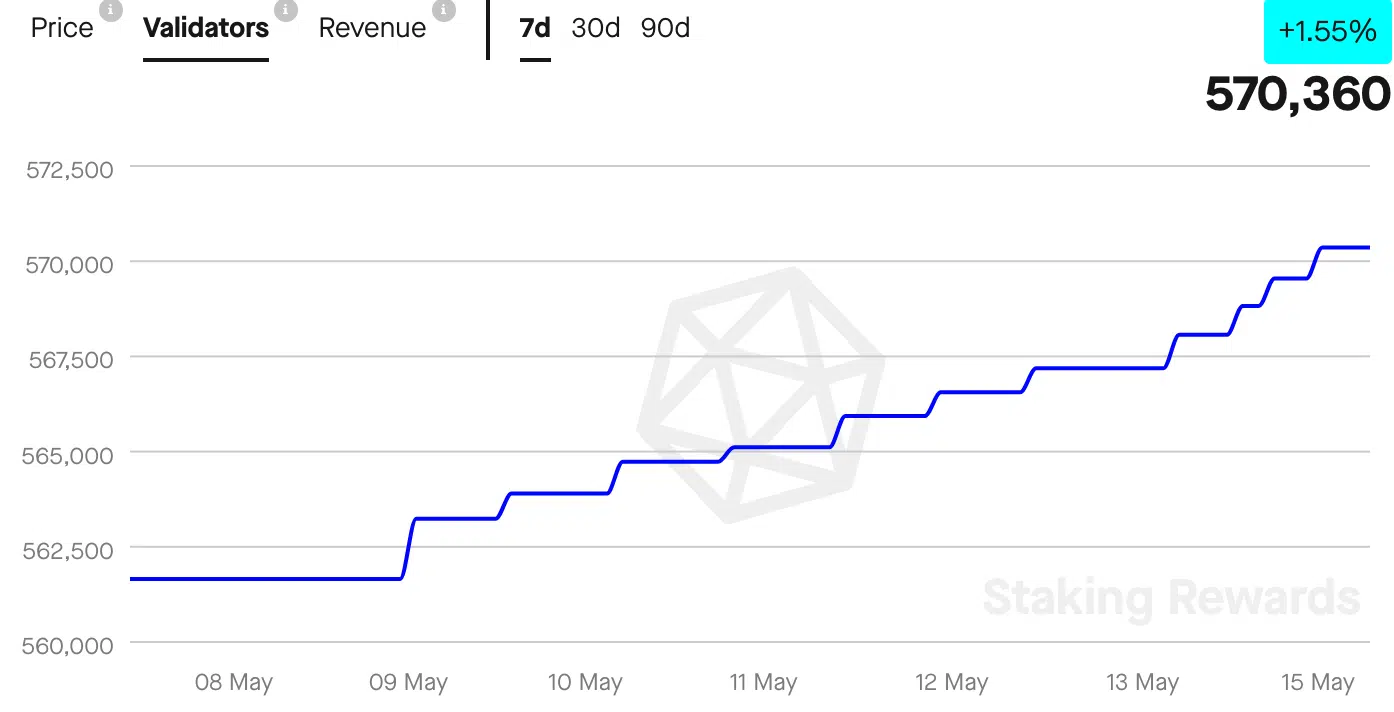

As of the time of writing, the count of validators on the Ethereum network was 570,360, representing a 1.55% rise over the last week.

What should ETH holders do?

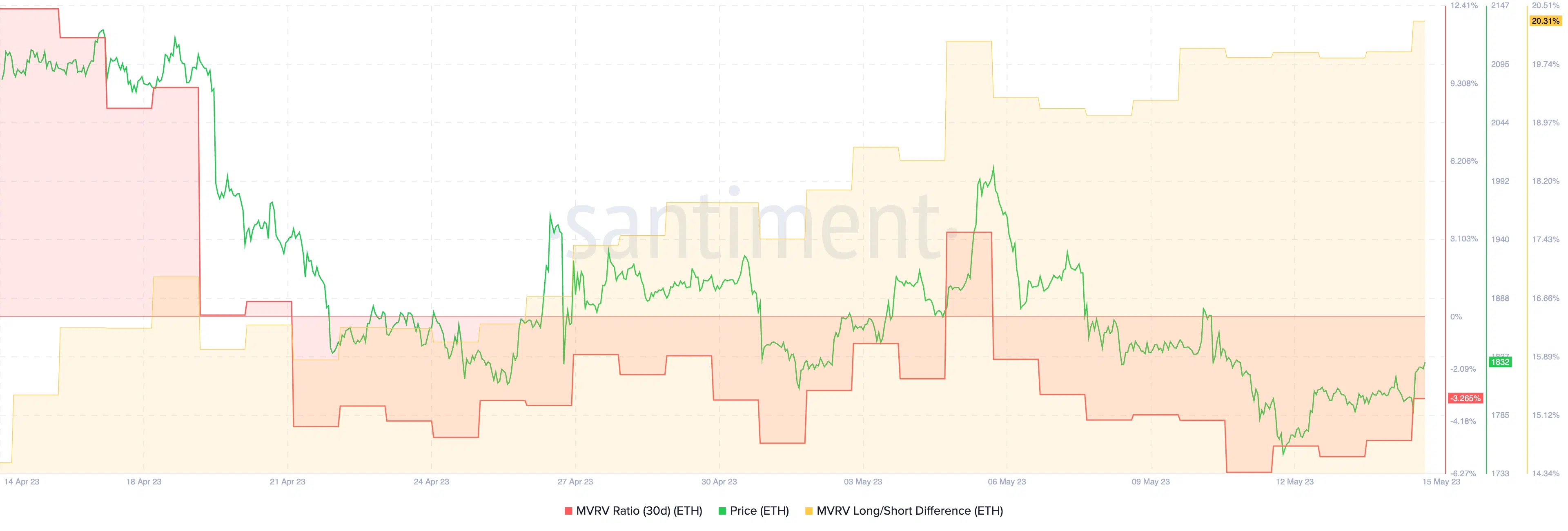

The enthusiasm exhibited towards staking Ethereum did not translate to the same level of interest in buying the cryptocurrency. In the past month, the value of ETH has experienced a significant decrease from $2088.14 to $1826.24.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Along with the decline in prices, the MVRV ratio of ETH also fell. This indicated that there was lesser selling pressure on ETH holders, as most of their holdings weren’t profitable. Another sign that suggested that addresses won’t be exiting their positions further would be the increasing Long/Short difference.

A positive Long/Short difference suggested that most addresses holding their ETH were long-term holders who were unlikely to sell their holdings.