Ethereum [ETH] becomes traders’ current favorite because of this reason

![Ethereum [ETH] becomes traders' current favorite because of this reason](https://ambcrypto.com/wp-content/uploads/2023/03/AMBCrypto_The_image_depicts_a_group_of_people_standing_in_a_cir_51b62fc5-49a5-4ef3-a744-aae01bcc51e4-e1679565904927.png)

- Ethereum traders issue large call options on ETH despite expected uncertainty as the Shanghai Upgrade inches closer.

- Whales begin to show interest, however, velocity and network growth start to decline.

As the Shanghai Upgrade inches closer, expectations regarding ETH’s volatility have been on the rise. However, it has recently been reported that traders have started to show positive interest in Ethereum.

Realistic or not, here’s ETH market cap in BTC’s terms

Making some “calls”

This was indicated through recent data which suggested that the overall number of traders buying call options on ETH started to rise. Over 20,000 block call options were traded at press time. Thus, suggesting that many traders were making bullish bets on ETH.

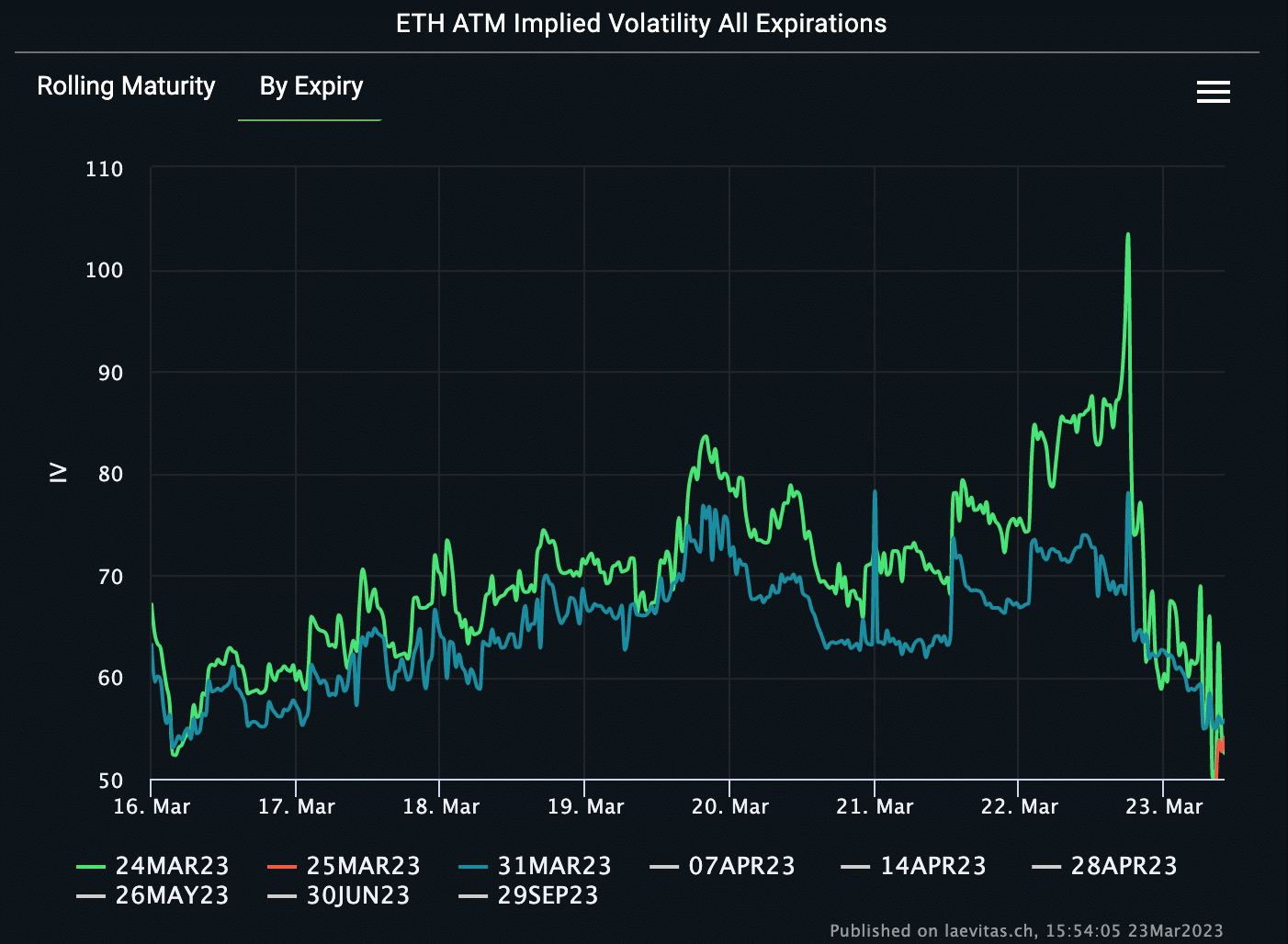

One of the reasons for the same would be the massive decline in Implied Volatility for ETH.

Implied volatility is a measure of the expected volatility of an underlying asset.

A sharp drop in implied volatility for ETH suggests that the market no longer expects the price of ETH to be very volatile in the near future.

This underlines the fact that the market is becoming more stable and less uncertain despite the upcoming Shanghai Upgrade.

More profits more problems

But the interest in ETH wasn’t just reserved for traders, new addresses started to join the Ethereum network and reached an all-time high of 95.89 million addresses according to glassnode’s data.

Notably, a large number of addresses on the Ethereum network were unprofitable in the past, however, many of them have now become profitable.

This may lead to an increase in selling pressure on ETH. Those with high profir may have greater incentives to sell their holdings.

? #Ethereum $ETH Number of Addresses in Loss (7d MA) just reached a 7-month low of 32,559,530.500

View metric:https://t.co/eTr2V1rqmQ pic.twitter.com/CyDeTGSWCd

— glassnode alerts (@glassnodealerts) March 22, 2023

Well, one factor that would offset this selling pressure would be when the Ethereum being held on the beacon chain gets unstaked after the Shanghai Upgrade.

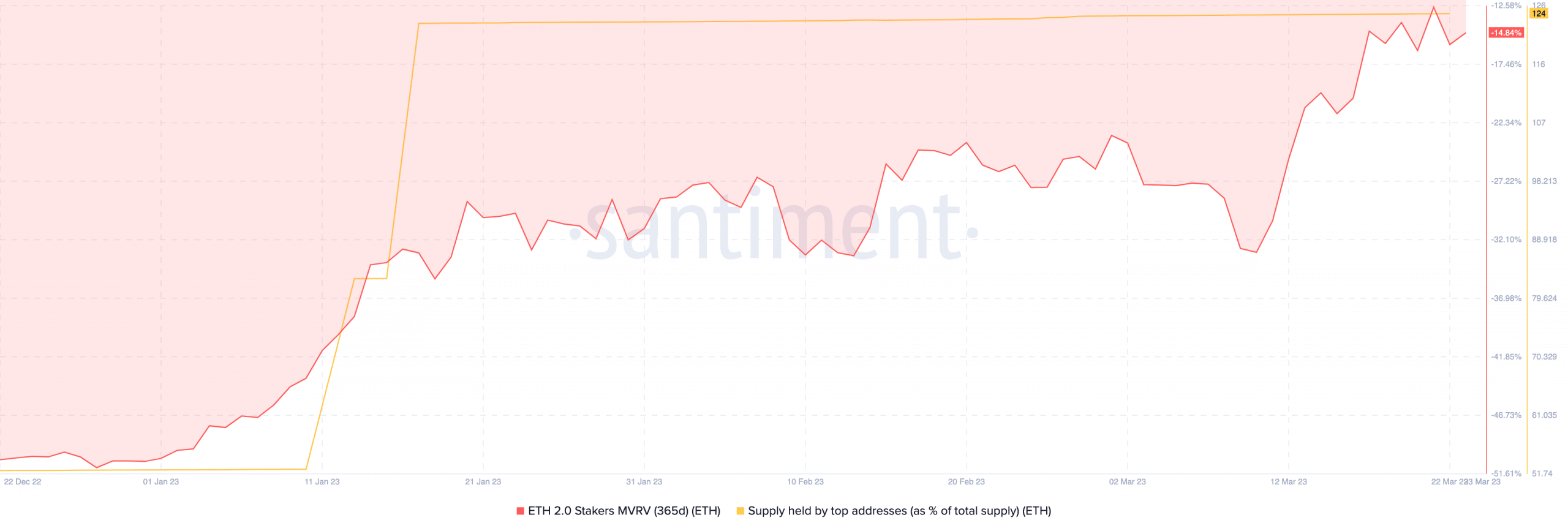

According to Santiment’s data, a large amount of the ETH staked on the beacon chain is still unprofitable.

Read ETH’s Price Prediction 2023-2024

When the respective addresses get a hold of their ETH, they are unlikely to sell their holdings. In fact, these addresses might HODL for a longer period of time before they decide to exit.