Ethereum [ETH] bulls secure $1800 support – Are shorting gains limited?

![Ethereum [ETH] bulls secure $1800 support - Are shorting gains limited?](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-22.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- There was mild bullish momentum at press time

- Elevated short-term selling pressure persists post-Fed rate hike

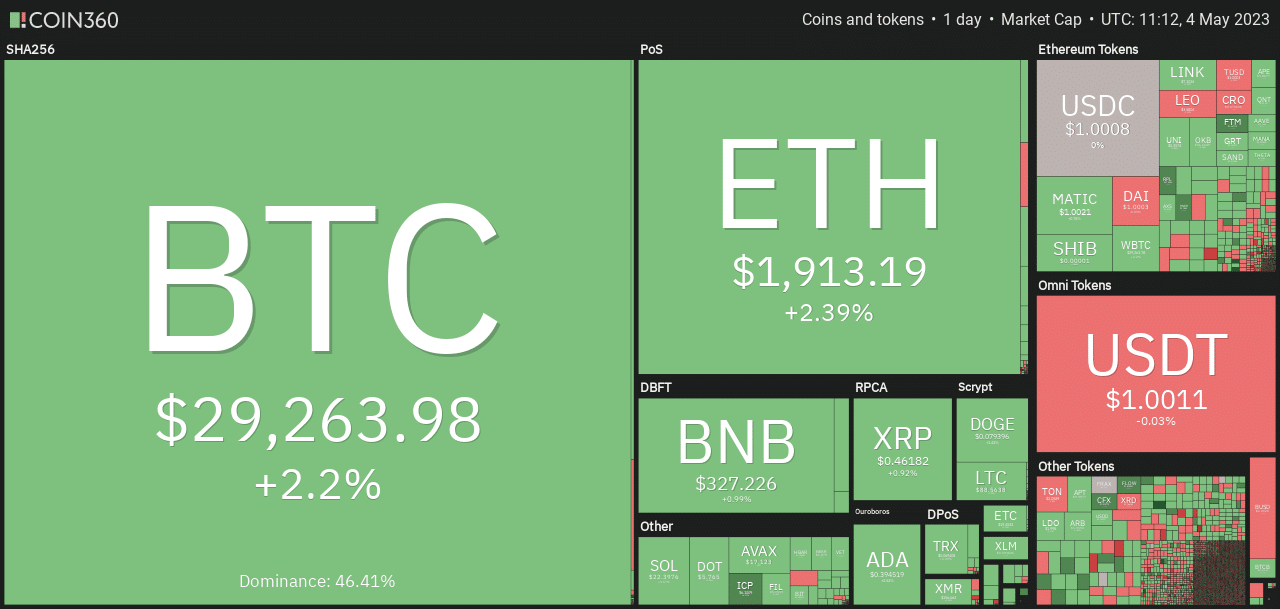

Ethereum [ETH] edged higher at press time, posting over 2% gains in the past 24 hours. It traded at $1,913. The mild bullish momentum followed Bitcoin’s [BTC] reclaiming of the $29k price zone.

Is your portfolio green? Check ETH Profit Calculator

An analysis of the state of digital asset investment products revealed that BTC and ETH saw more net outflows last week (24-30 April). In particular, ETH’s outflows totalled $19 million – The highest since the Merge in September 2022.

Will the net outflows dent the mild bullish momentum seen at press time?

Bulls defended the $1800-support

The $1800-level has been strong support in April. Near-term bulls defended it in late April and repeated it on 2 May. At press time, the price action was slightly above 50-EMA and 200-EMA – Confirming the mild bullish momentum.

If the $1,800 support continues to hold, it will be a sign of bullish momentum that could tip the ETH/USDT pair to retest the recent price ceiling at $2100. However, the 50-EMA and 200-EMA moved sideways on the 4-hour chart and could suggest a likely consolidation above $1800.

On the downside, a crack below the $1,800-support will show a weakening structure. Such a move could see sellers sink the altcoin to $1,500. Notably, the $1,500-support is a bullish order block on the daily chart that has proved steady since mid-January.

In the meantime, the RSI and OBV climbed higher – Confirming the mild buying pressure in the past few days.

Supply on exchanges surged

How much are 1,10,100 ETHs worth today?

According to Santiment, the supply on exchanges declined between 1 and 3 May. However, at press time, supply on exchanges spiked to 13.1 million ETHs compared to 13.01 million ETHs on 3 May. It reveals an elevated short-term selling pressure.

The spike in exchange inflows also confirms the selling pressure that could undermine the mild bullish momentum seen at press time.

However, funding rates remained positive over the same period. It reveals steady demand that could boost near-term bulls only if the overall market sentiment improves after the Fed rate hike.