Ethereum [ETH] declines on this front; the reason will not surprise you

![Ethereum [ETH] declines on this front; the reason will not surprise you](https://ambcrypto.com/wp-content/uploads/2023/04/DEX.jpg)

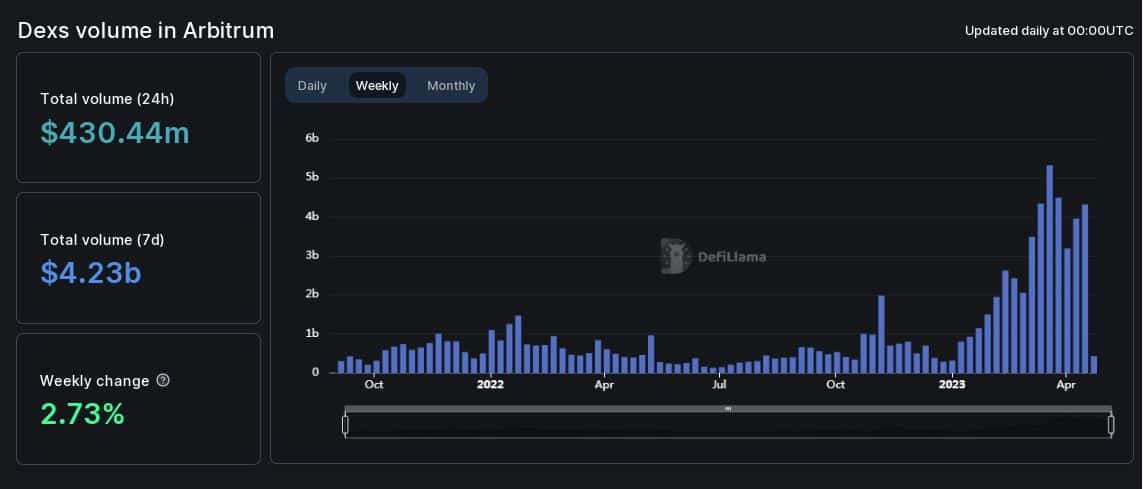

- About $4.23 billion worth of trades were settled on Arbitrum last week, as compared to $8.4 billion on Ethereum.

- The average number of transactions on all L2s has outpaced Ethereum mainnet transactions.

Ethereum’s [ETH] decentralized exchange (DEX) volume dominance on the 90-day moving average fell in April for the first time since the end of 2021, according to a tweet by blockchain analytics firm Messari. This marked a noticeable shift to layer-2 solutions (L2) and other layer-1 chains.

How much are 1,10,100 ETHs worth today?

The share of DEX volume on Ethereum dipped below 70% in April, down from its multi-year peak of nearly 80%, as USD Coin’s [USDC] depegging caused the shake-up of the broader DeFi market.

2/ For the first time since the end of 21', Ethereum’s 90-day moving average for DEX trading volume is beginning to decrease.

Following $USDC's depeg this March, volumes began following previous trends, as users moved to L2s and alt L1s. pic.twitter.com/Ki2qsbeYum

— Messari (@MessariCrypto) April 24, 2023

L2s gain prominence

As per data from DeFiLlama, Ethereum remained the most preferred chain for DEXs with a cumulative trading volume of more than $1 trillion as of this writing. However, the first quarter of 2023 saw growing popularity for scaling solutions like Arbitrum [ARB].

The weekly volume on Arbitrum has been on a steady uptrend since the start of 2023 and reached its zenith at $5.33 billion in March, just before the AirDrop of ARB tokens. About $4.23 billion worth of trades were settled on Arbitrum last week as compared to $8.4 billion on Ethereum, indicating the giant strides the L2 solution was taking.

Some of the other L2s, like Optimism [OP], also saw considerable growth. As of this writing, it was the sixth-largest chain in terms of DEX volume over the last 24 hours. In line with observations made earlier, the volume reached an all-time high of $245.77 million during the depegging of USDC.

Ethereum’s dominance to diminish further?

With the launch of more rollups like zkSync Era and Polygon [MATIC] zkEVM, interest in scaling solutions has never been higher. Messari research analyst Chase Devens opined that DeFi activities moving to L2s may signal the start of a long-term trend as customers enjoy cheaper costs and faster transactions without sacrificing security.

April marked the first time since the end of 2021 that Ethereum's DEX volume dominance has declined on the 90D moving average.

Expecting this to be the beginning of a long-term trend – unlike the 2022 flight away from alt L1s, there's no need for DEX activities to return to… pic.twitter.com/OhSFeI31ur

— Chase (@chasedevens) April 24, 2023

Is your portfolio green? Check out the Arbitrum Profit Calculator

The idea was backed up by data from L2Beat, which showed that after remaining neck-and-neck for the most part of 2023, the average number of transactions on all L2s has outpaced Ethereum mainnet transactions. At press time, L2s processed 31 transactions per second on average, compared to Ethereum’s 10 per second.

There was relief in terms of transaction fees as well. As per L2 Fees, investors required just $0.10 to send ETH on Arbitrum One, $0.27 on Optimism and $0.21 on Polygon zkEVM. On the other hand, users would have to pay $1.19 to send ETH on mainnet and nearly $6 to swap tokens.