Ethereum [ETH]: Decoding the possibility of a price correction as failed transactions surge

![Ethereum [ETH]: Decoding the possibility of a price correction as failed transactions surge](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_graph_depicting_Ethereums_price_fluctuations_over_t_d50bd42c-4085-42ce-b16a-4f5de41a9cff.jpg)

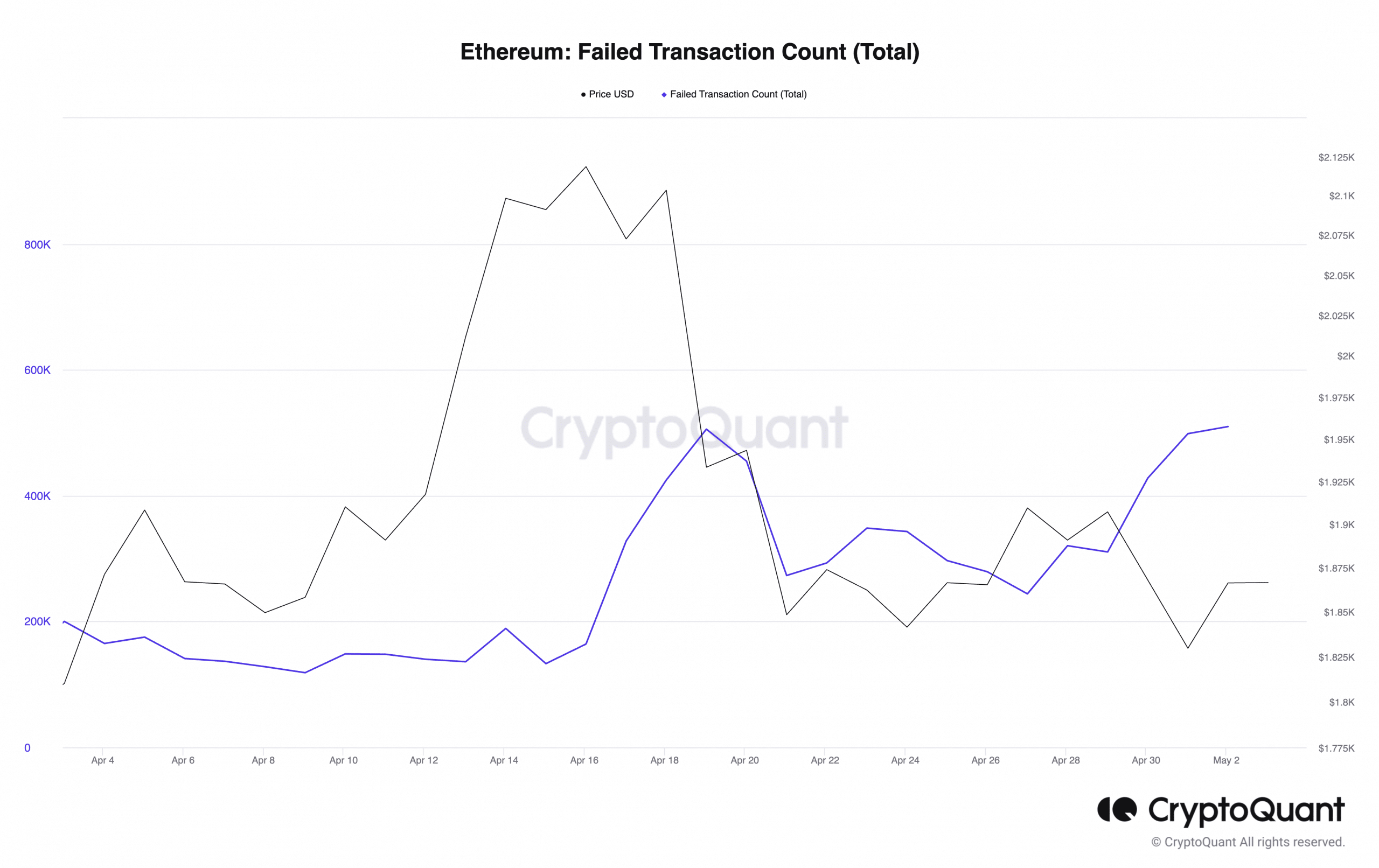

- The total number of failed Ethereum transactions exceeded 500,000.

- ETH’s price craters as network activity experienced a dip.

According to data from CryptoQuant, there was a significant surge in the total number of failed Ethereum[ETH] transactions, reaching over 500,000 as of 2 May.

How much are 1,10,100 ETHs worth today?

Taking a cue from ETH’s historical performance, pseudonymous CryptoQuant Analyst MACD, found an interesting fact. Whenever the total count of failed ETH transactions exceeded 200,000, it indicated “market overheating” and was often followed by price corrections.

“In the past, when Ethereum’s transaction failures rise above 200,000, it shows a market overheating and has often seen a price correction.”

To brace for a price correction or not?

In the last month, ETH’s price oscillated between $2100 and $1800. At press time, the leading altcoin exchanged hands at $1,869, with a 2% price rally within the past 24 hours, data from CoinMarketCap showed.

On-chain assessment of ETH’s performance revealed a decline in network activity since 14 April. According to Santiment, the count of daily active addresses that have since traded the alt fell by 41%.

Additionally, the number of new addresses created daily on the ETH network has plummeted as well. Information from the on-chain data provider revealed the creation of 12,492 new addresses on the ETH network on 1 May. This represented an 86% drop from the 91,560 new addresses created on 14 April.

With the continued decline in the count of new and active addresses trading ETH, the coin’s value fell from $2100 on 14 April to $1,869 at press time.

In addition to a fall in its network activity, ETH’s funding rates fell to a one-month low of -0.013 on 3 May. When a crypto asset records negative funding rates, it means that most traders in the market are taking short positions or betting against the asset.

As a result, it is often taken as an indicator of bearish sentiment and sometimes precipitates a decline in an asset’s value.

Furthermore, as ETH’s price fell since mid-April, holders of 1000 to 100,000 ETH coins gradually distributed their ETH holdings, contributing to the decline in value, per data from Santiment.

Is your portfolio green? Check the Ethereum Profit Calculator

Interestingly, bigger whales, that hold between 100,000 to 10,000,000 ETH coins, increased their holdings during the same period. However, with bearish sentiments still lingering in the market, this has failed to result in any significant price rally.

At press time, ETH’s Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned beneath their respective neutral spots, in downtrend positions. This indicated waning buying pressure and highlighted the need for new demand to drive up the alt’s value.