Ethereum

Ethereum [ETH] down bad? Scams, gas, DAU plague network – the list goes on

![Ethereum [ETH] down bad? Scams, gas, DAU plague network - the list goes on](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-07T114640.540-1000x600.png)

- The BNB chain DAU was almost three times that of Ethereum

- The altcoin’s TVL input did not match up with a few others in the last 30 days

Despite planning a series of upgrades in 2023, Ethereum [ETH] has not had the best of starts to the year. Bar the altcoin fantastic rally like the rest of the market in January 2023, the network has been full of irregularities and dawdling.

How much are 1,10,100 ETHs worth today?

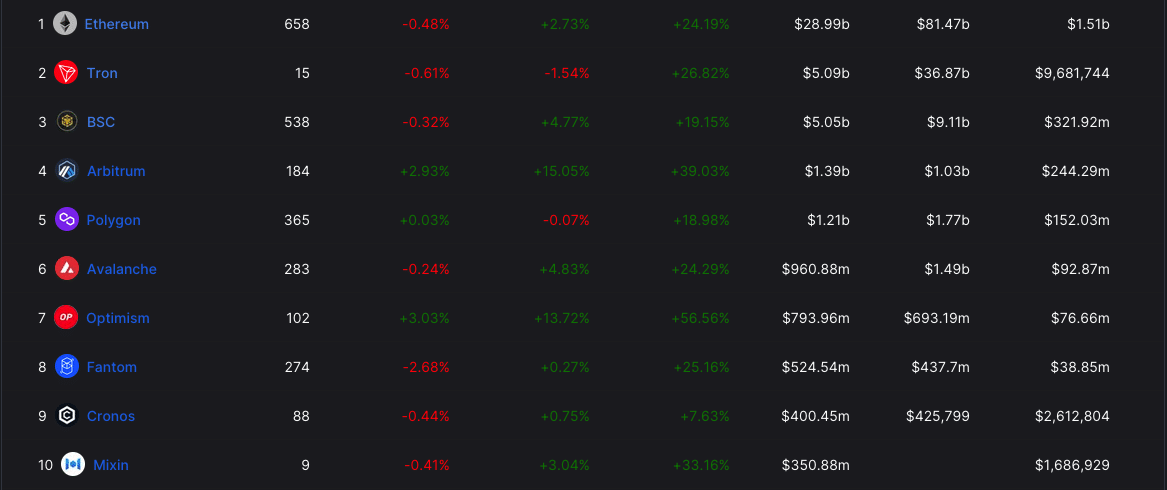

Notably, a fundamental bragging right has been its capability to house several decentralized applications (dApps). This same proficiency is why its DeFi Total Value Locked (TVL) is the highest. At press time, Ethereum’s TVL was valued at $28.99 billion.

Ethereum’s health is at risk as TVL spot is open for…

However, other chains in the DeFi ecosystem seem determined to outperform the second-ranked project in market value.

A noteworthy competitor that has given Ethereum a run for its money is TRON [TRX], the Justin Sun-led project. In the last 30 days, TRON’s TVL increased 26.82% even though it still played second fiddle to Ethereum.

In addition, the trendy Optimism [OP], whose aim is to scale the Ethereum ecosystem by using optimistic rollups, has also outperformed the Ethereum TVL. Despite being far below Ethereum’s worth, OP’s TVL increased 56.56%, according to DeFi Llama.

An interpretation of the above chart means that unique depositors have preferred to pump more liquidity into the above-mentioned chain over Ethereum. Also, the overall health of OP and TRON had become better than Ethereum.

But the blockchain is not the only one at risk. Rather, its users have been the victims of supposedly top contributors to the network. On 7 February, Peckshield Alert tweeted that the top two gas spenders on Ethereum have been scammers all along.

#PeckshieldAlert PeckShield has detected that the Top 2 gas spenders are scammers who conduct 0 token transfers.https://t.co/mrloyWBgEOhttps://t.co/iSSvXq2Afh

Scammers often create fake wallet addresses that resemble their target users' real addresses. pic.twitter.com/tYWg2sxYZe— PeckShieldAlert (@PeckShieldAlert) February 7, 2023

An assessment of both wallets showed that the scammers used fake phishing to lure unsuspecting addresses to use the fake smart contract wallets. The blockchain security firm pointed out,

“Scammers use the ‘transferFrom’ feature to conduct 0 transfers from ANY wallet address via a smart contract, thus making the 0 transfer show up in users’ wallet records & on Etherscan. Innocent individuals may mistakenly use these scam addresses without careful examination.”

While this might mean that Ethereum could find a solution, since the problem has been highlighted, it could further scare investors.

Recently, Ethereum gas prices skyrocketed in unimaginable ways, thus, making transactions more expensive for users. Due to the rise, Ethereum recorded a decline in transaction fees affecting the network’s revenue. This comes after the ETH burn hit the highest in over two months.

Shanghai in sight, but DAU evades the top

These happenings may not be the best for Ethereum, especially as the Shanghai upgrade billed for March, edges closer. With inconsistencies around, stakers might be

concerned about the state of their rewards.But that may not be affected as the developers have repeatedly assured investors that all was in place for the event. Nonetheless, comments from some stakers showed that they were highly positive about the withdrawal resumption.

In particular, Anthony Sassnano, an outspoken Ethereum educator and investor, expressed how bullish he was on the matter.

Staked ETH withdrawals is going to be the most bullish unlock in history

— sassal.eth ?? (@sassal0x) February 6, 2023

However, Etherum lagged behind the Binance- founded BNB Chain in terms of Daily Active Users (DAU). The metric assesses the number of unique users who engage with a network day in, day out.

As of 6 February, the BNB Chain [BNB] led the user metric with 815,500 users, based on Token Terminal data. On the other hand, Ethereum could not match up as its DAU was 344,300 while Polygon [MATIC] was third with 277,100 users on the said date.

Network down bad; Who will save the day?

Per on-chain status, Santiment showed that the ETH network growth was at its lowest in months, at 26,600 during press time. The metric measures the number of unique active addresses on a network and also to evaluate whether a project is gaining traction. Since the network growth has dropped, investors hardly looked in Ethereum’s direction.

Realistic or not, here’s ETH’s market cap in BTC’s terms

This was also evident in the active addresses trend, which trended downward toward the end of January. But since February began, the crowd interaction with Ethereum has flatlined at 5.64 million.

At press time, ETH was exchanging hands at $1,645 — a 4.76% increase in the last seven days. But as thing stands, the Ethereum development team might need to focus on resuscitating the network and improving security as overlooking these aspects may spell doom for the blockchain.