Ethereum [ETH] fared better than SOL, NEAR, AVAX on YTD basis, thanks to…

![Ethereum [ETH] fared better than SOL, NEAR, AVAX on YTD basis, thanks to...](https://ambcrypto.com/wp-content/uploads/2022/12/kanchanara-ffoMzQNvx2s-unsplash-1-e1672212154288.jpg)

- ETH’s price fared considerably better than other layer-1 altcoins this year.

- SOL suffered the most decline in value.

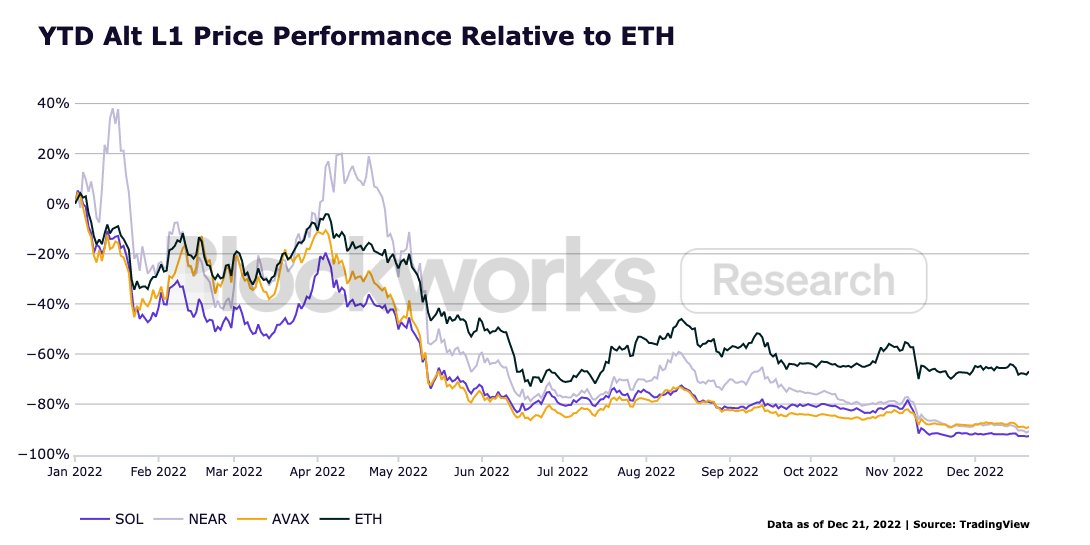

On a year-to-date basis, the price of leading altcoin Ethereum [ETH] fared better than other layer-1 altcoins (Alt L1s), including Solana [SOL], Near [NEAR], and Avalanche [AVAX], a new report revealed.

The cryptocurrency market has experienced a significant downturn in recent months, with a total loss of over $1.4 trillion in value. This decline has been attributed to a range of issues within the industry, including failed projects and a lack of liquidity.

In addition, the fall of FTX, a major player in the market, has also contributed to the overall decline.

Read Ethereum’s [ETH] Price Prediction 2023-2024

According to the report, prior to the transition of Ethereum to a proof-of-stake (POS) consensus mechanism, the spread between ETH and Alt L1s had already begun to widen. This divergence became more significant following the Merge.

ETH and its peers

Exchanging hands at $1,194.62, ETH’s price has fallen by 67% since January, data from CoinMarketCap showed. Of the Alt L1s listed above, SOL has suffered the most decline, with a 94% drop in its value.

The recent controversy surrounding Solana and its ties to disgraced-founder Sam Bankman-Fried has also contributed to a decrease in SOL’s value. In addition, in the past week, the network saw leading NFT projects announce their intentions to migrate to Ethereum and Polygon, all of which have brought Solana’s longevity into question.

As for NEAR, it has lost 90% of its value since the year started. There are, however, a series of upgrades to the Near Protocol in the coming year that many anticipate will lead to a rally in NEAR’s value.

Meanwhile, AVAX traded at $11.24 at press time, having declined by 89% since the year started.

How much Ethereum can you get for $1?

Thanks to PoS

According to the report, ETH fared considerably better than other Alt L1s, primarily due to Ethereum’s successful migration to a PoS consensus mechanism on 15 September.

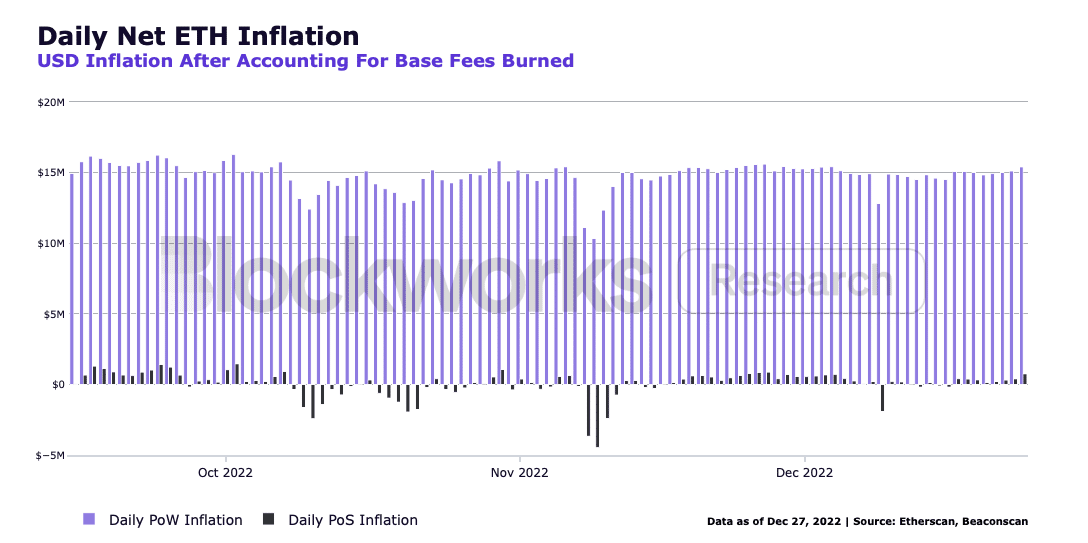

It was noted that the most notable impact of the switch to PoS for Ethereum was the change in ETH’s supply dynamics. After the Merge, ETH’s supply inflated by only 3,800, compared to the 1.2 million inflation that would have occurred if the network had continued to operate under Proof-of-work (PoW) consensus. In this regard, Blockworks Research found,

“In other words, over $1.5B of sell pressure has been removed from the market as a result of the Merge in under just four months,”