Ethereum [ETH]: Large, small holders attempt accumulation and yet…

![Ethereum [ETH]: Large, small holders attempt accumulation and yet...](https://ambcrypto.com/wp-content/uploads/2022/11/ethereum-5511937_1280-e1668064295490.jpg)

- Ethereum sharks and whales ramped up coin accumulation as the market attempted recovery

- Despite the freefall in the alt’s price, holders remain positive

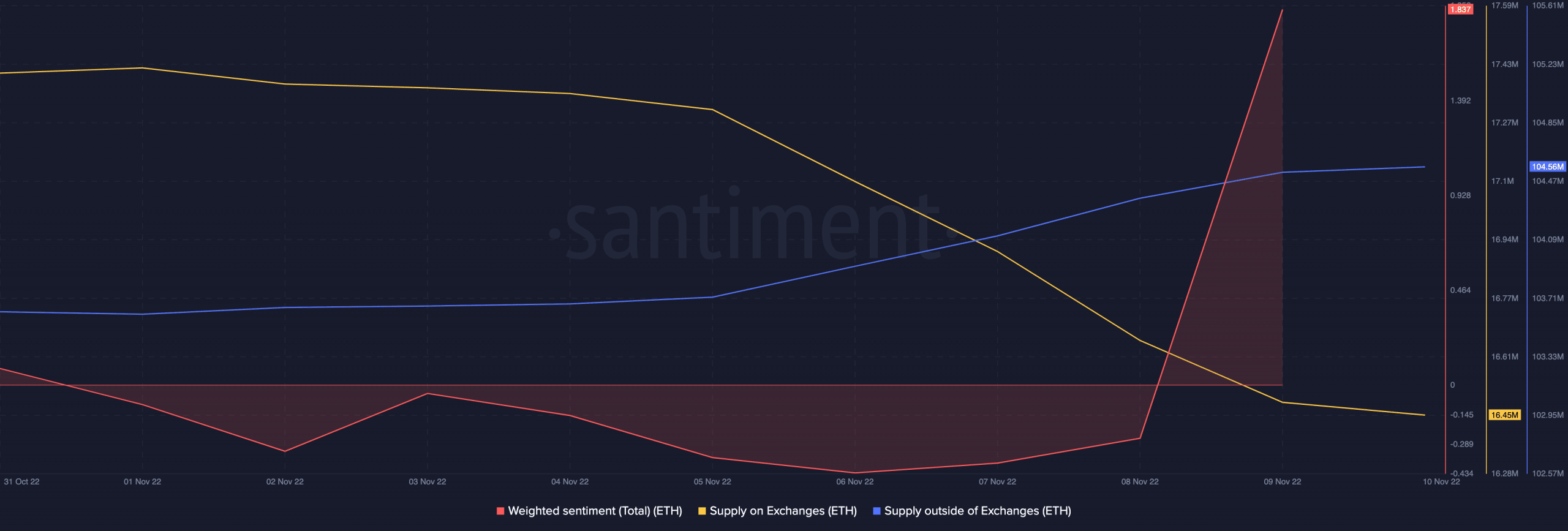

Before Binance confirmed withdrawing its offer to acquire embattled cryptocurrency exchange FTX, Ethereum [ETH] attempted recovery on the charts. During the intraday trading session on 9 November, data from Santiment revealed a surge in ETH accumulation by its whales and sharks.

Read Ethereum’s [ETH] Price Prediction 2023-2024

According to the on-chain analytics platform, as the price of ETH plunged, the cohort of investors holding between 100 to 1 million ETH coins ramped up ETH purchases to accumulate a combined 657, 390 ETH in just one day.

As of 9 November, the whales and sharks that held between 100 to 1 million ETH coins collectively accumulated 0.54% of ETH’s total supply. This percentage represented the largest single-day buys since 5 September, Santiment found.

FUD runs the market

While the surge in accumulation by this cohort of investors is often enough to initiate a price rally, the state of the general cryptocurrency market has made any such hike in ETH’s price impossible.

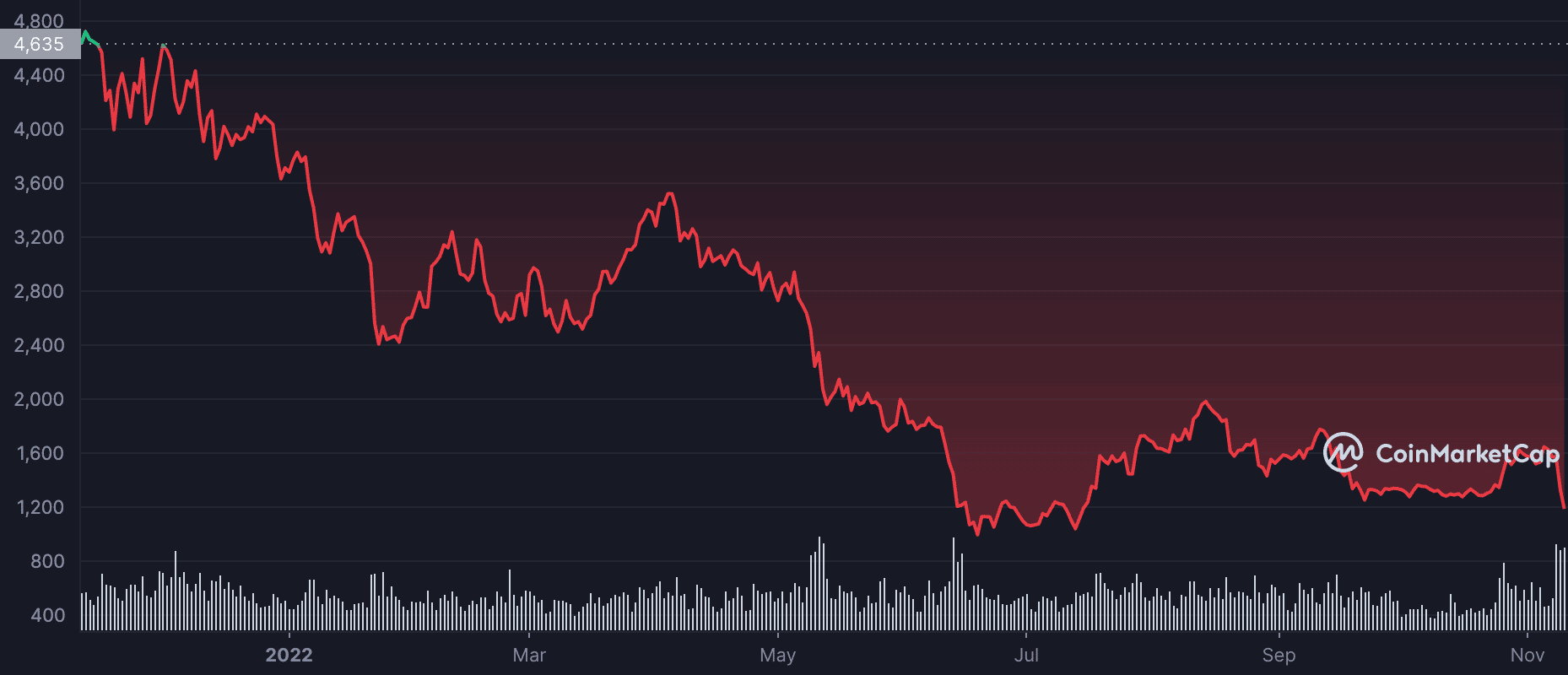

At the time of writing, the altcoin was trading at $1,182.28. A year ago, ETH was exchanging hands at $4,635 on the charts. Since then, however, the altcoin has declined by over 75%.

According to Santiment, the market is currently overrun by FUD.

“Terms related to #crash on crypto-platforms are at their highest frequency since May,” it noted in a tweet. In spite of the rally in whale accumulation over the last 48 hours, the presence of this level of fear in the ETH market would make it almost impossible for its price to climb significantly in the short term.

On the daily chart, ETH languished under the impact of the bears as coin distributors ravaged the market. At the time of writing, ETH’s Relative Strength Index (RSI) was 35.71. Its Money Flow Index (MFI) was 30.86.

Also indicating a rally in the asset’s selling pressure was its Chaikin Money Flow (CMF). At press time, its dynamic line (green) was positioned below the center line at -0.18.

Holders remain steadfast

Since the FTX debacle began, ETH’s value has dropped by 26%. Interestingly, despite the sustained fall in the alt’s price and the unpromising outlook in the short term, on-chain analysis revealed that ETH’s supply on exchanges has dropped by 6% this week. Within the same period, its supply outside exchanges hiked by 1%.

The drop in ETH’s supply on exchanges showed that ETH’s sell-offs have been less rampant this week, even in the face of a dwindling market. The minor growth in supply outside of exchanges within the same period only suggested that buying momentum has not been high enough to drive up the crypto’s price significantly.

Also, positive sentiment trailed ETH despite a 9% decline in price in the last 24 hours. At press time, its weighted sentiment was on an uptrend at 1.837.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)